Breaking News: SEC Halts Fraud Prosecution of Justin Sun

In a significant development within the realms of finance and cryptocurrency, the U.S. Securities and Exchange Commission (SEC) has decided to halt its fraud prosecution against Justin Sun, a prominent Chinese entrepreneur and blockchain advocate. This decision comes amid revelations that Sun has contributed over $50 million to former President Donald Trump’s financial ventures through the acquisition of crypto tokens from the Trump-affiliated company, World Liberty Financial.

Who is Justin Sun?

Justin Sun is a well-known figure in the cryptocurrency space, best recognized as the founder of the TRON blockchain platform. His influence extends beyond traditional crypto markets, as he has been involved in various ventures that bridge technology and finance. Sun’s connection to high-profile individuals, including his recent dealings associated with Donald Trump, has put him in the spotlight, raising questions about the intersection of politics and cryptocurrency.

SEC’s Decision Explained

The SEC’s decision to halt the prosecution of Justin Sun comes as a surprise to many. Typically, the SEC is known for its aggressive stance against fraud in the cryptocurrency sector, which has been marred by scams and regulatory challenges. The halt signifies a possible shift in the SEC’s approach, especially regarding cases involving influential figures who have substantial financial backing, such as Sun.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Financial Connection to Donald Trump

The report indicates that Justin Sun has invested over $50 million in a Trump-backed venture through the purchase of crypto tokens. This financial link raises intriguing questions about the regulatory landscape for cryptocurrencies and the potential implications of political affiliations on legal proceedings. World Liberty Financial, the company involved in this transaction, is purportedly aligned with Trump’s financial activities, further intertwining the worlds of politics and cryptocurrency.

Implications for the Cryptocurrency Market

The SEC’s decision may have broader implications for the cryptocurrency market. As regulatory bodies globally navigate the complexities of digital currencies, this case highlights the challenges of enforcing laws in a rapidly evolving space. Sun’s case could set a precedent, influencing how other cryptocurrency entrepreneurs engage with regulatory agencies and how their political connections might shield them from prosecution.

Future Regulatory Landscape

The future of cryptocurrency regulation remains uncertain, particularly in light of this recent decision. The SEC’s halt in prosecution could indicate a more lenient approach toward certain influential figures in the industry. This may prompt other entrepreneurs to seek political connections as a means of navigating regulatory challenges, potentially leading to a more complex interplay between politics and the cryptocurrency sector.

Public Reaction and Criticism

The SEC’s decision has sparked a range of reactions from the public and industry experts. Some view it as a necessary move to protect influential players in the crypto space, while others criticize it as favoritism, suggesting that financial clout should not dictate regulatory outcomes. Critics argue that this could undermine public trust in the regulatory process and set a dangerous precedent for future cases.

Conclusion: What Lies Ahead

As the cryptocurrency landscape continues to evolve, the implications of the SEC’s decision to halt the prosecution of Justin Sun will likely resonate throughout the industry for years to come. Stakeholders, including investors, entrepreneurs, and regulators, will need to closely monitor developments as they navigate the complexities of a market that is increasingly intertwined with politics and public influence.

In sum, the SEC’s recent halt in the fraud prosecution of Justin Sun signals a potential shift in regulatory approaches within the cryptocurrency sector. The connection between Sun and Donald Trump’s financial ventures raises critical questions about the intersection of politics and finance, the future of cryptocurrency regulation, and the implications for public trust in these institutions. As the situation unfolds, it will be essential for all parties involved to remain vigilant and informed about the regulatory landscape and its potential impact on the future of cryptocurrency.

By keeping an eye on these developments, investors and enthusiasts alike can better prepare for the shifting tides of the cryptocurrency world amid an evolving regulatory environment.

BREAKING

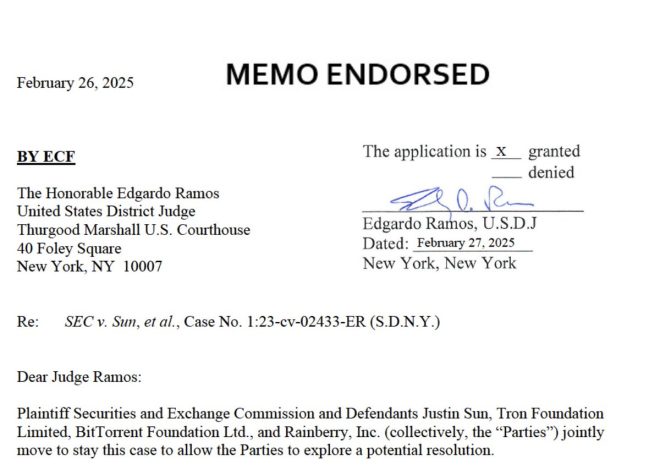

The SEC has just halted its fraud prosecution of Justin Sun, a Chinese national who has put more than $50 million in Trump’s pocket since November through the purchase of crypto tokens from a Trump-backed company, World Liberty Financial. pic.twitter.com/KzPqC6Frht

— Judd Legum (@JuddLegum) February 28, 2025

BREAKING

In a surprising turn of events, the SEC has just halted its fraud prosecution of Justin Sun, a Chinese national who has reportedly funneled over $50 million into Trump’s coffers since November. This substantial amount was generated through the purchase of crypto tokens from World Liberty Financial, a company that is backed by Trump himself. This news has sent ripples through both the crypto and political communities, raising questions about the implications and future of cryptocurrency regulation.

