Ohio Representatives Propose Bill to Remove State Taxes on Bitcoin Payments

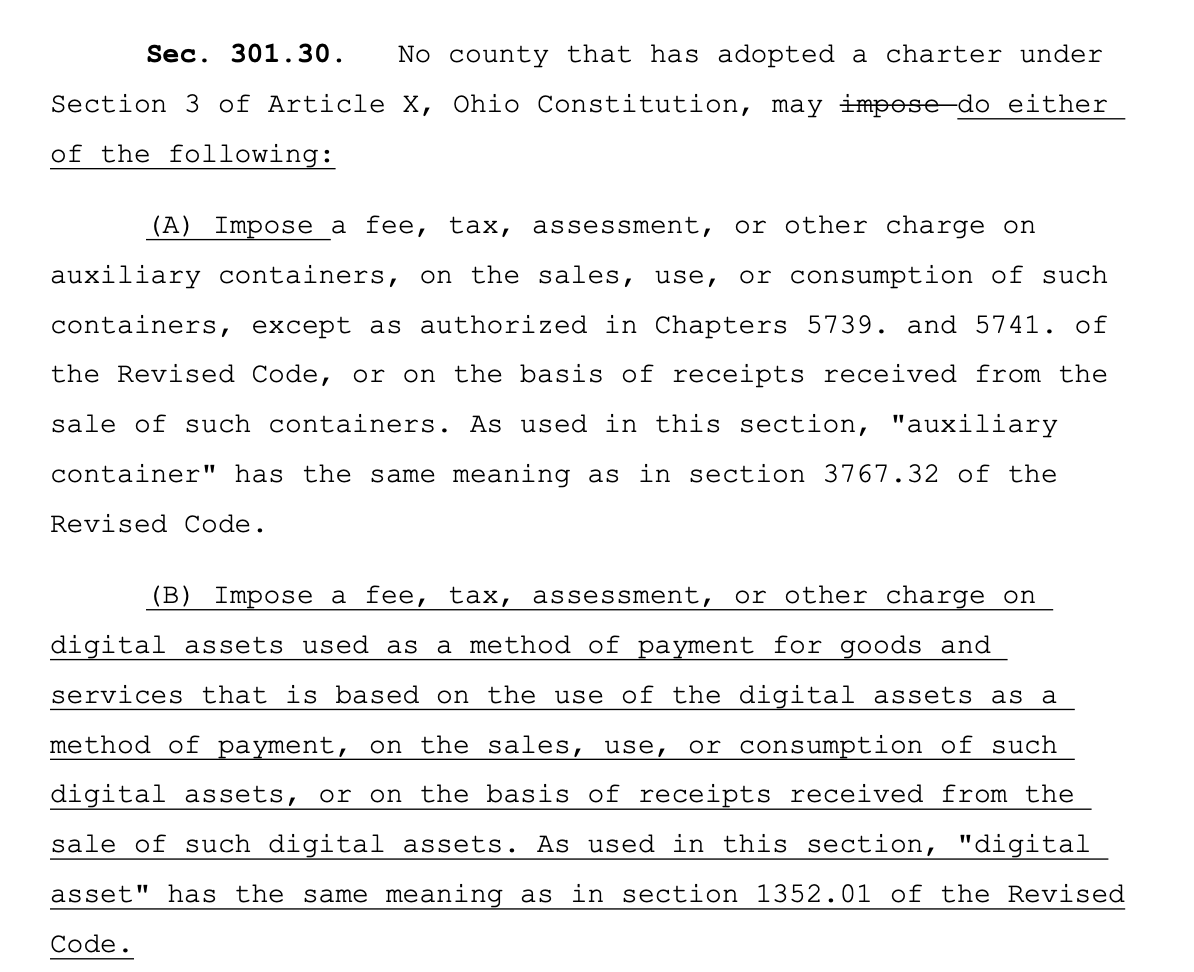

In a significant development for cryptocurrency enthusiasts and investors, representatives from Ohio have introduced a bill aimed at eliminating state taxes on Bitcoin payments. This move is seen as a strategic effort to promote the adoption of cryptocurrencies within the state and to attract businesses and investors in the burgeoning digital currency market.

The Bill: Key Provisions and Implications

The proposed legislation, which has garnered attention from both lawmakers and the public, seeks to create a tax-friendly environment for Bitcoin transactions. By removing state taxes on Bitcoin payments, Ohio aims to position itself as a frontrunner in the cryptocurrency space, encouraging more businesses to accept digital currencies as a form of payment.

