BlackRock’s Significant Cryptocurrency Transfer to Coinbase Prime

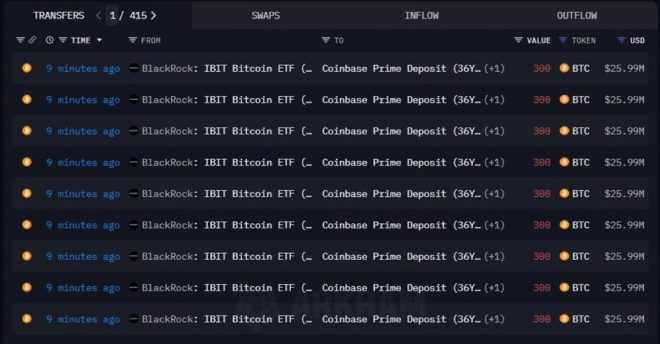

On February 27, 2025, a noteworthy event occurred in the cryptocurrency market as BlackRock, one of the world’s leading investment management firms, transferred a substantial amount of digital assets to Coinbase Prime. According to a tweet by Mr. WHALE, a prominent figure in the crypto community, BlackRock moved 5,100 Bitcoin (BTC), valued at approximately $441.88 million, alongside 30,280 Ethereum (ETH), worth around $71.85 million, into the Coinbase Prime platform within a remarkably short timeframe of just 30 minutes.

The Impact of BlackRock’s Transfer on the Cryptocurrency Market

BlackRock’s decision to transfer such a massive amount of cryptocurrency has raised eyebrows and sparked discussions among investors, analysts, and enthusiasts in the crypto space. The company’s involvement in digital assets is significant because it symbolizes a growing acceptance of cryptocurrencies within traditional financial institutions.

Understanding BlackRock’s Role in the Cryptocurrency Ecosystem

As the largest asset manager globally, BlackRock has been gradually exploring the cryptocurrency space. The firm has shown interest in Bitcoin and other digital assets as part of its broader strategy to diversify investment opportunities for its clients. The recent transfer to Coinbase Prime indicates a substantial commitment to the cryptocurrency market, potentially signaling to other institutional investors that digital assets are becoming increasingly mainstream.

Coinbase Prime: A Trusted Platform for Institutional Investors

Coinbase Prime is specifically designed for institutional clients, offering a secure and reliable platform for trading and storing digital assets. By moving its assets to Coinbase Prime, BlackRock aims to leverage the platform’s robust security features, compliance standards, and advanced trading tools.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Key Features of Coinbase Prime

- Enhanced Security: Coinbase Prime prioritizes the safety of its clients’ assets, employing cutting-edge security measures including cold storage and multi-signature wallets.

- Regulatory Compliance: With the increasing scrutiny on cryptocurrencies from regulatory bodies, Coinbase Prime ensures that it adheres to all relevant laws and regulations, providing institutional clients with peace of mind.

- Advanced Trading Solutions: The platform offers sophisticated trading solutions tailored for institutional investors, enabling them to execute large orders efficiently and manage their digital asset portfolios effectively.

The Broader Implications of Institutional Investment in Cryptocurrencies

The involvement of major financial institutions like BlackRock in the cryptocurrency market is a crucial development. It reflects a shift in perception towards digital assets, from being seen as speculative investments to being recognized as legitimate components of diversified investment portfolios.

Increased Legitimacy for Cryptocurrencies

BlackRock’s transfer of BTC and ETH to Coinbase Prime may enhance the legitimacy of cryptocurrencies in the eyes of potential investors. As more institutions engage with digital assets, it could lead to increased confidence among retail investors, potentially driving higher demand and further adoption.

The Future of Bitcoin and Ethereum

As of now, Bitcoin remains the dominant cryptocurrency, often referred to as "digital gold" due to its limited supply and store of value characteristics. Ethereum, on the other hand, is known for its smart contract capabilities and has become the backbone of many decentralized applications (dApps).

Price Predictions and Market Trends

The significant transfer by BlackRock could influence market trends for both Bitcoin and Ethereum. Analysts believe that institutional investment can lead to price appreciation, as increased demand from large players often drives up prices. As BlackRock continues to diversify its portfolio with cryptocurrencies, other institutional investors might follow suit, further propelling the growth of the digital asset market.

Conclusion: A New Era for Institutional Adoption of Cryptocurrencies

BlackRock’s recent movement of $441.88 million in Bitcoin and $71.85 million in Ethereum to Coinbase Prime marks a pivotal moment in the evolution of the cryptocurrency market. This transfer not only underscores the increasing acceptance of digital assets by traditional financial institutions but also highlights the potential for significant price movements in the coming months.

As the landscape continues to evolve, investors should pay close attention to institutional activities in the cryptocurrency space. The actions of firms like BlackRock could serve as bellwethers for the future of digital assets, indicating a broader trend toward mainstream adoption.

In summary, BlackRock’s substantial cryptocurrency transfer to Coinbase Prime represents a critical juncture for the cryptocurrency market, suggesting that digital assets are becoming an integral part of institutional investment strategies. This shift could pave the way for increased legitimacy, higher demand, and ultimately, a more robust cryptocurrency ecosystem.

By keeping an eye on these developments, investors can position themselves to capitalize on the opportunities presented by the evolving intersection of traditional finance and the burgeoning world of digital currencies.