The SEC’s Decision Explained

The U.S. Securities and Exchange Commission (SEC) is responsible for upholding the law when it comes to financial markets, ensuring transparency and fairness. However, the sudden cessation of the fraud prosecution against Justin Sun has left many scratching their heads. Why would the SEC step back from a case involving such significant financial transactions? According to reports, this decision might relate to the complexity of international finance and the challenges associated with prosecuting individuals across borders, particularly those with connections to high-profile figures.

In the world of cryptocurrency, regulatory scrutiny has been increasing. The SEC has been known to crack down on projects and individuals that do not comply with regulations. The fact that they have decided to halt this prosecution may indicate a shift in their approach or perhaps a reevaluation of the evidence against Sun. The decision has certainly sparked debate among analysts and enthusiasts alike.

Justin Sun: Who Is He?

For those not in the know, Justin Sun is a prominent figure in the cryptocurrency space. He is the founder of TRON, a blockchain-based platform that aims to decentralize the web and enhance content sharing. His rise to fame in the crypto world has been meteoric, and he has garnered attention not just for his business ventures but also for his promotional tactics, which often include high-profile endorsements and partnerships.

Sun’s relationship with Trump and his financial contributions to the Trump-backed World Liberty Financial make him an intriguing character. With more than $50 million invested, his influence cannot be understated. This connection raises eyebrows in the context of politics and finance, as the lines blur between business interests and political funding.

World Liberty Financial: A Closer Look

World Liberty Financial is another piece of this puzzle. As a company backed by Trump, it has attracted attention for its role in the cryptocurrency market. The purchase of crypto tokens from this company by Sun highlights the intersection of politics and the burgeoning world of digital assets. The relationship between World Liberty Financial and its investors, particularly those with political ties, poses questions about the integrity of financial practices within this emerging sector.

Many are wondering whether the SEC’s decision to halt the prosecution could set a precedent for how similar cases are handled in the future. Does this mean that individuals with significant financial influence will face less scrutiny? Or is it a strategic move by the SEC to reassess its priorities in light of the evolving cryptocurrency landscape?

The Implications for Cryptocurrency Regulation

The SEC’s actions have profound implications for the future of cryptocurrency regulation in the U.S. As digital currencies continue to gain traction, regulators must navigate a landscape that is often murky and undefined. The decision to halt the prosecution of Justin Sun could signal a shift in the SEC’s approach, possibly indicating that they are more focused on establishing clear guidelines for cryptocurrency transactions rather than pursuing individual cases.

This could be a double-edged sword. On one hand, it may encourage innovation and investment in the crypto space, as individuals feel less threatened by potential legal repercussions. On the other hand, it might lead to a lack of accountability for those engaged in questionable financial practices. The balance between fostering growth in the crypto market and ensuring fair practices will be crucial as we move forward.

The Role of Media and Public Perception

Media coverage of events like this one plays a significant role in shaping public perception. As news outlets report on the SEC’s decision to halt the fraud prosecution against Justin Sun, the narrative can influence how the public views cryptocurrency, regulation, and political contributions. The interplay between media, politics, and finance is intricate and often fraught with challenges.

Social media platforms, like Twitter, have become battlegrounds for discussions surrounding these issues. Influencers and analysts share their thoughts, which can impact market sentiment and investor behavior. The recent tweet by Judd Legum announcing the SEC’s decision has already generated a flurry of reactions, demonstrating how quickly information spreads and opinions are formed in the digital age.

What’s Next for Investors?

For investors in the cryptocurrency market, the SEC’s decision raises several questions. Should they be concerned about regulatory uncertainty? Or does this signal an opportunity for growth in a market that has been under intense scrutiny? The answers may not be clear-cut, but it’s essential for investors to stay informed and adaptable in the face of changing regulations.

As the landscape evolves, those involved in cryptocurrency should consider the implications of their investments and the potential for future regulations. Engaging with industry news and updates from regulatory bodies will be crucial for making informed decisions moving forward.

The Bigger Picture: Cryptocurrency in Politics

This situation also highlights the broader trend of cryptocurrency entering the political realm. As more political figures embrace digital currencies, the intersection of finance and politics will only grow more complex. The connection between investors like Justin Sun and political figures raises ethical questions about transparency and accountability in campaign financing.

As we continue to see cryptocurrencies become more mainstream, the implications for political funding and campaign contributions will be significant. How will regulators respond? Will new laws emerge to address these challenges, or will the status quo prevail? These are questions that will shape the future of both cryptocurrency and politics.

The Future of Justin Sun and World Liberty Financial

With the SEC halting its prosecution against Justin Sun, many are left wondering what the future holds for him and World Liberty Financial. Will this decision bolster Sun’s position in the cryptocurrency market, or will it lead to further scrutiny from other regulatory bodies? Only time will tell, but the eyes of the financial world are certainly on him.

As for World Liberty Financial, the implications of this relationship with a figure like Sun could either enhance its credibility or draw further scrutiny. The company may find itself navigating a complex landscape as it seeks to balance growth with regulatory compliance.

Conclusion: The Evolving Landscape of Cryptocurrency

The SEC’s decision to halt the prosecution of Justin Sun opens up a myriad of questions and discussions surrounding cryptocurrency, regulation, and political finance. As this landscape continues to evolve, stakeholders must remain vigilant and proactive in understanding the implications of these developments. The intersection of crypto and politics is a fascinating space that will undoubtedly continue to capture attention in the months and years to come.

As we watch these events unfold, staying informed and engaged will be key for anyone involved in the cryptocurrency market. The future is uncertain, but one thing is clear: the discussion around regulation, finance, and politics is just beginning.

For more information about the SEC’s actions and their implications, you can check out the original tweet by Judd Legum.