Significant Bitcoin Withdrawal from Binance: An Overview

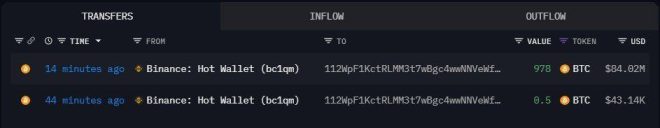

On February 27, 2025, Cointelegraph reported a significant event in the cryptocurrency world when a new wallet withdrew an impressive 978 Bitcoin (BTC) from the Binance exchange. This transaction, valued at approximately $84.02 million, has raised eyebrows within the crypto community and highlights the ongoing interest and activity surrounding Bitcoin.

The Implications of Large Withdrawals

When substantial amounts of Bitcoin are withdrawn from exchanges like Binance, it signals various potential implications for the cryptocurrency market. Investors and analysts closely monitor these movements, as they can indicate a range of market sentiments, from bullish to bearish.

Bullish Sentiment

Large withdrawals can often reflect a bullish sentiment among investors. When traders remove their assets from exchanges, they may be preparing for long-term holding (often referred to as "HODLing"), rather than engaging in immediate trading. This behavior can lead to a decrease in available Bitcoin on exchanges, potentially driving up prices due to reduced supply.

Bearish Sentiment

Conversely, significant withdrawals can also raise concerns. If a large amount of Bitcoin is moved to a wallet, it can be interpreted as a signal that investors expect a downturn in the market. This could lead to panic selling among smaller investors, further impacting Bitcoin’s price and market stability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Binance in the Crypto Ecosystem

Binance is one of the largest cryptocurrency exchanges in the world, offering a wide range of services, including trading, staking, and a variety of cryptocurrency options. Its popularity and volume of transactions make it a key player in the crypto market.

Security and Trust

Despite previous controversies and regulatory scrutiny, Binance remains a trusted platform for millions of users. Its robust security measures and user-friendly interface contribute to its standing in the industry. The recent withdrawal of 978 BTC from Binance highlights the ongoing trust that investors place in the exchange, despite the inherent risks associated with cryptocurrency trading.

Understanding Bitcoin’s Market Dynamics

Bitcoin’s price is influenced by several factors, including market sentiment, regulatory news, technological advancements, and macroeconomic trends. Large withdrawals like the one reported can showcase investor confidence, but they can also be a response to external pressures.

Market Reactions

Following this withdrawal, market analysts will be observing Bitcoin’s price movements closely. If the withdrawal leads to a price increase, it might validate the bullish sentiment. However, any subsequent market downturn could signal a shift in investor confidence.

The Future of Bitcoin and Cryptocurrency

As the cryptocurrency market continues to evolve, the significance of large transactions will likely remain a focal point for investors. The withdrawal of 978 BTC is just one example of the ongoing volatility and intrigue within this space.

Continued Growth

Bitcoin has shown resilience over the years, and its status as the leading cryptocurrency remains largely unchallenged. Innovations such as Bitcoin ETFs, institutional adoption, and advancements in blockchain technology contribute to the narrative of continued growth.

Conclusion

The recent withdrawal of 978 BTC worth $84.02 million from Binance has captured the attention of the cryptocurrency community. As investors assess the implications of this transaction, it serves as a reminder of the dynamic and ever-changing landscape of cryptocurrency. Whether this marks the beginning of a bullish trend or a potential shift in market sentiment remains to be seen. Nonetheless, it reinforces the importance of monitoring large transactions and their potential impact on the market.

As we look ahead, the ongoing developments in the crypto market will continue to shape the narrative of Bitcoin and its role in the global financial ecosystem. Investors and analysts alike will be keenly watching for further signals that could indicate the future trajectory of Bitcoin and other cryptocurrencies.

JUST IN: A fresh wallet has withdrawn 978 $BTC, worth $84.02M from Binance. pic.twitter.com/WOhT9M2LLu

— Cointelegraph (@Cointelegraph) February 27, 2025

JUST IN: A fresh wallet has withdrawn 978 $BTC, worth $84.02M from Binance.

