The Launch of the First Solana ETF: A Milestone for Cryptocurrency Investment

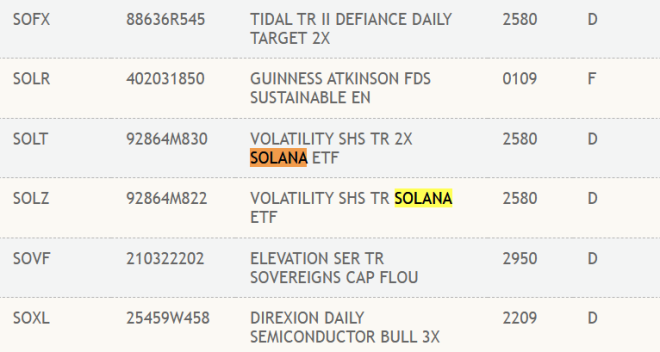

On February 27, 2025, a significant milestone in the world of cryptocurrency investment was announced: the first Solana ($SOL) Exchange-Traded Fund (ETF) has been officially listed on the Depository Trust & Clearing Corporation (DTCC). This development is pivotal for both investors and the broader cryptocurrency market, as it marks a new avenue for traditional investors to gain exposure to Solana’s blockchain ecosystem.

Understanding Solana and Its Significance

Solana has emerged as one of the leading blockchain platforms in the cryptocurrency space, known for its high throughput, low transaction costs, and scalability. With its innovative Proof of History consensus mechanism, Solana allows for more efficient processing of transactions, making it an appealing choice for decentralized applications (dApps) and decentralized finance (DeFi) projects. The rise of Solana has attracted significant attention from developers and investors alike, positioning it as a strong competitor to established platforms like Ethereum.

As the demand for Solana-based projects continues to grow, the introduction of an ETF represents an important progression in how investors can engage with this exciting blockchain technology. The ETF allows institutional and retail investors to invest in Solana without needing to directly buy or hold the cryptocurrency.

The Importance of ETFs in Cryptocurrency

Exchange-Traded Funds have become a popular investment vehicle, offering a way to invest in a diversified portfolio of assets. For cryptocurrencies, ETFs provide several advantages:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Accessibility: ETFs are traded on traditional stock exchanges, making them more accessible to investors who may be hesitant to navigate cryptocurrency exchanges.

- Regulatory Oversight: ETFs are regulated financial products, providing an additional layer of security for investors. This regulatory framework can help legitimize the cryptocurrency market and attract more institutional investment.

- Liquidity: As ETFs are traded on established exchanges, they offer liquidity that can be advantageous for investors looking to enter or exit positions quickly.

- Diversification: An ETF can offer exposure to multiple assets within the Solana ecosystem, allowing for diversified investment in various projects and applications built on the Solana blockchain.

The Impact of the First Solana ETF

The launch of the first Solana ETF is expected to have multiple repercussions:

- Increased Adoption: The availability of a Solana ETF could lead to increased adoption of the Solana blockchain as more investors seek to capitalize on its potential for growth. As traditional finance and cryptocurrency converge, this could attract a broader audience interested in blockchain technology.

- Price Stability: ETFs can contribute to price stability by providing a more structured investment vehicle. With institutional investors participating in the market, the volatility associated with cryptocurrency trading may be mitigated.

- Growth of Solana Ecosystem: As investment flows into the Solana ETF, there is potential for increased funding for projects within the Solana ecosystem. This influx of capital can lead to further innovations and developments, positioning Solana as a leader in the blockchain space.

- Positive Market Sentiment: The launch of cryptocurrency ETFs often generates positive sentiment in the market. Investors may view the introduction of the Solana ETF as a sign of growing legitimacy and acceptance of cryptocurrencies within the financial system.

Challenges Ahead

While the launch of the Solana ETF is a significant achievement, it also comes with challenges:

- Regulatory Scrutiny: The cryptocurrency market is still navigating complex regulatory landscapes. Future regulations could impact the operations of the Solana ETF and the broader market.

- Market Competition: Solana faces competition from other blockchain platforms and cryptocurrencies. The ongoing development and innovation within the space will determine Solana’s position and growth potential.

- Investor Education: As cryptocurrency remains a relatively new investment class, educating potential investors about the risks and rewards of investing in Solana through an ETF will be crucial for its success.

Conclusion

The introduction of the first Solana ETF marks a pivotal moment in the evolution of cryptocurrency investment. By providing a regulated, accessible, and diversified investment vehicle, the Solana ETF opens the door for both institutional and retail investors to engage with one of the most promising blockchain platforms available today. As the cryptocurrency landscape continues to evolve, the impact of this ETF on the Solana ecosystem and the broader market will be closely watched by investors and analysts alike.

Investors looking to diversify their portfolios with exposure to cryptocurrency now have a new option to consider. The Solana ETF not only reflects the growing acceptance of digital assets in traditional finance but also emphasizes the increasing importance of blockchain technology in shaping the future of finance. The coming months and years will be crucial as the market adapts to this new investment vehicle, and its effects on the Solana ecosystem and the cryptocurrency market as a whole unfold.

JUST IN: First Solana $SOL ETF listed on the DTCC. pic.twitter.com/vr9HCpFzBH

— Watcher.Guru (@WatcherGuru) February 27, 2025

JUST IN: First Solana $SOL ETF Listed on the DTCC

If you’re into cryptocurrencies, you probably have heard the buzz around Solana and its native token, $SOL. Well, here’s some exciting news! The first-ever Solana ETF has just been listed on the Depository Trust & Clearing Corporation (DTCC). This is a significant milestone for the Solana ecosystem and for investors who have been waiting for a more structured way to invest in this burgeoning blockchain technology.

