China’s February Manufacturing PMI Shows Positive Growth

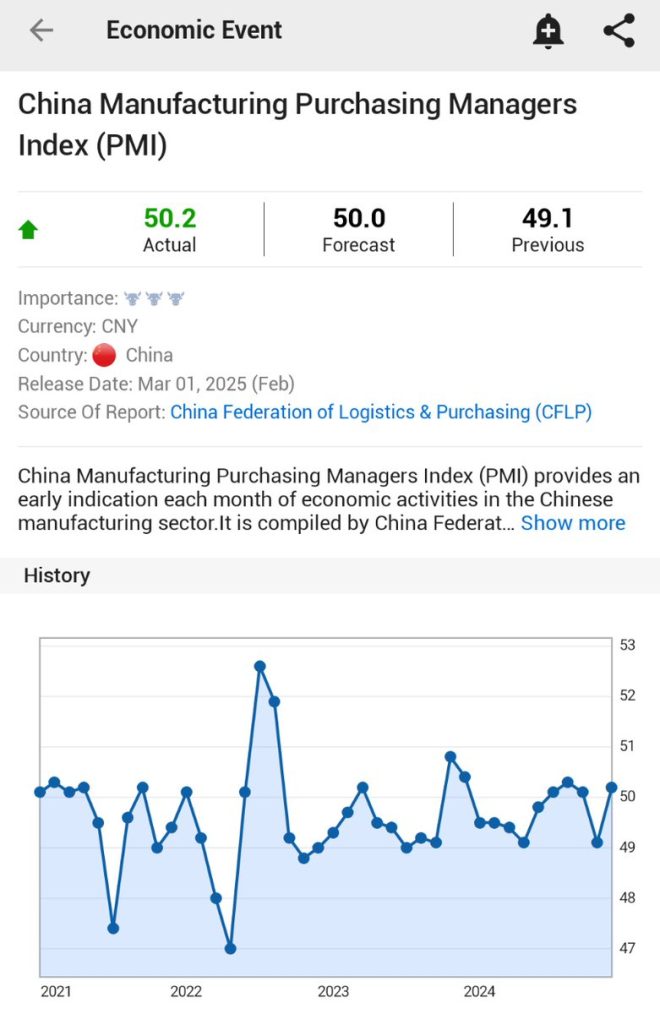

In a significant development for the global economy, China’s Manufacturing Purchasing Managers’ Index (PMI) for February 2025 has risen to 50.2, surpassing expectations and indicating a recovery in the manufacturing sector. This figure is notably higher than the estimated value of 50.0 and marks an increase from the previous month’s reading of 49.1. The PMI is a critical economic indicator, reflecting the health of the manufacturing sector and acting as a barometer for overall economic performance.

Understanding the PMI

The Purchasing Managers’ Index is a widely recognized gauge used to assess the economic health of the manufacturing sector. A PMI reading above 50 indicates expansion, while a reading below 50 suggests contraction. The February 2025 increase to 50.2 suggests that manufacturing activity is growing, which is a positive sign for both the domestic and global economies.

Key Takeaways from the February PMI Data

- Growth in Manufacturing Activity: The rise to 50.2 indicates that manufacturing activity in China is on an upward trajectory. This growth can be attributed to several factors, including increased domestic demand, improved export orders, and government stimulus measures aimed at boosting the economy.

- Comparison with Previous Month: The previous month’s PMI figure of 49.1 suggested a contraction in the manufacturing sector. The jump to 50.2 indicates a significant turnaround, showcasing the resilience of the Chinese economy amidst global challenges.

- Expectations vs. Reality: Analysts had anticipated a more modest increase to 50.0. The actual rise to 50.2 not only exceeds expectations but also reflects a stronger-than-expected rebound in manufacturing, which is crucial for China’s economic growth.

Implications for the Global Economy

China is often referred to as the "world’s factory," and its manufacturing output has a considerable impact on global supply chains and markets. The positive PMI reading for February suggests that:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Demand for Goods: A robust manufacturing sector in China can lead to increased production of goods, which may help alleviate supply chain bottlenecks that have been a concern for many industries worldwide.

