Bybit’s Significant Purchase of 71,755 ETH: A Game Changer in the Crypto Market

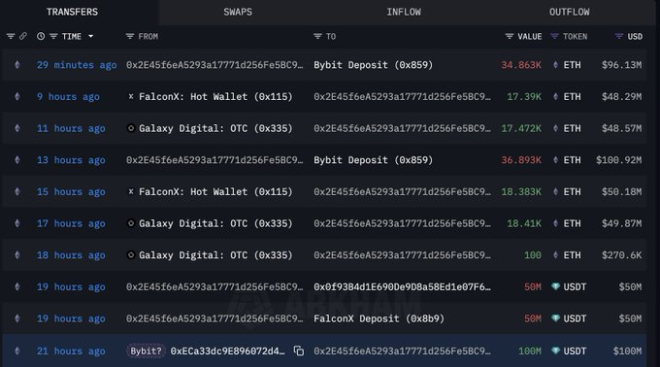

In a major development within the cryptocurrency landscape, Bybit, a prominent cryptocurrency exchange, has reportedly acquired a staggering 71,755 Ethereum (ETH) through over-the-counter (OTC) transactions. This transaction, valued at approximately $197 million, signals not only Bybit’s growing influence in the crypto market but also reflects broader trends in Ethereum’s adoption and investment strategies.

Understanding OTC Transactions

OTC transactions are a vital part of the cryptocurrency market, enabling large trades to be executed without causing significant fluctuations in the asset’s price. This is particularly important for high-volume purchases, such as Bybit’s recent acquisition of ETH. By utilizing OTC, Bybit can manage its investments discreetly, minimizing the impact on market prices and ensuring a more stable transaction environment.

Implications for Ethereum

The acquisition of 71,755 ETH by Bybit suggests a bullish sentiment towards Ethereum, which has been experiencing a resurgence in interest and investment. As the second-largest cryptocurrency by market capitalization, ETH is widely considered a cornerstone of decentralized finance (DeFi) and the burgeoning non-fungible token (NFT) market. Bybit’s substantial purchase could indicate confidence in Ethereum’s potential for future growth, especially as the network continues to evolve with upgrades like Ethereum 2.0.

Market Reactions and Trends

Following the news of Bybit’s purchase, there has been a notable uptick in discussions and analyses surrounding the future of Ethereum. Traders and investors are keenly observing market trends, with many speculating that such a significant acquisition could lead to increased demand and potentially drive up the price of ETH. The transaction could also spark similar moves from other exchanges and institutional investors, further solidifying Ethereum’s position in the market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bybit’s Strategic Moves

Bybit’s decision to acquire a large quantity of ETH aligns with its overarching strategy to expand its offerings and enhance its liquidity. As a leading cryptocurrency exchange, Bybit is continually looking for ways to attract more users and investors. By holding a substantial amount of ETH, Bybit not only increases its asset portfolio but also positions itself as a key player in the DeFi and NFT sectors, which are gaining traction among investors.

The Future of Ethereum and DeFi

Ethereum’s role in the DeFi ecosystem cannot be overstated. With numerous projects and platforms built on its blockchain, ETH serves as the backbone for many financial services, lending protocols, and decentralized applications. Bybit’s investment in ETH underscores the growing importance of DeFi and the expectation that Ethereum will continue to play a pivotal role in shaping the future of finance.

Conclusion

Bybit’s acquisition of 71,755 ETH through OTC transactions marks a significant moment in the cryptocurrency market. This move not only reflects the exchange’s strategic ambitions but also highlights the continued relevance and potential of Ethereum in the evolving digital economy. As the market responds to this news, traders and investors alike will be watching closely to see how Bybit’s purchase influences Ethereum’s trajectory and the broader crypto landscape.

In summary, Bybit’s transaction is a clear indication of the growing confidence in Ethereum and the increasing interest in decentralized finance. As more institutions and exchanges look to invest in digital assets, the implications of such significant acquisitions will continue to unfold, shaping the future of cryptocurrencies and the financial markets at large.

For more updates on cryptocurrency trends and insights, stay tuned to trusted sources and follow the discussions surrounding these pivotal developments in the blockchain ecosystem.

JUST IN: BYBIT APPEARS TO HAVE BOUGHT 71,755 $ETH ($197M) VIA OTC

Source: LookOnChain pic.twitter.com/BEqtXsyt3b

— Mario Nawfal’s Roundtable (@RoundtableSpace) February 23, 2025

JUST IN: BYBIT APPEARS TO HAVE BOUGHT 71,755 $ETH ($197M) VIA OTC

When it comes to major developments in the cryptocurrency world, few things generate as much buzz as a substantial acquisition. Recently, news broke that Bybit, one of the leading cryptocurrency exchanges, has made a significant move in the market by purchasing 71,755 Ethereum (ETH) for a staggering $197 million via over-the-counter (OTC) transactions. This news was reported by LookOnChain, a platform known for providing insights into blockchain data and market trends. So, what does this mean for Bybit, Ethereum, and the broader crypto landscape? Let’s dive in!

