Bitcoin and Ether Prices Dip After Bybit Exchange Hack

In a significant development within the cryptocurrency market, Bitcoin and Ether have experienced a decline in their prices following a substantial security breach that resulted in a nearly $1.5 billion hack of the Bybit exchange. This incident not only affected the prices of major cryptocurrencies but also had a ripple effect on smaller tokens, leading to deeper losses for some of them.

The Impact of the Bybit Hack

The Bybit exchange, known for its high trading volumes and diverse offerings, has faced a severe setback due to this hack. Hackers exploited vulnerabilities within the platform, leading to the loss of an estimated $1.5 billion in various cryptocurrencies. Such a massive breach raises concerns about the security protocols in place across cryptocurrency exchanges and the overall integrity of the digital asset ecosystem.

Following the news of the hack, Bitcoin, which is often viewed as a safe haven in the crypto world, remained relatively stable within its recent trading ranges. However, this stability was overshadowed by the downturn in prices. Ether, the second-largest cryptocurrency by market capitalization, also experienced a noticeable dip, reflecting the market’s apprehension in response to the hack.

Smaller Tokens Hit Harder

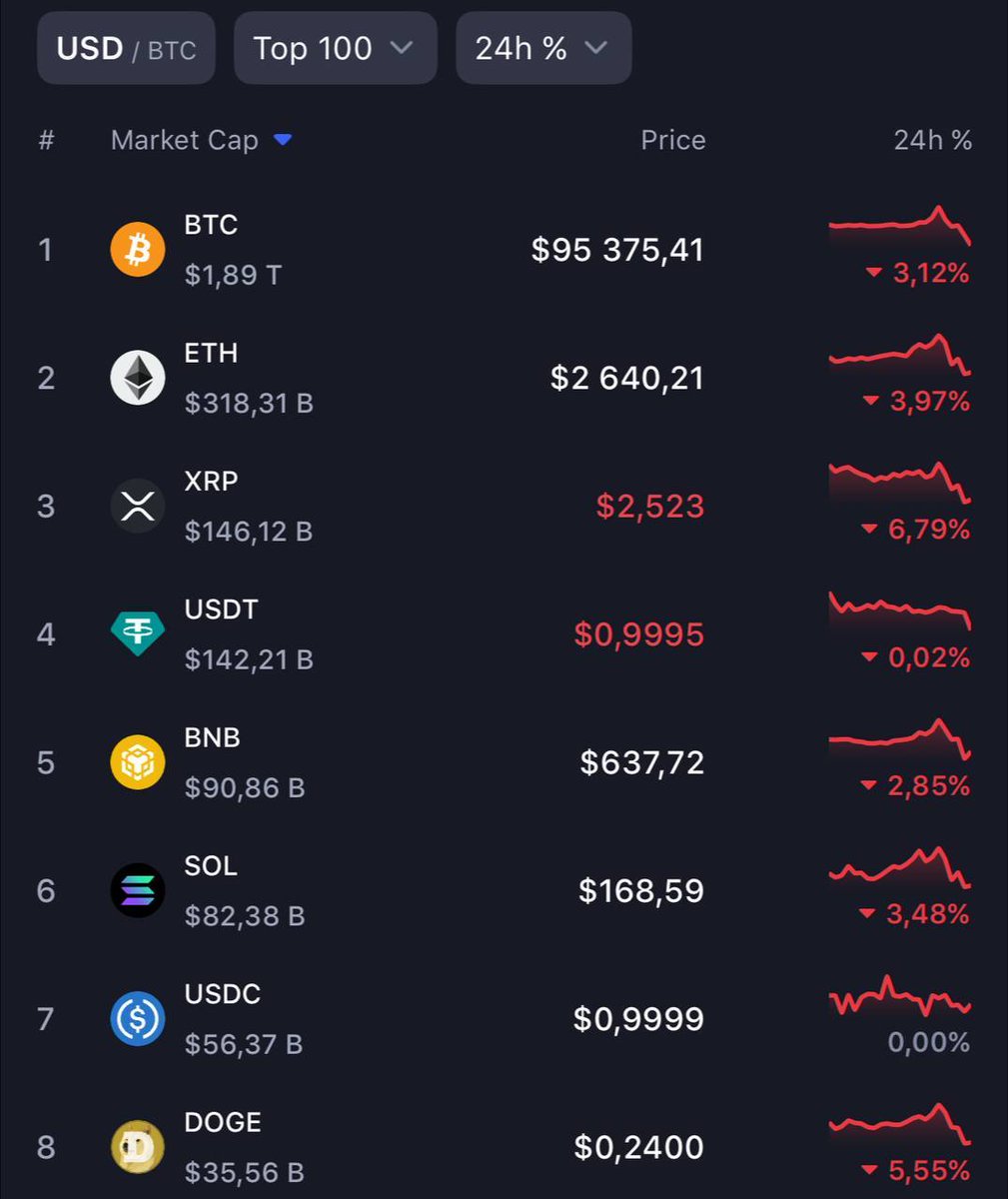

While major cryptocurrencies like Bitcoin and Ether showed resilience, smaller tokens faced harsher consequences. Tokens such as XRP, Solana (SOL), and Dogecoin (DOGE) saw deeper losses, highlighting the volatility and unpredictability that often characterize the cryptocurrency market. Investors in these smaller assets may be more sensitive to market fluctuations and negative news, leading to quicker sell-offs and price declines.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The hack’s impact on these smaller tokens underscores the interconnectedness of the cryptocurrency market. A significant event affecting one major exchange can quickly lead to broader market reactions, causing a cascading effect on other assets, regardless of their individual performance or fundamentals.

Market Reactions and Investor Sentiment

Investor sentiment following the Bybit hack has been one of caution and uncertainty. Many traders are now reassessing their positions, particularly in smaller tokens that have been more severely affected. The incident serves as a reminder of the risks associated with investing in cryptocurrencies, especially when it comes to exchange security.

As a result of the hack, some investors may choose to withdraw their assets from exchanges and move them to more secure wallets, further impacting trading volumes and liquidity across the market. This shift could lead to increased volatility as traders adjust to the new landscape.