- Boost in Global Trade: As China’s manufacturing sector grows, it can lead to an increase in exports, benefiting trading partners and contributing to a more balanced global economy.

- Investor Confidence: Positive economic indicators such as the PMI can enhance investor confidence, potentially leading to increased foreign direct investment in China and increased stock market activity.

Sector-Specific Insights

The manufacturing PMI encompasses various sectors, including textiles, electronics, and heavy machinery. The positive growth in February is likely to have different implications across these sectors:

- Textiles and Apparel: As consumer demand rebounds, the textile sector may see a surge in production to meet both domestic and international demand.

- Electronics: Growth in the electronics sector can be linked to the increasing global reliance on technology and digitalization, particularly as remote work and e-commerce continue to thrive.

- Heavy Machinery: An uptick in infrastructure projects and government spending can boost the heavy machinery sector, leading to increased production and employment opportunities.

Challenges Ahead

While the February PMI data is encouraging, challenges remain on the horizon. Factors such as supply chain disruptions, rising raw material costs, and potential geopolitical tensions could impact the sustainability of this growth. It is crucial for policymakers and business leaders to navigate these challenges effectively to maintain momentum in the manufacturing sector.

Conclusion

The rise of China’s Manufacturing PMI to 50.2 in February 2025 is a positive indicator of the country’s economic recovery and growth. This data not only reflects an uptick in manufacturing activity but also has broader implications for global trade and economic stability. As China continues to rebound from previous downturns, the global economy may benefit from increased production and trade flows. However, staying vigilant about potential challenges will be essential to sustaining this growth trajectory.

For investors, businesses, and policymakers, the February PMI data serves as a vital signal of the health of the manufacturing sector, indicating a period of expansion and potential opportunities in the market. As China moves forward, it will be essential to monitor these trends closely and adapt to the evolving economic landscape.

In summary, the February 2025 Manufacturing PMI results highlight a significant recovery in China’s manufacturing sector, showcasing resilience and potential growth opportunities for both domestic and international markets.

JUST IN:

*CHINA FEBRUARY MANUFACTURING PMI RISES TO 50.2; EST. 50.0; PREV. 49.1

— Investing.com (@Investingcom) March 2, 2025

JUST IN:

In a significant development for the global economy, China’s manufacturing sector has shown signs of recovery. The latest data indicates that the China February Manufacturing PMI rises to 50.2, surpassing expectations of 50.0 and improving from the previous month’s reading of 49.1. This uptick is noteworthy, as it suggests that China’s manufacturing activity is gaining momentum, which could have implications for businesses and investors worldwide. This article will delve into what this PMI rise means, the factors behind it, and its potential impact on both the Chinese and global economies.

*CHINA FEBRUARY MANUFACTURING PMI RISES TO 50.2; EST. 50.0; PREV. 49.1

The Purchasing Managers’ Index (PMI) is a crucial indicator of economic health in the manufacturing sector. A reading above 50 typically indicates expansion, while a reading below 50 signals contraction. The latest PMI figure of 50.2 marks a significant rebound for China, particularly following the previous month’s dip below the critical threshold of 50. For many investors and analysts, this data point is a signal that the manufacturing sector may be stabilizing after a period of uncertainty.

But what exactly is driving this increase? Several factors come into play. Firstly, the end of strict COVID-19 restrictions has allowed factories to ramp up production, as labor shortages ease and supply chains begin to normalize. Additionally, the Chinese government has implemented various stimulus measures aimed at boosting domestic demand, which has likely contributed to the surge in manufacturing activity.

This latest PMI reading has sparked optimistic reactions not just in China but around the globe. With China being one of the world’s largest manufacturing hubs, any positive movement in this sector can have ripple effects across international markets. Investors keep a close eye on China’s economic data, as it often serves as a barometer for global economic conditions.