This initiative aligns with the growing trend of states and countries around the world recognizing the potential of cryptocurrencies and integrating them into their financial systems. The bill not only has implications for individual users of Bitcoin but also for businesses considering adopting this form of payment, potentially leading to increased economic activity in the state.

Why Ohio?

Ohio has been a pioneer in the realm of cryptocurrency, previously being one of the first states to allow residents to pay their taxes using Bitcoin. However, this initiative faced challenges and was eventually suspended. The new bill represents a renewed commitment to embrace cryptocurrency as a legitimate financial instrument, signaling to the public and the market that Ohio is serious about becoming a leader in the digital economy.

Benefits of Removing State Taxes on Bitcoin Payments

- Encouraging Adoption: By eliminating state taxes, the bill is likely to encourage more businesses and consumers to use Bitcoin for transactions. This could lead to a broader acceptance of cryptocurrencies, fostering a more robust digital economy.

- Attracting Businesses: With no state taxes on Bitcoin payments, Ohio could attract businesses that prioritize innovative payment solutions. Companies looking to expand or relocate may find Ohio’s favorable tax environment appealing, potentially boosting local job creation and economic growth.

- Increasing Revenue: While the state may initially lose tax revenue from Bitcoin transactions, the increased business activity and consumer spending could lead to a more significant overall economic impact, ultimately generating revenue through other channels.

Challenges Ahead

Despite the potential benefits, there are challenges that Ohio may face in implementing this legislation. One of the primary concerns is the volatility associated with Bitcoin and other cryptocurrencies. The fluctuating value of Bitcoin could pose risks for both consumers and businesses, leading to potential losses in transactions.

Additionally, regulatory clarity is essential. As cryptocurrencies continue to evolve, state and federal regulations are also changing. Ohio will need to ensure that its laws align with broader regulatory frameworks to protect consumers and businesses engaged in cryptocurrency transactions.

The Broader Context: Cryptocurrency Adoption in the U.S.

The introduction of this bill comes at a time when cryptocurrency adoption in the United States is on the rise. More Americans are investing in and using digital currencies, leading to a growing demand for favorable regulatory environments. Other states are also exploring similar measures, reflecting a nationwide trend towards embracing cryptocurrencies.

Conclusion: A Step Forward for Ohio and Cryptocurrency

The introduction of the bill to remove state taxes on Bitcoin payments marks a significant step forward for Ohio in its pursuit of becoming a cryptocurrency hub. By fostering an environment that encourages the use of digital currencies, Ohio could see increased innovation, investment, and economic growth.

As the landscape of cryptocurrency continues to evolve, Ohio’s proactive approach may serve as a model for other states considering similar legislation. The success of this initiative will depend on the collaboration between lawmakers, businesses, and the cryptocurrency community to navigate the challenges and opportunities that lie ahead.

For those interested in the future of cryptocurrency and its implications for the economy, Ohio’s legislative move is certainly worth watching. With more states likely to consider similar measures, the future of Bitcoin and other digital currencies could be brighter than ever.

JUST IN: Ohio Representatives introduce bill that would remove state taxes on Bitcoin payments. pic.twitter.com/YGcARTxsIA

— Bitcoin Magazine (@BitcoinMagazine) February 24, 2025

JUST IN: Ohio Representatives introduce bill that would remove state taxes on Bitcoin payments.

In a significant move for cryptocurrency enthusiasts and businesses operating in Ohio, state representatives have introduced a bill aimed at removing state taxes on Bitcoin payments. This initiative has the potential to reshape how cryptocurrencies are treated in the realm of commerce, providing a more favorable environment for Bitcoin transactions.

But what does this mean for you, the average consumer or business owner? Let’s dive into the implications of this groundbreaking bill and explore how it could impact the future of Bitcoin in Ohio.

Why Remove State Taxes on Bitcoin Payments?

The primary motivation for introducing this bill is to encourage the adoption of Bitcoin as a legitimate payment method. Currently, businesses accepting Bitcoin face tax liabilities that can deter them from embracing digital currencies. By removing state taxes on Bitcoin payments, Ohio aims to foster innovation and attract more businesses to the state.

This legislative move could make Ohio a leader in the cryptocurrency space, drawing in tech companies and startups that are looking for a favorable environment to operate. The elimination of taxes on Bitcoin transactions would not only simplify accounting processes for businesses but also enhance the overall appeal of using cryptocurrencies for everyday purchases.

