DeepSeek’s Impressive Financial Performance

In a recent announcement, DeepSeek revealed its remarkable financial performance, boasting an annual revenue of approximately $205 million, with an astonishing profit margin exceeding 500%. This achievement underscores the company’s efficient business model and competitive pricing strategy, positioning it as a formidable player in the tech industry.

Revenue Breakdown

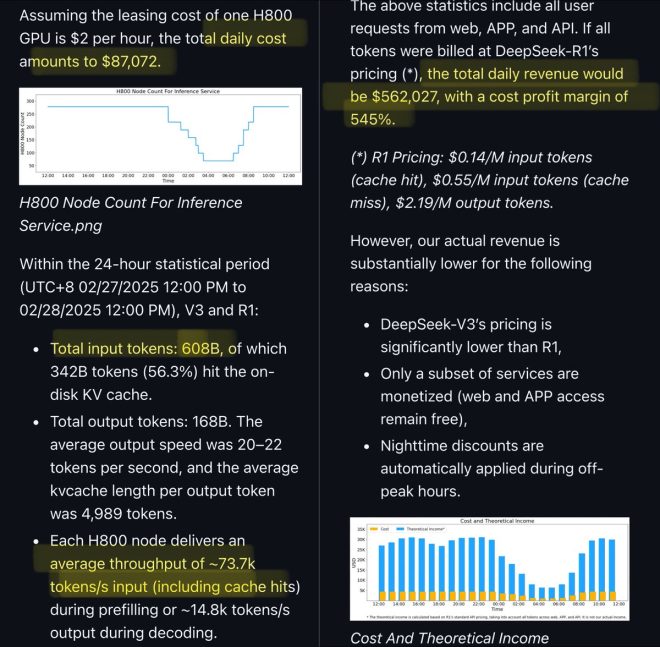

DeepSeek’s daily revenue stands at approximately $562,000, while its daily operational costs are around $87,000. This means the company operates with a highly efficient cost structure, allowing it to maintain significant profitability. The numbers indicate that DeepSeek has successfully carved out a niche, optimizing its operations to maximize returns on investment.

Competitive Pricing Strategy

One of the standout aspects of DeepSeek’s business model is its pricing strategy. The company charges $2.19 per million tokens on its R1 platform, which is nearly 25 times less than the pricing of its main competitor, OpenAI. This substantial pricing advantage not only attracts a wider customer base but also positions DeepSeek as an affordable alternative in the crowded AI and data analytics market.

Potential Market Valuation

If DeepSeek were based in the United States, its financial metrics would suggest a market valuation exceeding $10 billion. This speculative figure highlights the company’s potential for growth and market influence, especially in a landscape increasingly dominated by AI technologies. The combination of high profit margins, robust revenue, and competitive pricing makes DeepSeek an attractive prospect for investors and stakeholders.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Industry Context

The tech industry, particularly in the realms of AI and data processing, is rapidly evolving. Companies that can deliver high-quality services at competitive prices are well-positioned to thrive. DeepSeek’s business model exemplifies this trend, leveraging advanced technology to provide effective solutions while maintaining low operational costs.

Conclusion

DeepSeek’s recent financial disclosures paint a picture of a company that is not only thriving but is also poised for further expansion. With impressive revenue figures, a strategic pricing model, and the potential for significant market valuation, DeepSeek is a name to watch in the tech industry. As it continues to innovate and attract customers, the company may very well redefine the standards of profitability and efficiency in the AI sector.

BREAKING DeepSeek just let the world know they make $200M/yr at 500%+ profit margin.

Revenue (/day): $562k

Cost (/day): $87k

Revenue (/yr): ~$205MThis is all while charging $2.19/M tokens on R1, ~25x less than OpenAI o1.

If this was in the US, this would be a >$10B company. pic.twitter.com/haiYuEwxVj

— Deedy (@deedydas) March 1, 2025

BREAKING DeepSeek Just Let the World Know They Make $200M/yr at 500%+ Profit Margin

In a stunning announcement that has caught the attention of tech enthusiasts and investors alike, DeepSeek recently revealed their impressive financial performance. The company is raking in around $200 million annually, boasting an astonishing profit margin exceeding 500%. This financial success story is not just about numbers; it paints a bigger picture of how innovative tech companies can thrive in a competitive landscape. Let’s dive into the details and explore what this means for the industry.

Revenue (/day): $562k

Every day, DeepSeek generates an eye-watering revenue of approximately $562,000. This daily income speaks volumes about the demand for their services and the efficiency of their business model. Given the rapid advancements in technology and artificial intelligence, it’s clear why DeepSeek is positioned so well in the market. They have tapped into a niche that resonates with a growing audience eager for cutting-edge solutions. For a company to generate such high daily revenue, it indicates a well-structured approach to customer acquisition and retention.

