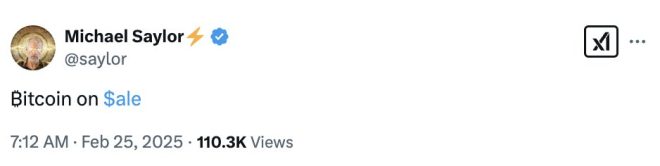

Michael Saylor Advocates Buying Bitcoin on Sale

In a recent tweet that has garnered significant attention, Michael Saylor, the co-founder and executive chairman of MicroStrategy, expressed his bullish outlook on Bitcoin. He stated, "Bitcoin on sale," urging investors to consider purchasing during the current dip in price. This statement has resonated deeply within the cryptocurrency community, highlighting the ongoing volatility in the crypto market and the opportunities it presents for savvy investors.

The Context of "Buying the Dip"

The phrase "buying the dip" is commonly used among traders and investors to signify the strategy of purchasing an asset after its price has dropped, under the belief that the price will eventually rebound. Saylor’s tweet comes during a period where Bitcoin’s price has experienced fluctuations, prompting many to reassess their investment strategies. For those unfamiliar with Bitcoin and its market dynamics, this can be a pivotal moment to understand the potential benefits of entering the market.

Who is Michael Saylor?

Michael Saylor has become a prominent figure in the cryptocurrency space, particularly known for his strong advocacy of Bitcoin. His company, MicroStrategy, has made headlines for its substantial investments in Bitcoin, positioning it as one of the largest corporate holders of the cryptocurrency. Saylor’s insights and predictions often influence market sentiment, making his statements particularly noteworthy for both individual and institutional investors.

The Current State of Bitcoin

As of February 2025, Bitcoin’s price has been experiencing volatility, a characteristic feature of the cryptocurrency market. Market corrections, where prices decline significantly after a period of rapid growth, create opportunities for investors to buy in at lower prices. Saylor’s tweet suggests that he believes the current dip represents an attractive buying opportunity, reinforcing the idea that long-term holders should consider accumulating Bitcoin during such fluctuations.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Analyzing Market Trends

Investors looking to buy Bitcoin must consider various factors that influence its price. These include market sentiment, regulatory news, and macroeconomic trends. For instance, positive developments in institutional adoption or favorable regulatory changes can drive prices up, while negative news can lead to declines. Saylor’s encouragement to buy during a dip suggests a belief in the long-term value of Bitcoin, despite short-term price fluctuations.

The Importance of Education in Cryptocurrency Investing

For those new to cryptocurrency, understanding the market is crucial before making investment decisions. Saylor’s advocacy emphasizes the importance of education and research. Potential investors should familiarize themselves with Bitcoin’s technology, market dynamics, and historical performance. This knowledge equips investors to make informed decisions, especially when navigating periods of volatility.

Community and Social Media Influence

Saylor’s tweet also highlights the growing influence of social media in shaping the cryptocurrency market. Platforms like Twitter have become vital for real-time updates and discussions among investors. Following key figures and sources can provide valuable insights and lead to better-informed investment strategies. However, it is essential to approach social media with caution and conduct independent research to avoid potential pitfalls.

Long-Term vs. Short-Term Investment Strategies

When considering whether to buy Bitcoin during a dip, investors must weigh their long-term goals against short-term market trends. Saylor’s perspective seems to align with a long-term investment strategy, which advocates for holding assets despite market volatility. This approach often involves a more profound understanding of the asset’s potential growth and the broader economic landscape.

Risk Management in Cryptocurrency Investing

Investing in cryptocurrencies like Bitcoin carries inherent risks due to market volatility. Therefore, it’s essential for investors to implement risk management strategies. This may include diversifying investments, setting stop-loss orders, or only investing what one can afford to lose. Saylor’s tweet serves as a reminder that while opportunities exist, investors must remain vigilant and prepared for market fluctuations.