The Importance of Security in Cryptocurrency

The Bybit hack underscores the critical importance of security measures within cryptocurrency exchanges. With the market continuing to grow and attract new investors, the need for robust security protocols is more crucial than ever. Exchanges must invest in advanced security technologies, including multi-signature wallets, cold storage solutions, and comprehensive auditing processes, to safeguard user assets and build trust within the community.

Investors are also encouraged to conduct thorough research before choosing an exchange and consider factors such as security history, regulatory compliance, and user reviews. By prioritizing security, both exchanges and investors can help mitigate the risks associated with hacks and fraud.

Future Outlook for Bitcoin, Ether, and Smaller Tokens

Looking ahead, the future of Bitcoin, Ether, and smaller tokens will largely depend on how the market reacts to the Bybit hack and the subsequent recovery efforts. While Bitcoin and Ether may show resilience due to their established positions, the road to recovery for smaller tokens could be more challenging.

As the cryptocurrency market evolves, there may be opportunities for innovation and improvement in terms of security and user experience. Projects that prioritize safety and transparency could gain traction and attract more investors, potentially leading to a more stable market environment.

In conclusion, the recent hack of the Bybit exchange has created a significant stir within the cryptocurrency market, leading to price dips for major cryptocurrencies like Bitcoin and Ether, while smaller tokens faced even steeper declines. This incident serves as a cautionary tale for investors and highlights the critical need for enhanced security measures within the cryptocurrency ecosystem. As the market continues to navigate these challenges, the focus will remain on recovery, security improvements, and the overall health of the digital asset landscape.

JUST IN: Bitcoin and Ether prices dipped following a nearly $1.5 billion hack of the Bybit exchange.

While major tokens like Bitcoin remained within their recent trading ranges, smaller tokens such as $XRP, $SOL, and $DOGE experienced deeper losses. pic.twitter.com/bcdeQRIHPw

— Cointelegraph (@Cointelegraph) February 21, 2025

JUST IN: Bitcoin and Ether Prices Dip Following a Nearly $1.5 Billion Hack of the Bybit Exchange

It’s a rough day in the crypto world as Bitcoin and Ether prices have taken a hit. The cause? A staggering hack of the Bybit exchange, amounting to nearly $1.5 billion. If you’ve been following the crypto market, you know that security breaches like this can send shockwaves through the entire ecosystem. So, let’s dive deeper into what happened and how it’s affecting the market.