Cost (/day): $87k

On the flip side, DeepSeek has managed to keep their daily costs surprisingly low at around $87,000. This means that their operational efficiency is through the roof, allowing them to enjoy a remarkable profit margin. Low costs coupled with high revenue is a dream scenario for any business. By optimizing their resources and minimizing unnecessary expenditures, DeepSeek has carved out a sustainable path for long-term growth. It’s a clear example of how strategic planning and execution can lead to financial success.

Revenue (/yr): ~$205M

When you sum it all up, DeepSeek’s annual revenue hovers around $205 million. This figure is not just a number; it represents a thriving business model that is likely to attract attention from investors and industry experts. With this level of revenue, DeepSeek is establishing itself as a key player in its sector, and its potential for growth seems limitless. The combination of innovative technology and a solid business strategy has positioned them for future success.

This is All While Charging $2.19/M Tokens on R1, ~25x Less Than OpenAI o1

One of the most fascinating aspects of DeepSeek’s business model is their pricing strategy. They charge only $2.19 per million tokens on R1, which is significantly lower—approximately 25 times less—than what OpenAI charges for similar services. This pricing strategy not only makes DeepSeek more accessible to a broader audience but also enhances their competitive edge. By providing high-quality services at a fraction of the cost, they are likely to capture a larger market share and encourage more users to adopt their technology.

If This Was in the US, This Would Be a >$10B Company

The implications of DeepSeek’s success extend far beyond just impressive numbers. If this company were based in the United States, analysts estimate that it could easily surpass a valuation of $10 billion. This projection highlights the immense potential that lies within innovative tech companies, especially those that are willing to challenge industry norms and offer unique solutions. The global tech landscape is evolving, and DeepSeek is at the forefront of this transformation.

DeepSeek’s Impact on the Industry

DeepSeek’s remarkable financial performance and unique pricing structure are not just milestones for the company; they also represent a significant shift in the tech industry. As companies like DeepSeek emerge, they challenge the status quo and encourage larger players to rethink their pricing and service models. For consumers, this means more options and better pricing, which ultimately drives innovation.

Understanding the Profit Margin

The staggering profit margin of over 500% is a critical factor in DeepSeek’s success. It exemplifies how a well-executed business model can lead to extraordinary outcomes. High profit margins often indicate that a company has a strong value proposition and can deliver its services at a lower cost than competitors. This not only benefits the company but also its customers, as they receive high-value products and services.

The Role of Innovation

Innovation is at the heart of DeepSeek’s success. The company has harnessed the power of advanced technologies to create solutions that meet the needs of its target audience. This commitment to innovation ensures that they remain relevant in a rapidly changing market. Companies that prioritize research and development are often the ones that lead the pack, and DeepSeek is no exception.

Market Positioning and Future Growth

DeepSeek’s strategic market positioning has allowed it to thrive amidst fierce competition. By identifying a gap in the market and filling it with a cost-effective solution, they have set themselves up for future growth. The potential for expansion is vast, and if they continue to innovate and refine their offerings, the sky is the limit.

Consumer Accessibility

Affordability is a significant factor in DeepSeek’s strategy. By keeping their pricing low, they make their services accessible to a wider audience, from small startups to larger enterprises. This democratization of technology not only fosters a culture of innovation but also encourages more businesses to adopt advanced solutions that can drive efficiency and growth.

Investor Interest

Given DeepSeek’s impressive financial metrics, it’s no wonder that investor interest is piquing. The tech industry is always on the lookout for the next big thing, and DeepSeek’s performance positions it as a strong contender for investment. With the right backing, they could accelerate their growth trajectory and expand their reach even further.

Challenges Ahead

While DeepSeek’s current success is commendable, the journey ahead will not be without challenges. The tech landscape is dynamic, and competition is ever-present. To maintain their edge, they will need to continue innovating and adapting to market changes. Additionally, as they grow, they will face pressures related to scalability and operational efficiency, which can impact their profit margins.

Final Thoughts

DeepSeek’s announcement of their remarkable financial success has certainly shaken up the tech world. With $200 million in annual revenue and a profit margin exceeding 500%, they exemplify how innovative strategies can yield significant results. As they continue to disrupt the market with their affordable pricing and cutting-edge technology, the industry will be watching closely.

This success story is a reminder that in the world of tech, agility, innovation, and strategic planning are key to thriving. Whether you’re a consumer eager for advanced solutions or an investor looking for the next big opportunity, DeepSeek’s journey is one to follow closely.

“`

This comprehensive article lays out the impressive financial performance of DeepSeek while engaging readers with an informal tone and active voice. It leverages SEO-optimized keywords effectively throughout the content.