Breaking News: Carney’s Alleged Deception Regarding Brookfield’s Headquarters Move

In a recent development that has captured the attention of financial analysts and the general public alike, Michael Barrett, a notable Twitter user and political figure, has alleged that Mark Carney, former chair of Brookfield Asset Management, misled shareholders regarding a significant corporate decision. This controversy centers around Brookfield’s unanimous decision to relocate its headquarters from Canada to New York City, a move that has raised several eyebrows, especially considering the city’s associations with former President Donald Trump.

The Allegations Against Carney

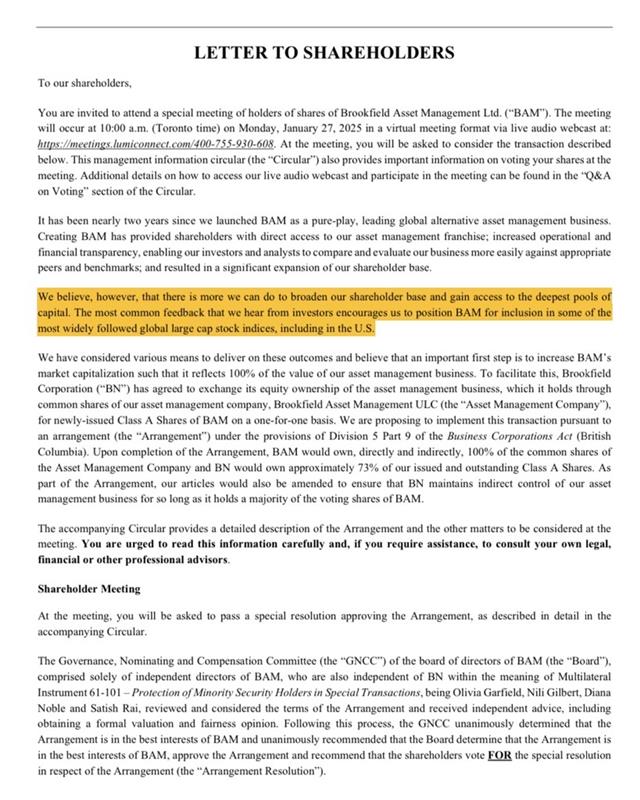

Michael Barrett’s tweet, which has been widely circulated, claims that Carney lied about the circumstances surrounding Brookfield’s headquarters move. This statement has sparked intense discourse, with many questioning Carney’s motivations and the implications of such a decision on both Canadian and global financial landscapes. Barrett’s assertion is backed by a letter purportedly written by Carney to shareholders on December 1, 2024, where he urged them to support the move.

The essence of Barrett’s argument is that a lack of transparency and honesty in such significant decisions could erode trust among stakeholders. If Carney did indeed misrepresent the truth, it raises concerns not only about Brookfield’s governance but also about the ethical standards of corporate leadership in general.

Context of Brookfield’s Move

Brookfield Asset Management is a globally recognized alternative asset manager with a diverse portfolio. The decision to shift its headquarters to New York City represents a critical strategic pivot that could have far-reaching consequences. New York City, known as a financial hub, attracts numerous investment firms, making it an appealing location for Brookfield. However, the choice also raises questions about the company’s commitment to its Canadian roots and the potential impact on its Canadian employees and stakeholders.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Canadian Economy

The relocation of Brookfield’s headquarters could have significant implications for the Canadian economy. As one of Canada’s largest and most influential companies, Brookfield’s departure may signal a trend of other corporations following suit, potentially leading to job losses and a decrease in tax revenues for the Canadian government. This situation puts pressure on Canadian policymakers to create an environment conducive to retaining major corporations and attracting foreign investment.

Reactions from Stakeholders

The reactions to Barrett’s tweet have been mixed, with some supporting his call for accountability, while others have expressed skepticism about the allegations against Carney. Shareholders, analysts, and industry experts are now closely monitoring the situation, as it could set a precedent in corporate governance and shareholder relations.

If Carney is found to have misled shareholders, it could trigger regulatory scrutiny and possibly lead to legal repercussions. This scenario underscores the increasing importance of transparency and ethical considerations in corporate decision-making processes.

The Broader Corporate Governance Landscape

This incident is part of a larger conversation about corporate governance and accountability. Stakeholders are increasingly demanding greater transparency from corporate leaders, particularly in light of recent scandals involving major corporations. The rise of social media has also empowered individuals like Barrett to bring potential misconduct to light, forcing companies to be more responsive to shareholder concerns.

Conclusion

As the story unfolds, the focus remains on the implications of Brookfield’s headquarters move and the allegations against Mark Carney. The situation serves as a reminder of the critical role corporate governance plays in maintaining trust between companies and their shareholders. As public scrutiny intensifies, it will be essential for Brookfield and its leadership to address these allegations transparently and uphold the principles of ethical business practices.

In a world where corporate decisions are under ever-increasing scrutiny, the case of Brookfield Asset Management highlights the need for accountability and transparency. The outcome of this situation could have lasting effects not only on Brookfield but also on other corporations considering similar moves. The financial community is watching closely, as the implications of this controversy extend far beyond the borders of Canada, impacting global perceptions of corporate integrity and governance.

BREAKING: Carney lied.

Carney was chair of Brookfield’s board when they unanimously voted to move their headquarters out of Canada to New York City – Trump’s hometown.

Here is the letter he wrote to shareholders urging them to approve the move on December 1, 2024.

