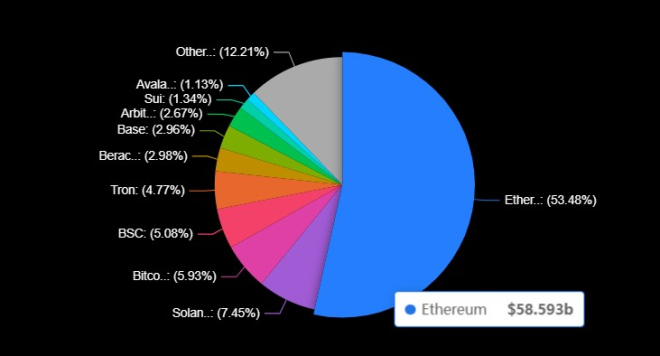

Berachain’s Total Value Locked (TVL) Surges Past $3.26 Billion, Overtaking Arbitrum and Base to Become the Sixth-Largest Blockchain

In a significant milestone for the blockchain ecosystem, Berachain has recently reported an impressive surge in its Total Value Locked (TVL), which has now surpassed $3.26 billion. This remarkable achievement places Berachain ahead of prominent platforms like Arbitrum and Base, securing its position as the sixth-largest blockchain in terms of TVL. This development is notable not only for Berachain but for the entire DeFi (Decentralized Finance) landscape, highlighting the growing interest and investment in blockchain technologies.

Understanding Total Value Locked (TVL)

Total Value Locked (TVL) is a critical metric in the DeFi space that quantifies the total capital held within a blockchain’s smart contracts. It serves as an indicator of the blockchain’s health and popularity. A higher TVL typically signifies greater user engagement, trust, and investment in the platform. As more users lock their assets in a blockchain, it can lead to increased liquidity, which is a crucial factor for the success of decentralized applications (dApps).

Berachain’s Rise in the DeFi Space

Berachain’s ascent to a TVL of over $3.26 billion is indicative of the platform’s robust ecosystem and the appeal it holds for users and investors alike. Launched with a focus on scalability, security, and user-centric design, Berachain has attracted a diverse array of projects and users, contributing to its rising TVL. The platform’s innovative features, such as lower transaction fees and faster processing times, have made it a preferred choice among developers and investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Comparison with Other Blockchains

By overtaking Arbitrum and Base, Berachain has positioned itself prominently within the competitive blockchain market. Arbitrum, known for its layer-2 scaling solutions for Ethereum, and Base, a layer-2 blockchain developed by Coinbase, have long been key players in the DeFi sector. Berachain’s ability to surpass these established platforms demonstrates its rapid growth and the increasing trust users are placing in its infrastructure.

Factors Contributing to Berachain’s Success

Several factors have contributed to Berachain’s robust growth in TVL:

- User-Friendly Interface: Berachain offers a seamless user experience that attracts both novice and experienced users. This accessibility has facilitated greater participation in the platform.

- Strong Community Support: The active engagement of the Berachain community has fostered a collaborative environment, encouraging developers to build innovative dApps on the platform.

- Diverse Ecosystem: Berachain hosts a variety of projects, ranging from DeFi applications to NFT marketplaces. This diversity ensures that users have multiple options for engaging with the blockchain.

- Strategic Partnerships: Collaborations with other projects and platforms have enhanced Berachain’s visibility and credibility in the blockchain space.

- Robust Security Features: Ensuring users’ funds are safe is paramount. Berachain has implemented strong security measures, which have increased user confidence and participation.

Implications of Berachain’s Growth

Berachain’s growth in TVL not only solidifies its position in the market but also has broader implications for the DeFi landscape. As more platforms like Berachain emerge with innovative solutions, we can expect increased competition, which will likely drive further advancements in technology, security, and user experience.

Moreover, as DeFi continues to gain traction among institutional investors and mainstream users, platforms with high TVL are likely to attract even more attention and resources. This can lead to a virtuous cycle where increased investment leads to enhanced features and services, further driving user engagement.

Future Prospects for Berachain

Looking ahead, Berachain appears well-positioned for continued growth. The increasing adoption of blockchain technology and DeFi applications suggests that platforms like Berachain will play a pivotal role in shaping the future of finance. As regulatory frameworks become clearer and more supportive of DeFi, the potential for platforms to attract larger pools of capital increases.

Additionally, the ongoing development of new features and enhancements, along with an expanding ecosystem of dApps, will likely contribute to Berachain’s sustained growth. The focus on interoperability with other blockchains can also enhance its appeal, allowing users to seamlessly interact across different platforms.

Conclusion

In conclusion, Berachain’s recent achievement of surpassing $3.26 billion in TVL marks a significant milestone in the DeFi sector, positioning it as the sixth-largest blockchain in the space. This growth is a testament to the platform’s innovative approach, user-friendly design, and strong community support. As the DeFi landscape continues to evolve, Berachain’s trajectory suggests it will remain a key player in the blockchain ecosystem.

Investors and users alike should keep an eye on Berachain as it navigates the competitive landscape, potentially setting new standards for performance and user engagement in the ever-expanding world of decentralized finance. With its proven track record and commitment to innovation, Berachain is poised for a bright future in the dynamic world of blockchain technology.