So, why is this such a big deal? Let’s dive into the details.

The Significance of the Solana ETF

The introduction of a Solana ETF is a game-changer for numerous reasons. First of all, it provides a regulated framework for investors looking to gain exposure to Solana without having to deal with the complexities of purchasing and storing $SOL directly. Imagine not having to worry about wallets, private keys, or exchanges. With an ETF, you can simply buy shares just like you would with any other stock or mutual fund.

Moreover, this ETF opening up on the DTCC signals a growing acceptance of cryptocurrencies within mainstream financial systems. It’s a validation of blockchain technology and its potential to revolutionize various sectors, not just finance.

What is an ETF and How Does it Work?

For those who might be new to this concept, an Exchange-Traded Fund (ETF) is essentially a collection of assets—like stocks, bonds, or in this case, cryptocurrencies—that you can buy and sell on an exchange. ETFs are designed to track the performance of a specific asset or index, and they allow investors to gain exposure without needing to buy the underlying assets directly.

So, when you buy a share of the Solana ETF, you’re essentially investing in a basket of assets that are tied to the performance of the Solana blockchain. This could include $SOL tokens and potentially other assets associated with projects on the Solana network.

Why Invest in Solana?

You might be wondering—why should anyone invest in Solana, and what makes it stand out from other cryptocurrencies like Bitcoin or Ethereum? Well, Solana offers several unique features:

1. **Speed and Scalability**: Solana can handle thousands of transactions per second, making it one of the fastest blockchains out there. This speed opens up possibilities for real-time applications and services that aren’t feasible on slower networks.

2. **Low Transaction Fees**: One of the attractive aspects of Solana is its incredibly low transaction fees, which often amount to just a fraction of a cent. This makes it an ideal choice for developers and businesses looking to leverage blockchain technology without breaking the bank.

3. **Growing Ecosystem**: As of now, Solana has a rapidly growing ecosystem that includes decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and various other projects. The interest from developers and investors alike is a testament to its potential.

4. **Strong Community Support**: The Solana community is vibrant and supportive, with numerous initiatives and projects being built on the network. This kind of community backing can often be a predictor of long-term success.

The Future of ETFs in the Crypto Space

The listing of the first Solana ETF on the DTCC might just be the tip of the iceberg. As cryptocurrencies continue to gain traction, we could see a wave of new ETFs focused on various digital assets. This could pave the way for more institutional investment, bringing even more legitimacy to the crypto space.

Additionally, with regulatory bodies starting to accept cryptocurrency ETFs, we can anticipate a more structured and secure investing environment for retail and institutional investors alike. The Solana ETF could set a precedent, encouraging other blockchain projects to follow suit.

How to Invest in the Solana ETF

If you’re interested in investing in the newly launched Solana ETF, here are a few steps to consider:

1. **Research**: Before diving in, make sure to do your homework. Understand the fundamentals of Solana, the ETF’s objectives, and how it fits into your investment strategy.

2. **Brokerage Account**: To purchase shares of the ETF, you’ll need a brokerage account that allows for ETF trading. Make sure your broker is equipped to handle cryptocurrency-related investments.

3. **Buy Shares**: Once your account is set up, you can place an order to buy shares of the Solana ETF. Keep in mind that prices can fluctuate, so it’s wise to keep an eye on market trends.

4. **Monitor Your Investment**: Like any investment, it’s essential to keep track of how your ETF shares are performing. Regularly review your investment strategy to ensure it aligns with your financial goals.

Risks to Consider

While the launch of the Solana ETF is exciting, it’s crucial to remember that all investments come with risks. The cryptocurrency market is known for its volatility, and the value of your investment could fluctuate significantly. Here are a few risks to consider:

– **Market Risk**: The value of the ETF will be directly tied to the performance of the Solana blockchain and $SOL token. If the market experiences a downturn, the ETF will likely follow.

– **Regulatory Risks**: As cryptocurrency regulations continue to evolve, there could be changes that impact the ETF’s performance or even its existence.

– **Technology Risks**: While Solana is known for its speed and scalability, no technology is without flaws. Potential vulnerabilities could affect the blockchain’s performance and, consequently, the ETF’s value.

The Excitement Around the Solana ETF

The listing of the Solana ETF has created quite a buzz in the cryptocurrency community. Investors are keenly watching how this development unfolds, and many are optimistic about the future of Solana and its ecosystem. It’s a thrilling time to be involved in the world of cryptocurrency, and the introduction of this ETF could very well be a catalyst for broader adoption.

In addition to that, the Solana ETF can encourage more traditional investors who may have hesitated to enter the crypto space. With a regulated investment vehicle, the barriers to entry are significantly lowered, and that could lead to a wave of new investors eager to explore the benefits of blockchain technology.

Final Thoughts

The launch of the first Solana $SOL ETF on the DTCC is more than just a financial product; it represents a shift in how cryptocurrencies can be accessed and utilized by the average investor. With its unique features, growing community, and potential for future growth, Solana is carving out its space in the crowded crypto landscape.

As always, it’s essential to stay informed, do your research, and approach investing with a clear strategy in mind. Whether you’re a seasoned investor or just starting, the world of cryptocurrency offers exciting opportunities, and the Solana ETF is a significant step forward in making those opportunities more accessible.

Keep an eye on this space! Exciting developments are sure to come, and those who stay informed will be well-positioned to take advantage of them.