The Current Landscape of Bitcoin in Ohio

Ohio has been relatively progressive when it comes to cryptocurrency. In 2018, the state became the first in the U.S. to allow businesses to pay taxes with Bitcoin, a move that generated a lot of buzz in the crypto community. However, this was short-lived, as the program was suspended in 2019 due to regulatory concerns.

Fast forward to today, the reintroduction of Bitcoin payments without state taxes signifies a renewed commitment to the cryptocurrency ecosystem. With the growing interest in Bitcoin and other digital currencies, this bill could pave the way for Ohio to reclaim its position as a frontrunner in crypto adoption.

What Are the Benefits for Consumers?

If this bill passes, consumers can expect several benefits. First and foremost, the removal of state taxes on Bitcoin payments means that you might see lower prices when purchasing goods and services with Bitcoin. This could incentivize more people to use Bitcoin for everyday transactions, making it a more mainstream payment option.

Additionally, as businesses begin to adopt Bitcoin, consumers may enjoy a broader range of options for making purchases. Imagine being able to buy your morning coffee, groceries, or even a new car with Bitcoin, all without the burden of state taxes. This shift could fundamentally change the way we think about money and transactions.

Impacts on Businesses in Ohio

For businesses, the implications of this bill are profound. By eliminating state taxes on Bitcoin payments, companies can reduce their operational costs and potentially increase profit margins. This financial relief could encourage more businesses to accept Bitcoin, creating a more vibrant cryptocurrency ecosystem in Ohio.

Moreover, businesses that embrace Bitcoin may find themselves appealing to a tech-savvy customer base. As younger generations become more comfortable with digital currencies, the ability to pay with Bitcoin could become a significant competitive advantage.

Potential Challenges and Concerns

While the benefits of removing state taxes on Bitcoin payments are clear, there are also potential challenges that need to be addressed. For instance, the volatility of Bitcoin prices can pose risks for both consumers and businesses. If the value of Bitcoin fluctuates significantly between the time of a purchase and the time of conversion to fiat currency, it could lead to financial losses.

Additionally, regulatory concerns remain a hot topic in the cryptocurrency world. While Ohio’s bill is a step in the right direction, there may still be hurdles to overcome in terms of federal regulations and compliance. It’s essential for lawmakers to work closely with financial regulators to ensure that the cryptocurrency landscape remains secure and transparent.

The Role of Education in Cryptocurrency Adoption

As Ohio moves forward with this bill, education will play a crucial role in its success. Many consumers and businesses still have misconceptions about Bitcoin and cryptocurrencies in general. Providing resources and educational programs can help demystify digital currencies and encourage more people to participate in the crypto economy.

Workshops, seminars, and informational campaigns can help bridge the knowledge gap and empower individuals to make informed decisions about using Bitcoin. By fostering a culture of understanding and acceptance, Ohio can create a thriving environment for cryptocurrency innovation.

Looking Ahead: The Future of Bitcoin in Ohio

The introduction of this bill is just the beginning of what could be a transformative era for Bitcoin in Ohio. As lawmakers continue to push for the removal of state taxes on Bitcoin payments, the potential for growth and innovation in the cryptocurrency space is immense.

If successful, Ohio could set a precedent for other states to follow suit, creating a ripple effect across the nation. This could lead to increased adoption of Bitcoin and other cryptocurrencies, ultimately reshaping the financial landscape as we know it.

How Can You Get Involved?

If you’re excited about the potential of Bitcoin and want to support this initiative, there are several ways to get involved. Start by reaching out to your local representatives and expressing your support for the bill. Engaging in conversations about the benefits of cryptocurrency can help raise awareness and encourage more people to advocate for change.

Additionally, consider exploring Bitcoin yourself. Whether it’s through investing or simply learning more about how it works, becoming knowledgeable about cryptocurrency can empower you to be part of this evolving landscape.

Conclusion: A New Dawn for Bitcoin in Ohio

The proposed bill to remove state taxes on Bitcoin payments is an exciting development for Ohio and the broader cryptocurrency community. By fostering an environment that encourages the use of digital currencies, Ohio is positioning itself as a leader in the crypto space.

As we continue to monitor the progress of this bill, one thing is clear: the future of Bitcoin in Ohio is bright, and the possibilities are endless. Whether you’re a consumer, business owner, or simply a curious observer, this is a moment worth paying attention to. The evolution of money is happening right before our eyes, and Ohio is at the forefront of this exciting transformation.