Breaking News: Whale Purchase of 4,700 ETH Worth $12.93 Million

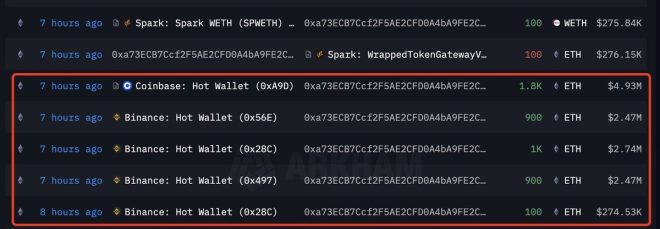

In a significant development in the cryptocurrency market, a prominent whale has made headlines by purchasing 4,700 Ethereum (ETH) worth an impressive $12.93 million on leading exchanges Binance and Coinbase. This massive acquisition has sparked excitement among investors and enthusiasts alike, leading many to speculate about the potential implications for the price of ETH and the broader market.

Understanding Whales in Cryptocurrency

In the world of cryptocurrency, the term "whale" refers to individuals or entities that hold large amounts of a particular cryptocurrency. These whales can significantly influence market trends due to their ability to buy or sell substantial amounts of digital assets. Their actions often lead to price fluctuations, making their movements closely watched by traders and investors.

The Impact of the Purchase

The recent purchase of 4,700 ETH by a whale is particularly noteworthy because it highlights a growing confidence in Ethereum’s market potential. Such large-scale investments can create a ripple effect, encouraging other investors to jump on the bandwagon, thus potentially driving the price of ETH higher. The notion that this significant acquisition could lead to an "ETH pump" has been circulating on social media, with many enthusiasts expressing optimism about the future price trajectory.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions

Following the announcement of the whale’s purchase, the cryptocurrency community erupted with excitement, with many users speculating about the implications for ETH’s price. Social media platforms, including Twitter, have become hotbeds for discussions regarding the potential for an ETH price surge. The phrase "ETH pump will melt faces" encapsulates the enthusiasm surrounding this event, suggesting that investors are bracing for a sharp increase in value.

Ethereum’s Current Market Position

As one of the leading cryptocurrencies, Ethereum has gained immense popularity due to its smart contract functionality and robust ecosystem. The recent whale purchase comes at a time when ETH has been experiencing volatility, leading many traders to seek out opportunities. The influx of capital from significant purchases like this often correlates with increased market activity, potentially setting the stage for price rallies.

The Role of Binance and Coinbase

Both Binance and Coinbase are among the largest cryptocurrency exchanges globally, providing a platform for traders to buy, sell, and exchange various cryptocurrencies. The choice of these exchanges for such a substantial transaction indicates a strategic move by the whale, taking advantage of the liquidity and trading volumes available on these platforms. This also reflects the growing acceptance and adoption of Ethereum, further solidifying its position in the cryptocurrency ecosystem.

Analyzing the Potential ETH Pump

The notion of an ETH pump refers to a significant increase in the price of Ethereum, often driven by large purchases or positive market sentiment. Analysts and traders are closely monitoring the situation, as increased demand resulting from whale activity can lead to a bullish trend. However, investors are also advised to remain cautious, as the cryptocurrency market is notoriously volatile, and price movements can be unpredictable.

Conclusion

The recent whale purchase of 4,700 ETH for $12.93 million on Binance and Coinbase has stirred up excitement and speculation within the cryptocurrency community. As investors eagerly await the potential impact on Ethereum’s price, the implications of this significant acquisition are being discussed across various platforms. This event serves as a reminder of the influence that large holders can exert on the market and the importance of monitoring their activities as part of a comprehensive trading strategy.

Key Takeaways

- Whale Activity: The purchase by a whale highlights the significant influence that large holders have on the cryptocurrency market.

- Market Sentiment: The excitement surrounding the purchase indicates a potentially bullish sentiment for Ethereum, leading to discussions of an "ETH pump."

- Exchange Dynamics: The choice of Binance and Coinbase underscores the importance of liquidity and trading volumes in large transactions.

- Caution Advised: While optimism is high, the inherent volatility of cryptocurrencies means that investors should approach the market with caution.

As the cryptocurrency landscape continues to evolve, the actions of major players like this whale will remain a focal point for market analysts and investors alike. Keep an eye on Ethereum as it navigates through these dynamic market conditions, and stay informed about the broader trends impacting the cryptocurrency world.

BREAKING:

A WHALE JUST BOUGHT 4,700 ETH

WORTH $12.93 MILLION ON BINANCE

AND COINBASE.ETH PUMP WILL MELT FACES pic.twitter.com/FveFul0Q8R

— Ash Crypto (@Ashcryptoreal) February 21, 2025

BREAKING: A WHALE JUST BOUGHT 4,700 ETH WORTH $12.93 MILLION ON BINANCE AND COINBASE

In the ever-evolving world of cryptocurrency, big moves often signal significant shifts in market trends. Recently, a massive transaction caught the attention of crypto enthusiasts and investors alike. A whale, a term used to describe individuals or entities holding large amounts of cryptocurrency, has made headlines by purchasing 4,700 ETH for a staggering $12.93 million across two major exchanges: Binance and Coinbase. This purchase raises eyebrows and questions about the future of Ethereum and the broader crypto market.