Another exciting aspect of this PMI rise is its potential impact on trade. If the manufacturing sector continues to grow, it could lead to increased demand for raw materials from other countries. This demand could boost economies that are heavily reliant on exporting commodities to China, such as Australia, Brazil, and various Southeast Asian nations. On the flip side, if the PMI rise translates into higher production costs, it could also signal inflationary pressures, which are already a concern for many countries.

The Importance of PMI Data

Understanding the significance of PMI data is essential for anyone interested in market trends and economic forecasts. The PMI is based on surveys of purchasing managers at various manufacturing companies, providing insight into factors such as new orders, production levels, employment, and supplier deliveries. These elements are crucial for assessing the overall health of the manufacturing sector.

For instance, if new orders are rising, it suggests that businesses are optimistic about future demand, prompting them to increase production. Conversely, if employment levels are stagnant or decreasing, it may indicate that companies are cautious about future growth. Therefore, the PMI serves as a valuable tool for investors, policymakers, and economists alike, allowing them to gauge the direction of the economy.

Market Reactions to PMI News

Following the announcement of China’s February Manufacturing PMI, markets reacted in various ways. Typically, a rise in PMI can lead to a positive response in stock markets, as it suggests economic growth prospects. Investors often view manufacturing expansion as a sign of increased corporate earnings, which can drive stock prices higher.

However, market reactions can vary based on context. If the PMI rise is accompanied by other data suggesting potential inflation or supply chain issues, investors may approach the news with caution. Additionally, geopolitical factors can also influence market sentiment. For instance, ongoing tensions or trade disputes could overshadow the positive manufacturing news, causing volatility in stock prices.

Future Outlook for China’s Manufacturing Sector

Looking ahead, the outlook for China’s manufacturing sector appears cautiously optimistic. Analysts suggest that if the current trend continues, we might see further improvements in PMI readings in the coming months. This positivity could be bolstered by government policies aimed at stimulating growth and consumer spending.

Moreover, as global demand rebounds post-pandemic, China’s manufacturing sector could benefit from increased exports. Countries around the world are likely to turn to China for goods as they recover from the economic impacts of COVID-19. However, it’s essential to monitor other economic indicators, such as inflation rates and consumer confidence, which could also influence the manufacturing landscape.

The Role of Technology in Manufacturing

Another factor to consider is the role of technology in enhancing manufacturing efficiency. Many Chinese manufacturers are increasingly adopting advanced technologies, such as automation and artificial intelligence, to optimize production processes. These innovations can lead to cost savings and improved product quality, further positioning China as a leader in global manufacturing.

As technology continues to evolve, it will be interesting to see how it impacts the sector in the long term. Companies that invest in modernization may gain a competitive edge, allowing them to respond more swiftly to changing market conditions and consumer demands.

Global Implications of China’s Manufacturing PMI

The implications of China’s manufacturing PMI extend beyond its borders. As one of the world’s largest economies, China plays a pivotal role in global trade. A thriving manufacturing sector can lead to increased imports and exports, influencing supply chains worldwide. Countries that rely on exports to China may experience a boost in their economies, while those that compete with Chinese manufacturers may face challenges.

Furthermore, fluctuations in China’s manufacturing output can impact commodity prices globally. For instance, if Chinese demand for raw materials increases, prices for commodities like iron ore, copper, and crude oil may rise, affecting markets in producing countries.

Conclusion

The rise of China’s February Manufacturing PMI to 50.2 is a significant development, signaling potential growth in the manufacturing sector. As analysts and investors digest this information, the focus will be on whether this trend continues and what it means for the broader economy. With various factors at play, including government policies, global demand, and technological advancements, the future of China’s manufacturing sector looks promising yet complex.

For more insights and updates on economic trends, you can follow the conversation on platforms like [Investing.com](https://www.investing.com/) where financial experts share their analysis and forecasts. Keeping an eye on these developments will be crucial for anyone looking to navigate the ever-changing landscape of the global economy.