JUST IN: Berachain’s TVL surges past $3.26B, overtaking Arbitrum and Base to become the sixth-largest. pic.twitter.com/t76Lef67pn

— Cointelegraph (@Cointelegraph) February 24, 2025

JUST IN: Berachain’s TVL surges past $3.26B, overtaking Arbitrum and Base to become the sixth-largest.

In the ever-evolving landscape of decentralized finance (DeFi), Berachain has made an impressive leap forward. With its total value locked (TVL) recently surpassing $3.26 billion, Berachain has not only carved out a significant niche for itself but has also overtaken established players like Arbitrum and Base. This rise to the sixth-largest position in the DeFi space is nothing short of remarkable and has caught the attention of investors and enthusiasts alike.

What is Berachain?

Before diving deeper into the implications of its skyrocketing TVL, it’s essential to understand what Berachain is all about. Berachain is a layer-1 blockchain designed specifically for DeFi applications. Its unique architecture allows for high throughput, low latency, and minimal transaction costs, making it an attractive option for developers and users. Unlike other platforms that may struggle with congestion or high fees, Berachain aims to create an ecosystem where transactions are fast and affordable.

The Significance of TVL in DeFi

Total value locked (TVL) is a crucial metric in the DeFi world. It represents the total assets that are staked or locked in a DeFi protocol. A higher TVL generally indicates greater trust and adoption of the platform. It also reflects the liquidity available for various services like lending, borrowing, and trading. When Berachain’s TVL surged past $3.26 billion, it signified not just growth in numbers but also a strong validation of its technology and offerings.

Overtaking Arbitrum and Base

The fact that Berachain has overtaken notable platforms like Arbitrum and Base is a statement in itself. Arbitrum, known for its layer-2 scaling solutions for Ethereum, has been a popular choice for users looking to avoid high gas fees. Base, on the other hand, is closely tied to the Coinbase ecosystem, providing seamless integration for users. By surpassing these platforms in TVL, Berachain is sending a clear message that it has become a formidable player in the DeFi space.

Factors Contributing to Berachain’s Growth

So, what exactly has fueled Berachain’s meteoric rise? Let’s break it down:

- Innovative Features: Berachain offers unique features that differentiate it from its competitors. Its focus on providing a seamless user experience with low fees has attracted many users.

- Strong Community Support: The community behind Berachain is vibrant and engaged. This support is crucial for any DeFi project, as it fosters trust and encourages more users to participate.

- Strategic Partnerships: Collaborations with other DeFi projects and platforms have helped Berachain expand its reach and utility.

- Robust Security: In the DeFi world, security is paramount. Berachain’s emphasis on security measures has instilled confidence among users, further driving up its TVL.

The Future of Berachain

With its recent success, many are left wondering what the future holds for Berachain. Given its current trajectory, it’s likely we’ll see continued growth. The DeFi space is still maturing, and Berachain’s innovative approach could position it favorably as more users seek reliable and efficient platforms.

Understanding the DeFi Ecosystem

To appreciate Berachain’s position fully, it’s essential to understand the broader DeFi ecosystem. Decentralized finance is reshaping how we think about banking, lending, and trading. Unlike traditional financial systems, DeFi operates on blockchain technology, providing users with increased transparency and control over their finances.

The competition in the DeFi space is fierce, with numerous platforms vying for users’ attention. However, as Berachain continues to innovate and expand its offerings, it has the potential to become a leader in this rapidly growing market.

How to Get Involved with Berachain

If you’re interested in exploring Berachain or participating in its ecosystem, there are several ways to get involved:

- Investing: You can buy Berachain tokens through various decentralized or centralized exchanges. Be sure to do your research and understand the risks involved.

- Providing Liquidity: Users can contribute to Berachain’s liquidity pools, earning rewards in return. This is a great way to support the platform while also generating passive income.

- Participating in Governance: Many DeFi platforms, including Berachain, allow token holders to participate in governance decisions. This means you can have a say in the future direction of the platform.

Challenges Ahead

Despite its successes, Berachain isn’t without challenges. The DeFi space is notorious for its volatility and risks. Regulatory scrutiny is also increasing, and how Berachain navigates these challenges will be critical for its long-term success. Additionally, as more competitors emerge, Berachain will need to continuously innovate to maintain its edge.

Community and Ecosystem Development

The strength of a DeFi platform often lies in its community. Berachain has been proactive in fostering community engagement through various initiatives. This includes AMAs (Ask Me Anything sessions), educational resources, and developer grants aimed at encouraging third-party projects to build on its platform. A vibrant community not only enhances the platform’s reputation but also drives adoption and engagement.

Conclusion

Berachain’s surge past $3.26 billion in TVL, overtaking Arbitrum and Base, is a testament to the platform’s innovation and the growing trust of its user base. As the DeFi landscape continues to evolve, Berachain stands out as a promising player poised for future growth. Whether you’re an investor, a developer, or just a curious observer, the developments in the Berachain ecosystem are certainly worth keeping an eye on. The journey of Berachain is just beginning, and the possibilities are endless!

For more information on Berachain, you can check out the latest updates from Cointelegraph.