What Does This Whale Purchase Mean for Ethereum?

When a whale buys such a significant amount of Ethereum, it usually indicates a bullish sentiment towards the asset. Investors are keen to know whether this massive buy will lead to a ETH pump that could “melt faces,” as the tweet suggested. The phrase implies an explosive increase in ETH’s price, potentially leading to major gains for those already invested in Ethereum.

The Role of Market Sentiment

Market sentiment plays a critical role in the cryptocurrency landscape. A whale’s activity can serve as a barometer for what other investors might do next. If this whale believes that Ethereum is undervalued at the moment, it could motivate smaller investors to follow suit. This herd mentality is common in crypto trading, where emotions often dictate buying and selling decisions rather than fundamentals.

Analyzing the Transaction

Let’s break down the purchase: 4,700 ETH at a value of $12.93 million. To put that into perspective, that’s approximately $2,747 per ETH. This price point is crucial because it gives us insight into the whale’s perception of Ethereum’s value. If the market price for ETH rises significantly after this purchase, it could validate the whale’s confidence in the asset.

Whales and Their Impact on the Market

Whales have the power to influence market trends significantly. Their buying or selling actions can lead to sudden price fluctuations, affecting traders’ strategies. In the case of Ethereum, this whale’s purchase could be seen as a signal that larger players are betting on ETH’s future growth. Additionally, such movements often lead to increased trading volume, which can attract even more investors to the market.

Understanding Ethereum’s Current Landscape

Ethereum is more than just a cryptocurrency; it’s a platform for decentralized applications (dApps) and smart contracts. This versatility has made it a cornerstone of the blockchain ecosystem. As Ethereum continues to evolve, especially with developments like Ethereum 2.0, investors are keenly observing how these changes will affect its price and utility.

Ethereum 2.0 and Its Potential Impact

Ethereum 2.0 is a significant upgrade that aims to improve the network’s scalability, security, and sustainability. As this upgrade rolls out, it’s expected to enhance Ethereum’s value proposition, making it more attractive to investors. The whale’s purchase could be a strategic move, anticipating that Ethereum will gain further traction as these upgrades are implemented.

The Psychology of Cryptocurrency Investing

Investing in cryptocurrencies is often driven by psychological factors. Fear of missing out (FOMO) can lead to irrational buying, while fear of loss can trigger panic selling. When a whale makes a substantial purchase, it can trigger FOMO among smaller investors, leading to a ripple effect in buying activity. Understanding this psychological aspect is vital for navigating the volatile crypto market.

What Should Investors Do?

For those considering entering the Ethereum market or increasing their holdings, it’s essential to conduct thorough research. Keeping an eye on major transactions and market trends can provide valuable insights. Tools like CoinGecko or CoinMarketCap can help track Ethereum’s price movements and trading volumes, aiding investors in making informed decisions.

The Future of Ethereum and Cryptocurrency

As we look ahead, the future of Ethereum seems promising. Despite the inherent volatility of cryptocurrencies, innovations and upgrades like Ethereum 2.0 are likely to foster growth. The recent whale purchase serves as a reminder of the potential for massive gains in this space, but it also underscores the risks involved. Investors must remain vigilant and adaptable to changing market conditions.

Staying Informed

In the fast-paced world of cryptocurrency, staying informed is crucial. Following credible sources, engaging with the community, and utilizing social media platforms can provide real-time insights into market movements. For example, keeping up with discussions on platforms like Twitter can offer a glimpse into the sentiment around specific assets, including Ethereum.

The Importance of Diversification

While Ethereum may be a focal point for many investors, diversification remains a key strategy in cryptocurrency investing. Spreading investments across various assets can mitigate risks associated with market volatility. Considering altcoins or other blockchain projects alongside Ethereum can create a balanced portfolio, offering opportunities for growth while protecting against potential downturns.

Risk Management Strategies

Implementing risk management strategies is essential for navigating the cryptocurrency market. Setting stop-loss orders, conducting regular portfolio reviews, and defining investment goals can help investors manage their exposure. Understanding one’s risk tolerance is crucial, especially in a market as unpredictable as crypto.

Conclusion: What Lies Ahead for ETH?

As the dust settles from this monumental whale purchase, the future of Ethereum and the broader cryptocurrency landscape remains uncertain yet exciting. Investors are left pondering the implications of this transaction and its potential to influence market trends. Whether you’re a seasoned investor or new to the crypto space, the next few weeks could be pivotal in shaping the future of Ethereum. Keeping an eye on market developments and maintaining an informed perspective will be key to navigating this thrilling journey in the world of cryptocurrency.

“`

This article captures the essence of the whale purchase while maintaining a conversational tone, engaging the reader with relevant information and insights into the cryptocurrency market. The structure allows for easy navigation and emphasizes critical points for both novice and experienced investors.