Understanding Bybit’s Bold Move

Bybit’s decision to acquire such a large quantity of ETH is not just a random act; it reflects a calculated strategy within the ever-evolving cryptocurrency ecosystem. Bybit is known for its innovative trading features and commitment to enhancing the user experience. This acquisition indicates their confidence in Ethereum’s potential and future growth.

Investing $197 million in Ethereum suggests that Bybit anticipates a bullish trend for ETH. The exchange is likely looking to bolster its offerings and attract more users who are keen on engaging with Ethereum-based assets. Furthermore, with Ethereum being the backbone of numerous decentralized applications (dApps) and the DeFi movement, Bybit’s move could be a strategic play to align itself with the growing demand for Ethereum-based services and products.

What is OTC Trading?

Before delving deeper into the implications, let’s clarify what OTC trading is. Over-the-counter trading refers to the process of buying and selling assets directly between two parties, rather than through a centralized exchange. This type of trading is often preferred for large transactions, as it helps to minimize market impact and allows for more favorable pricing.

In the case of Bybit, engaging in OTC trading for their Ethereum purchase likely provided them with more flexibility and the ability to negotiate better terms. For retail investors, this can be quite different from the traditional trading experience found on exchanges, where prices can be more volatile due to high trading volumes and public visibility.

The Impact on the Ethereum Market

This acquisition could have several ripple effects on the Ethereum market. Firstly, such a massive buy can create upward pressure on ETH’s price. With Bybit bringing a substantial amount of Ethereum into circulation, it’s likely to influence market sentiment positively. Investors often view large purchases as a signal of confidence in an asset, which can lead to increased buying activity among retail investors.

Moreover, Bybit’s involvement with Ethereum underscores the growing institutional interest in cryptocurrencies. More and more corporations and financial institutions are recognizing the potential of blockchain technology and cryptocurrencies, and moves like this from Bybit help validate Ethereum’s place in that conversation.

Ethereum’s Future Prospects

The future of Ethereum looks promising, especially with the ongoing developments surrounding Ethereum 2.0. This upgrade aims to improve the network’s scalability, security, and sustainability by transitioning from a proof-of-work to a proof-of-stake system. Such changes are expected to enhance Ethereum’s usability and attract even more institutional investment.

Bybit’s significant acquisition aligns with this momentum. As Ethereum continues to evolve and improve, exchanges that hold large quantities of ETH will be well-positioned to capitalize on its growth. This acquisition not only strengthens Bybit’s portfolio but also positions it as a preferred destination for traders looking to invest in Ethereum.

What’s Next for Bybit and Its Users?

So, what does this mean for Bybit users? With a substantial amount of ETH in its reserves, Bybit may introduce new trading pairs, staking opportunities, or enhanced features related to Ethereum. This could provide users with more options to engage with the asset and capitalize on its growth.

Moreover, Bybit’s commitment to Ethereum could lead to innovative products tailored to Ethereum investors, such as futures or options that allow for more sophisticated trading strategies. The exchange could also enhance its educational resources, helping traders understand Ethereum’s intricacies and the potential for future growth.

The Broader Crypto Landscape

Bybit’s purchase is just one piece of the puzzle in the ever-expanding world of cryptocurrency. As exchanges like Bybit make significant moves, they contribute to a broader narrative of institutional adoption and the maturation of the crypto market. The influx of capital from large players can lead to increased liquidity, more robust trading environments, and ultimately greater adoption of cryptocurrencies by the general public.

Additionally, this acquisition could inspire other exchanges to follow suit, leading to a competitive landscape where platforms seek to differentiate themselves through their cryptocurrency holdings and offerings. This competitive drive could lead to innovation and improved services for users across the board.

Final Thoughts

In summary, Bybit’s acquisition of 71,755 ETH for $197 million via OTC transactions is a clear indicator of the exchange’s confidence in Ethereum’s future potential. This strategic move not only enhances Bybit’s standing in the crypto market but also reflects the growing institutional interest in Ethereum as a key player in the blockchain space.

As the cryptocurrency landscape continues to evolve, it’s essential for traders and investors to stay informed about these developments. Bybit’s bold move could be a sign of exciting times ahead for Ethereum and the broader crypto market. Whether you’re a seasoned trader or just starting, keeping an eye on these shifts can help you navigate this dynamic environment effectively.

For those interested in the latest updates and insights, following resources like LookOnChain can provide valuable information on market trends and significant transactions. By staying informed, you can make better decisions and potentially capitalize on the opportunities that arise in this fast-paced industry.