Bybit Acquires 266,694 ETH After Significant Hack

In a recent development that has sent waves through the cryptocurrency community, Bybit, a prominent cryptocurrency exchange, has acquired an impressive 266,694 Ethereum (ETH) valued at approximately $746 million following a major security breach. This move comes amidst ongoing discussions about the security of cryptocurrency exchanges and the measures being taken to protect user assets.

The Context of the Hack

The incident has raised concerns among traders and investors regarding the safety of their investments in digital currencies. Cybersecurity threats have become increasingly common in the crypto world, leading to significant financial losses for both exchanges and their users. The hack that prompted Bybit’s massive purchase of ETH serves as a stark reminder of the vulnerabilities present in the digital asset space.

Bybit’s Strategic Move

Bybit’s acquisition of such a large amount of ETH can be seen as a strategic response to the hack. By purchasing these assets, Bybit aims to reassure its users about the safety and integrity of its platform. The exchange is actively working to bolster its security measures and recover from the ramifications of the breach, which has affected the confidence of many traders.

Financial Implications

The purchase of 266,694 ETH is a significant financial commitment and indicates Bybit’s determination to maintain its position as a leading exchange despite the setbacks caused by the hack. The acquisition not only strengthens the exchange’s balance sheet but also demonstrates a proactive approach to managing the fallout from security incidents. Furthermore, Bybit’s actions may influence the broader market dynamics of Ethereum and cryptocurrency trading in general.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Road Ahead for Bybit

As Bybit moves forward in the wake of the hack, it faces the challenge of regaining user trust and ensuring that such security breaches do not occur in the future. The exchange is reportedly planning to implement advanced security protocols and improve its overall operational transparency. By doing so, Bybit aims to strengthen its reputation within the crypto community and attract users back to its platform.

The Importance of Security in Cryptocurrency

The incident involving Bybit underscores the critical importance of security in the cryptocurrency sector. With billions of dollars invested in digital assets, the need for robust security measures is paramount. Users are increasingly looking for exchanges that prioritize their safety and offer reliable protection against hacking attempts.

Conclusion

In conclusion, Bybit’s acquisition of 266,694 ETH following a significant hack reflects its commitment to user security and operational resilience. As the exchange continues to navigate the challenges posed by cybersecurity threats, it is crucial for platforms like Bybit to enhance their security measures and build trust with their users. The crypto community will undoubtedly be watching closely as Bybit takes steps to recover and fortify its position in the market.

Future Prospects for Bybit and Ethereum

Looking ahead, the ramifications of this incident may extend beyond Bybit, potentially impacting the entire cryptocurrency market. As exchanges reevaluate their security protocols, there may be a shift in how digital assets are traded and stored. Additionally, Ethereum, as the second-largest cryptocurrency by market capitalization, will likely experience fluctuations in its value in response to Bybit’s large purchase and the overall sentiment in the market.

This situation serves as a critical learning opportunity for all stakeholders in the cryptocurrency ecosystem. By prioritizing security and transparency, exchanges can foster a more stable and secure environment for all users. As the landscape continues to evolve, it is essential for exchanges to remain vigilant and proactive in their efforts to safeguard user assets and maintain the integrity of the crypto market.

Recommendations for Users

For users of cryptocurrency exchanges, it is paramount to stay informed about the security practices of the platforms they engage with. Here are some recommendations:

- Research the Exchange: Before investing, research the exchange’s security measures, history of breaches, and user reviews.

- Use Two-Factor Authentication: Always enable two-factor authentication (2FA) for added security.

- Diversify Investments: Avoid keeping all assets on a single exchange; consider using hardware wallets for long-term storage.

- Stay Updated: Keep abreast of news and updates regarding the exchange you use, especially in the wake of security incidents.

- Educate Yourself on Cryptocurrencies: Understanding the market and various cryptocurrencies can help you make informed decisions.

Bybit’s recent actions highlight the ongoing challenges faced by cryptocurrency exchanges and the importance of security in building a trustworthy trading environment. As the industry continues to mature, users and exchanges alike must prioritize safety and transparency to foster a healthy and resilient cryptocurrency ecosystem.

BREAKING:

BYBIT HAS BOUGHT 266,694 ETH

WORTH $746 MILLION SINCE HACK.ALMOST $700M MORE TO GO !!! pic.twitter.com/bOjADyXimh

— Ash Crypto (@Ashcryptoreal) February 24, 2025

BREAKING:

In an astonishing move that has sent ripples through the cryptocurrency community, BYBIT HAS BOUGHT 266,694 ETH worth a staggering $746 MILLION SINCE HACK. This acquisition not only highlights BYBIT’s commitment to the Ethereum blockchain but also raises questions about the future trajectory of both the exchange and the crypto market at large. The implications of such a significant purchase are far-reaching, and many are eager to understand what this means for investors, traders, and the ecosystem itself.

What Led to the Purchase?

The backdrop of this purchase is a recent hack that shook the foundations of the crypto world. With security breaches becoming a more common occurrence, exchanges are under increasing pressure to secure their assets and reassure their users. BYBIT’s decision to buy a large amount of Ethereum seems to be a strategic move to bolster its balance sheet and demonstrate resilience in the face of adversity. As reported by CoinDesk, this acquisition follows a significant security breach, prompting BYBIT to take immediate action to safeguard its interests and those of its clients.