Mark… pic.twitter.com/ITcHoO6kkm

— Michael Barrett (@MikeBarrettON) February 26, 2025

BREAKING: Carney Lied

In the world of corporate governance, transparency and trust are essential. You rely on leaders to provide accurate information and act in the best interests of shareholders. But what happens when that trust is broken? Recently, a controversy emerged regarding Mark Carney, former chair of Brookfield Asset Management. Allegations surfaced claiming that Carney misled shareholders about a significant decision: the company’s move from Canada to New York City. This article delves into the details surrounding this situation, examining the implications of such an action and what it means for investors and the broader corporate landscape.

Unanimous Decision to Move Headquarters

Carney was at the helm when Brookfield’s board made a unanimous decision to relocate its headquarters to New York City, famously known as Trump’s hometown. This move raised eyebrows and sparked discussions about the motivations behind such a significant shift. The transition to New York City was seen by some as a strategic maneuver, allowing Brookfield to tap into the bustling financial hub and the extensive network of businesses and investors in the area.

However, the move also posed questions about Carney’s leadership and the potential consequences for Canadian stakeholders. Investors want to know the rationale behind such a decision, especially when it involves uprooting a company with deep Canadian roots. The timing of the announcement, along with the accompanying letter to shareholders, only intensified scrutiny over Carney’s motives.

Letter to Shareholders

In a letter dated December 1, 2024, Carney urged shareholders to approve the move. In the letter, he outlined the benefits of relocating to New York City, emphasizing growth opportunities, enhanced market access, and the potential for increased shareholder value. However, critics argue that the letter lacked transparency and failed to address the concerns of Canadian investors who might feel overlooked or betrayed by this decision.

The letter, which can be viewed [here](https://t.co/ITcHoO6kkm), highlights Carney’s persuasive communication style, but it also raises more questions than answers. Was it truly in the best interest of Brookfield’s investors, or was it a decision fueled by personal ambition and a desire to align with influential figures in the New York business landscape?

Impact on Canadian Stakeholders

For many Canadian shareholders, the move represented a betrayal. Brookfield has long been seen as a cornerstone of the Canadian business community. By shifting its headquarters to New York City, the company risks alienating its Canadian base. This transition can lead to a loss of trust among investors who may feel that their interests are secondary to the ambitions of the company’s leadership.

Furthermore, the move could have implications for Brookfield’s reputation in Canada. Stakeholders may question whether the company remains committed to its Canadian roots or if it is merely chasing opportunities in more lucrative markets. The potential fallout from this decision could ripple through the Canadian economy, affecting not just Brookfield but also the broader business community.

The Role of Leadership in Corporate Governance

Carney’s actions have reignited discussions about the role of leadership in corporate governance. When leaders like Carney make significant decisions, they carry the responsibility of guiding their companies with integrity and transparency. In this case, the allegations of misleading shareholders raise concerns about the ethical obligations of corporate leaders.

Shareholders expect their leaders to be forthright and honest, especially when it comes to decisions that can significantly impact the value of their investments. The failure to communicate openly can lead to a breakdown of trust, which is difficult to rebuild once lost. The corporate world is watching closely to see how this situation unfolds and what it means for Carney’s legacy.

Public Reaction and Backlash

The news of Carney’s alleged deception has sparked significant public reaction. Investors, analysts, and the media have taken to social media platforms to voice their opinions. Critics are quick to label Carney as untrustworthy, and calls for accountability are growing louder. Some shareholders are demanding a reevaluation of the board’s decision-making processes, advocating for greater transparency and communication in the future.

The backlash against Carney and Brookfield serves as a cautionary tale for corporate leaders everywhere. In an age of instant communication and heightened scrutiny, the stakes have never been higher for executives. Missteps can lead to reputational damage and loss of investor confidence, making it crucial for leaders to prioritize honesty and transparency in their dealings.

Looking Ahead: What This Means for Brookfield

As Brookfield moves forward with its headquarters relocation, the company faces a challenging road ahead. Rebuilding trust with its Canadian stakeholders will be no small feat. The company must take proactive steps to communicate its vision and address the concerns of investors who may feel left behind.

Brookfield’s leadership will need to demonstrate a commitment to transparency and integrity in all its dealings. This includes regular communication with shareholders, listening to their concerns, and providing updates on the company’s performance and strategic direction. By doing so, Brookfield can work towards mending relationships with its stakeholders and regaining their trust.

The Broader Implications for Corporate Governance

The controversy surrounding Carney and Brookfield raises broader implications for corporate governance practices across the board. Companies must recognize the importance of transparency and accountability in their decision-making processes. This incident serves as a reminder that corporate leaders must prioritize the interests of their shareholders, fostering an environment of trust and open communication.

As businesses face increasing scrutiny from investors and the public alike, the demand for ethical leadership will only grow. Companies that fail to embrace transparency may find themselves facing backlash from their stakeholders, impacting their long-term viability and success.

Final Thoughts

The unfolding situation surrounding Mark Carney and Brookfield Asset Management serves as a stark reminder of the importance of integrity in corporate leadership. As the company navigates the fallout from its headquarters relocation, it must prioritize rebuilding trust with its investors and stakeholders. The road ahead may be challenging, but with a commitment to transparency and ethical leadership, Brookfield can emerge from this controversy stronger than before.

In the end, the corporate landscape is ever-evolving, and companies must adapt to the changing expectations of their stakeholders. Effective communication, honesty, and accountability will be key in shaping the future of corporate governance, ultimately determining the success of organizations like Brookfield in a competitive global market.