In the ever-evolving world of cryptocurrency, significant movements can send ripples through the market. Just recently, a fresh wallet made headlines by withdrawing a staggering 978 Bitcoins, which is worth approximately $84.02 million, from the major exchange Binance. This kind of transaction is a clear indication of market dynamics and investor sentiment. But what does this mean for the average crypto enthusiast or investor? Let’s dive deeper into the implications of such a transaction and what it could signal for the future.

The Impact of Large Withdrawals in Crypto Markets

When a large amount of cryptocurrency is withdrawn from an exchange, it can often be interpreted in multiple ways. First and foremost, it could signify that an investor is taking their assets out for long-term holding, commonly referred to as “HODLing.” This move is typically seen as a bullish sign, suggesting that the investor believes in the future value of Bitcoin and wants to secure their assets away from the volatility of exchanges.

On the other hand, large withdrawals can also raise some eyebrows. Some analysts may interpret this action as a precursor to potential selling pressure. If the holder plans to sell a significant portion of their assets, it could potentially lead to a decrease in price. However, it’s essential to note that the intentions behind such withdrawals can vary widely from one investor to another.

What Does This Withdrawal Mean for Bitcoin’s Price?

With Bitcoin’s price being highly influenced by supply and demand dynamics, large withdrawals like this one can lead to fluctuations in its value. Investors often keep a close eye on such movements. The fact that nearly $84.02 million worth of Bitcoin has left Binance could lead to speculation about future price movements.

In the wake of this withdrawal, traders might brace for volatility as they try to gauge the motivations behind this transaction. If the investor is indeed planning to sell, it could create downward pressure on Bitcoin’s price. However, if the withdrawal is merely for secure storage, it might indicate a strong belief in Bitcoin’s long-term value, which could stabilize or even boost its price in the long run.

Understanding Binance’s Role in the Crypto Ecosystem

Binance has become one of the largest cryptocurrency exchanges globally, serving millions of users and facilitating billions in trading volume daily. The platform has established a reputation for its wide variety of trading pairs, advanced trading features, and robust security measures.

For many investors, Binance is the go-to platform for buying and selling cryptocurrencies, including Bitcoin. Therefore, movements like the withdrawal of 978 BTC can attract significant attention and analysis from both seasoned traders and newcomers alike.

Additionally, Binance has been proactive in enhancing user experience and security, which can contribute to the overall confidence that investors have in using the platform. As such, any significant movements from this exchange can be critical indicators of market sentiment.

What Should Investors Consider?

For those invested in or considering Bitcoin, it’s essential to keep a few things in mind. First, always stay updated with market news and analyses that could affect Bitcoin’s price. Understanding the broader market context can help you make more informed decisions.

Moreover, consider your investment strategy. Are you in for the long haul, or are you looking for short-term gains? The answer to this question can shape how you interpret large transactions like the recent withdrawal from Binance.

Lastly, never underestimate the value of community insights. Engaging with various crypto forums, social media platforms, and news outlets can provide additional perspectives that may influence your investment decisions.

Broader Market Trends and Their Influence

The cryptocurrency market is notoriously volatile, and large transactions can often reflect broader trends. For instance, if more investors begin withdrawing significant amounts of Bitcoin from exchanges, it might indicate a growing trend of HODLing, potentially leading to a supply crunch and upward price pressure.

Conversely, if large sell-offs become commonplace, it could suggest a bearish sentiment within the market. Keeping an eye on these trends can provide valuable insights into potential price movements and market sentiment.

Conclusion: What’s Next for Bitcoin?

With significant transactions like the withdrawal of 978 BTC from Binance, it’s crucial for investors to stay informed and adaptable. The crypto landscape is continuously shifting, and understanding the motivations behind these movements can offer valuable insights.

As always, investing in cryptocurrencies carries risks, and it’s essential to do thorough research and consider your financial goals before making any investment decisions. Whether you’re a seasoned trader or just beginning your crypto journey, staying engaged with the market will help you navigate its complexities.

Remember, the world of cryptocurrency is full of surprises, and staying informed is your best strategy for success. Keep an eye on the news, analyze market trends, and engage with your fellow investors. The journey through the crypto universe is as exciting as it is unpredictable!