JUST IN: BlackRock moved 5,100 $BTC ($441.88M) and 30,280 $ETH ($71.85M) into Coinbase Prime in the last 30 minutes.

— Mr. WHALE (@MrBigWhaleREAL) February 27, 2025

JUST IN: BlackRock moved 5,100 $BTC ($441.88M) and 30,280 $ETH ($71.85M) into Coinbase Prime in the last 30 minutes

In an intriguing move that sent ripples through the cryptocurrency market, BlackRock, the world-renowned investment management corporation, transferred a staggering 5,100 Bitcoin (BTC), valued at approximately $441.88 million, and 30,280 Ethereum (ETH), worth around $71.85 million, to Coinbase Prime within a mere half-hour window. This swift action has sparked curiosity among investors and crypto enthusiasts alike, raising questions about BlackRock’s strategy and the potential implications for the broader crypto market.

Understanding the Significance of BlackRock’s Move

BlackRock’s recent transaction is nothing short of monumental. As one of the largest investment firms globally, their involvement in cryptocurrency can greatly influence the market’s perception and trends. By moving such significant amounts of BTC and ETH to Coinbase Prime, BlackRock is signaling its confidence in these major cryptocurrencies, potentially encouraging other institutional investors to follow suit.

Coinbase Prime is known for providing advanced trading tools and services tailored specifically for institutional investors. Thus, this move could indicate that BlackRock is preparing for larger investments or is looking to hold these assets long-term. The timing of the transaction, along with its sheer scale, suggests that BlackRock is positioning itself strategically within the crypto space.

The Impact on Bitcoin and Ethereum Prices

Market reactions to large transactions can often be volatile. When news breaks about significant movements of cryptocurrency by large entities like BlackRock, it can lead to rapid price fluctuations. Investors often interpret such actions as bullish signals, which can drive prices up as they rush to buy in anticipation of rising values.

For Bitcoin, which has been a focal point of institutional interest, this transaction underscores its status as a legitimate asset class. The movement of 5,100 BTC is a clear indicator of institutional appetite. Similarly, Ethereum continues to gain traction as a platform for decentralized applications and smart contracts, and BlackRock’s acquisition of 30,280 ETH reinforces its value proposition.

What Does This Mean for Retail Investors?

The movements of large institutional investors can often leave retail investors feeling anxious or uncertain. However, this situation presents an interesting opportunity. For those who have been closely following the trends in cryptocurrency, BlackRock’s actions could serve as a catalyst for further growth in the sector. Retail investors might consider this an opportune moment to evaluate their own investment strategies in light of institutional confidence in cryptocurrencies.

Furthermore, it’s essential to remember that while institutional moves can influence market sentiment, they do not dictate individual investment success. Understanding the underlying technology, market trends, and personal risk tolerance remains crucial for all investors, regardless of their size.

The Evolution of Institutional Investment in Cryptocurrency

Historically, institutional investors have been hesitant to dive into the cryptocurrency market due to its volatility and regulatory uncertainties. However, recent years have seen a significant shift. More and more institutions are recognizing the potential of cryptocurrencies as a viable asset class. Companies like BlackRock entering the space not only legitimizes crypto but also encourages other institutions to explore investment opportunities.

This evolution is reflected in the increasing amount of capital flowing into cryptocurrencies. As institutional interest grows, it’s likely that we’ll see more robust infrastructure developed around digital assets, which could lead to greater market stability and acceptance.

Future Implications for the Cryptocurrency Market

The transfer of assets by BlackRock is a clear indicator of the growing acceptance of cryptocurrencies in mainstream finance. As large entities continue to enter the market, we can expect to see enhanced regulatory frameworks, which could provide more security for both institutional and retail investors. Additionally, the increased competition and demand could drive innovation within the crypto space, leading to the development of new technologies and investment vehicles.

With BlackRock’s recent actions, we may witness a substantial shift in how cryptocurrencies are perceived and utilized in the financial sector. The firm’s strategies could set a precedent for others, potentially leading to a domino effect of institutional investment in digital assets.

The Role of Coinbase Prime in This Transaction

Coinbase Prime has emerged as a prominent player in the cryptocurrency ecosystem, especially for institutional investors. By providing a secure and regulated platform for trading, it caters specifically to the needs of larger investors who require more than just basic trading functionalities. BlackRock’s choice to transfer a significant amount of BTC and ETH to Coinbase Prime suggests a strong partnership between traditional finance and the cryptocurrency world.

This collaboration could pave the way for other financial institutions to consider similar moves, enhancing the credibility of cryptocurrency platforms like Coinbase. As trust grows, so too will the volume of transactions and investments flowing into the crypto market, creating a more vibrant ecosystem.

Conclusion: Keeping an Eye on the Future

BlackRock’s recent move involving 5,100 BTC and 30,280 ETH is a landmark event in the cryptocurrency landscape. It signifies not only the firm’s confidence in these digital assets but also the broader acceptance of cryptocurrencies by institutional investors. As the market continues to evolve, it’s crucial for all investors to stay informed and agile in their strategies.

Whether you’re a seasoned investor or just starting, keeping an eye on the actions of major players like BlackRock can provide valuable insights into market trends and future opportunities. The crypto revolution is just beginning, and the best may yet be to come.