Breaking Down the Numbers

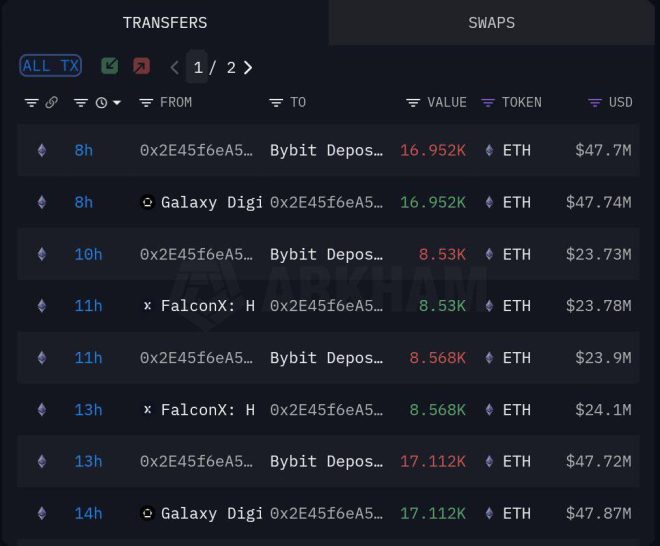

Let’s take a closer look at the figures involved in this monumental buy. The purchase of 266,694 ETH represents a hefty investment, particularly in the ever-volatile crypto market. At the time of the purchase, this amount of Ethereum was valued at approximately $746 million. This investment reflects BYBIT’s confidence in Ethereum’s long-term potential. In addition to this initial amount, there are reports that BYBIT plans to spend ALMOST $700M MORE TO GO !!! This could mean even more substantial purchases on the horizon, further solidifying its position in the market.

What Does This Mean for Ethereum?

So, what does this mass acquisition mean for Ethereum? Well, it’s a clear indicator that institutional interest in Ethereum is not waning. In fact, it’s growing stronger. This kind of investment can lead to increased demand, which is often a precursor to price appreciation. Many analysts believe that such large purchases can serve as a bullish signal for Ethereum, potentially attracting more investors and traders to the ecosystem.

Moreover, the influx of capital into Ethereum could help sustain its development. Ethereum is undergoing significant upgrades aimed at enhancing scalability and efficiency, such as the transition to Ethereum 2.0. With more financial resources being directed towards Ethereum, we could see accelerated innovation, improvements, and a more robust ecosystem.

Market Reactions

The crypto market is known for its volatility, and major news like this can lead to swift changes in sentiment. Following the announcement of BYBIT’s purchase, many traders took to social media to express their opinions. Some see this as a bullish sign, interpreting it as a vote of confidence in Ethereum’s future. Others are more cautious, reminding the community that while large purchases can indicate positive sentiment, they don’t guarantee future price movements. For those interested in the latest market reactions, you can check out insights from CryptoSlate.

BYBIT’s Strategic Positioning

BYBIT isn’t just any exchange; it’s one of the largest cryptocurrency exchanges globally. Their decision to acquire such a massive amount of ETH indicates a strategic positioning that goes beyond temporary market trends. By investing heavily in Ethereum, BYBIT is likely looking to solidify its standing as a primary player in the crypto space. This could also signal to other exchanges and financial institutions that Ethereum remains a critical asset in a diversified portfolio.

What’s Next for BYBIT?

With almost $700M MORE TO GO !!! in potential investments, many are speculating on BYBIT’s next moves. Will they continue to accumulate Ethereum, or will they diversify their investments into other cryptocurrencies? Given the current market dynamics, it wouldn’t be surprising to see BYBIT explore new opportunities. Additionally, as they continue to navigate the aftermath of the hack, it will be interesting to observe how they enhance security measures to protect their assets and their users.

The Bigger Picture

This acquisition is part of a larger trend within the cryptocurrency market. Institutional investors and exchanges are increasingly recognizing the value of digital assets and are making significant investments to secure their positions. As cryptocurrencies mature, we can expect to see more large-scale investments that could reshape the market landscape.

Furthermore, this event may serve as a wake-up call for other exchanges to ensure they are adequately protecting their assets and taking proactive measures against potential threats. The hack that catalyzed BYBIT’s decision is a reminder of the vulnerabilities that exist in the space, and the importance of robust security protocols cannot be overstated.

Final Thoughts

BYBIT’s recent purchase of 266,694 ETH worth $746 million since hack is a significant event that could have far-reaching implications for the entire cryptocurrency ecosystem. As they prepare to invest ALMOST $700M MORE TO GO !!!, the market will be watching closely to see how this unfolds. Whether you’re a seasoned investor, a trader, or just someone intrigued by the world of cryptocurrencies, this is a development that’s worth keeping an eye on.

As we continue to explore the dynamics of the crypto market, it’s essential to stay informed and engaged. The landscape is ever-changing, and knowing what moves major players like BYBIT are making can provide valuable insights into where the market might head next.

For ongoing updates and more in-depth analysis of the crypto market, consider following trusted news sources and experts in the field. The world of cryptocurrency is exciting, and staying informed will help you navigate this fast-paced environment!