The Future of Bitcoin

Looking ahead, many experts predict that Bitcoin will continue to play a significant role in the financial landscape. Factors such as increasing institutional adoption, advancements in blockchain technology, and potential changes in regulatory frameworks could influence Bitcoin’s future trajectory. Saylor’s bullish stance reinforces the notion that Bitcoin may be viewed as a digital store of value, similar to gold.

Conclusion

Michael Saylor’s call to action to consider buying Bitcoin during its current dip encapsulates the ongoing discourse surrounding cryptocurrency investments. His influence as a prominent figure in the crypto space highlights the importance of understanding market dynamics and the potential opportunities that arise amid volatility. For investors, whether seasoned or new, Saylor’s tweet serves as a timely reminder to conduct thorough research, develop a clear investment strategy, and stay informed about the ever-evolving cryptocurrency landscape.

As Bitcoin continues to capture the attention of both retail and institutional investors, the discussions around its value and potential for growth are likely to persist. The cryptocurrency market remains a complex and dynamic environment, and staying updated with insights from influential figures like Michael Saylor can be instrumental in navigating this terrain. With the right approach, investors may find themselves well-positioned to capitalize on the opportunities that come with market fluctuations.

JUST IN: Michael Saylor says, “₿itcoin on $ale.”

Are you buying the dip? pic.twitter.com/z0laXnG7hT

— Cointelegraph (@Cointelegraph) February 24, 2025

JUST IN: Michael Saylor says, “₿itcoin on $ale.”

In the ever-evolving landscape of cryptocurrency, few names resonate as strongly as Michael Saylor. Recently, he made waves with his bold declaration: “₿itcoin on $ale.” This statement, shared via a [tweet](https://twitter.com/Cointelegraph/status/1894173111433740689?ref_src=twsrc%5Etfw) from Cointelegraph, has sparked a flurry of discussions among both seasoned investors and newcomers alike. But what exactly does this mean for Bitcoin prices? And more importantly, should you consider buying the dip?

Understanding the Current Bitcoin Market

The cryptocurrency market is notorious for its volatility. Just like a rollercoaster, it has its ups and downs, and Bitcoin is often at the forefront of this wild ride. When Saylor mentions Bitcoin being on sale, he’s highlighting a potential opportunity for investors. Many people have been observing recent price dips, which can be seen as a chance to buy Bitcoin at a lower price.

Investing during these dips can be a strategic move, especially for long-term holders who believe in Bitcoin’s future. However, it’s essential to analyze the market trends and understand the underlying factors contributing to these price movements.

Are You Buying the Dip?

The phrase “Are you buying the dip?” has become a rallying cry in the crypto community. It prompts investors to consider purchasing assets when prices fall, rather than waiting for them to rise again. But how do you know if it’s the right time to buy?

First off, it’s crucial to assess your financial situation and risk tolerance. Investing in cryptocurrencies can be risky, and it’s not for everyone. If you’re considering buying the dip, make sure you’re not investing money you can’t afford to lose.

Next, take a look at the market indicators. Is there significant selling pressure, or are prices stabilizing? Resources like [CoinMarketCap](https://coinmarketcap.com/) can help you track price trends and market sentiment, giving you a clearer picture of whether it’s the right time to enter the market.

Michael Saylor’s Influence on Bitcoin

Michael Saylor, co-founder of MicroStrategy, has become one of the most vocal supporters of Bitcoin. His company has invested heavily in Bitcoin, accumulating a significant amount of it over the years. Saylor believes that Bitcoin will act as a hedge against inflation and a store of value, much like gold.

His endorsement of Bitcoin carries weight; many investors look to his actions and statements for guidance. When he talks about Bitcoin being on sale, it resonates with those who view him as a thought leader in the cryptocurrency space. His insights often lead to increased interest and investment in Bitcoin, which can influence its price.

What to Consider Before Buying Bitcoin

Before diving headfirst into a Bitcoin purchase, there are a few things you should consider:

1. **Research**: Knowledge is power. Familiarize yourself with Bitcoin, blockchain technology, and the overall cryptocurrency market. Understanding the fundamentals can help you make informed decisions.

2. **Timing**: While buying the dip can be a great strategy, timing is crucial. Use technical analysis and market indicators to help guide your buying decisions.

3. **Diversification**: Don’t put all your eggs in one basket. While Bitcoin is a strong asset, consider diversifying your investments across different cryptocurrencies and other asset classes to mitigate risk.

4. **Long-Term Vision**: Ask yourself why you’re investing in Bitcoin. If you believe in its potential as a long-term store of value, you may be more inclined to hold through the volatility.

5. **Security**: Make sure to choose a reputable exchange for purchasing Bitcoin. Also, consider using a hardware wallet for added security of your assets.

The Community’s Reaction

The crypto community is buzzing with excitement following Saylor’s announcement. Many enthusiasts are interpreting his statement as a sign that Bitcoin is poised for a resurgence. [Twitter](https://twitter.com/Cointelegraph/status/1894173111433740689?ref_src=twsrc%5Etfw) has lit up with discussions about whether now is the right time to buy, with individuals sharing their strategies and insights.

Social media platforms, especially Twitter, have become a hub for crypto discussions. Posts and threads are filled with opinions on market trends, predictions, and personal experiences. Engaging with these communities can provide valuable insights and help you feel more connected in your investment journey.

Long-Term vs. Short-Term Investment Strategies

When considering investing in Bitcoin, it’s essential to distinguish between long-term and short-term strategies.

– **Long-Term Holding**: This strategy involves buying Bitcoin and holding onto it for an extended period, regardless of market fluctuations. Many long-term investors believe that Bitcoin will appreciate significantly over time, making short-term volatility less of a concern.

– **Day Trading**: On the other hand, day trading involves buying and selling Bitcoin within short time frames to capitalize on price movements. This method requires a keen understanding of market trends and can be risky, especially for inexperienced investors.

Deciding which strategy suits you best depends on your investment goals, risk tolerance, and time commitment.

Potential Risks of Investing in Bitcoin

While the potential for profit is alluring, investing in Bitcoin comes with its own set of risks:

1. **Market Volatility**: Bitcoin is known for its price swings. A sudden market crash can lead to significant losses if you’re not prepared.

2. **Regulatory Changes**: Governments are still grappling with how to regulate cryptocurrencies. Changes in regulations could impact Bitcoin’s value and accessibility.

3. **Security Concerns**: While blockchain technology is generally secure, exchanges and wallets can be vulnerable to hacks. Ensuring your assets are stored securely is vital.

4. **Market Manipulation**: The cryptocurrency market can be susceptible to manipulation, affecting prices unpredictably.

Understanding these risks can help you make more informed decisions and prepare for the ups and downs of the crypto market.

How to Get Started with Bitcoin

If you’re inspired by Michael Saylor’s comments and are considering buying Bitcoin, here’s a simple roadmap to get you started:

1. **Choose a Cryptocurrency Exchange**: Select a reputable exchange like Coinbase, Binance, or Kraken to create your account.

2. **Verify Your Identity**: Most exchanges will require you to verify your identity for security reasons. This process can vary in time, so be prepared.

3. **Fund Your Account**: Once verified, deposit funds into your account. You can do this via bank transfer, credit card, or other methods, depending on the exchange.

4. **Buy Bitcoin**: With your account funded, you can now purchase Bitcoin. Choose the amount you want to buy and complete the transaction.

5. **Store Your Bitcoin Safely**: After buying Bitcoin, consider transferring it to a secure wallet. Hardware wallets offer the best security for long-term holdings.

Conclusion: Is Now the Right Time to Buy Bitcoin?

Michael Saylor’s proclamation that Bitcoin is “on sale” has reignited discussions about the potential for profit in the current market. While buying the dip can be an enticing strategy, it’s important to do your homework and weigh the risks and rewards carefully.

Ultimately, whether you choose to invest now or wait for a better opportunity depends on your individual financial situation, market understanding, and investment goals. As always, stay informed, keep learning, and engage with the community for the best insights. Happy investing!