What Happened with the Bybit Exchange Hack?

Bybit, one of the leading cryptocurrency exchanges, faced a massive security breach that has left many investors reeling. The hack reportedly compromised user data and resulted in the loss of billions in digital assets. News of the breach spread like wildfire, impacting not only Bybit users but the entire cryptocurrency market.

Security breaches in exchanges are not new, but this particular incident raises questions about the safety of centralized platforms. While exchanges like Bybit offer convenience, the risks associated with hacks can be daunting. This incident is a stark reminder for investors to remain vigilant and consider the security measures in place when choosing where to store their digital currencies.

Impact on Major Tokens: Bitcoin and Ether

In the wake of the Bybit hack, prices for major tokens like Bitcoin and Ether dipped, albeit less dramatically than smaller altcoins. Bitcoin remained within its recent trading ranges, showcasing its resilience, while Ether also displayed similar behavior.

It’s interesting to note that even though these major cryptocurrencies experienced a drop, they didn’t fall off a cliff. This could indicate that investors are still holding strong on these established tokens, perhaps due to their historical performance and market acceptance. However, the dip still serves as a cautionary tale about the volatility and risks inherent in the crypto space.

Smaller Tokens Take a Bigger Hit

While Bitcoin and Ether managed to maintain some level of stability, smaller tokens like [XRP](https://twitter.com/search?q=%24XRP&src=ctag&ref_src=twsrc%5Etfw), [SOL](https://twitter.com/search?q=%24SOL&src=ctag&ref_src=twsrc%5Etfw), and [DOGE](https://twitter.com/search?q=%24DOGE&src=ctag&ref_src=twsrc%5Etfw) experienced deeper losses. This highlights a common trend in the crypto market—when major events occur, smaller tokens often react more dramatically.

Investors in these smaller altcoins may be feeling the burn right now, especially as they tend to be more susceptible to market fluctuations. The increased volatility can lead to significant price drops, making it essential for investors to stay informed and prepared for swift changes.

The Importance of Security in Crypto Investments

This incident underscores the importance of security in the cryptocurrency arena. As the market matures, so does the sophistication of cybersecurity threats. It’s crucial for investors to be aware of how exchanges protect their assets. Look for exchanges that provide robust security measures, including two-factor authentication and insurance policies for digital assets.

Furthermore, consider using hardware wallets or decentralized exchanges for storing cryptocurrencies. These options can offer better security than keeping everything on a centralized platform. Remember, not all exchanges are created equal, and doing your research can save you from potential losses in the future.

What Should Investors Do Now?

In light of the recent events, investors may be wondering what steps to take next. First and foremost, it’s essential to stay informed about the developments surrounding the Bybit hack and the broader crypto market. Follow trusted sources like [Cointelegraph](https://cointelegraph.com) for the latest updates and analyses.

If you’re holding larger amounts in smaller tokens like XRP, SOL, or DOGE, consider re-evaluating your investment strategy. It might be wise to diversify your portfolio or even shift some assets to more stable cryptocurrencies during this turbulent time.

Engaging with community discussions on platforms like Reddit or Twitter can also provide insights into how other investors are reacting to the situation. Sometimes, hearing from fellow crypto enthusiasts can help you gauge the market sentiment and make informed decisions.

Future Outlook: Will the Market Recover?

The big question on everyone’s mind is whether the cryptocurrency market will bounce back from this hack. While it’s impossible to predict the future, history has shown that the market is resilient. Investors often find opportunities in the aftermath of downturns. If you’re a long-term believer in the potential of cryptocurrencies, this might be a good time to buy the dip on major tokens.

However, caution is always advisable. Keep an eye on how the market reacts in the coming days and weeks. If investor confidence wavers, we could see further declines, especially among smaller tokens. Staying updated with news and market trends will be crucial as you navigate this landscape.

In Conclusion: Stay Informed and Secure

The hack of the Bybit exchange has certainly sent ripples through the cryptocurrency market, impacting prices for both major and smaller tokens. As an investor, it’s vital to be aware of such events and understand their implications on your investments.

Always prioritize security and consider diversifying your portfolio. The crypto world is exciting but comes with its fair share of risks. By staying informed and making well-thought-out decisions, you can better navigate the volatile landscape of cryptocurrency investing.

Keep your eyes on the market, and remember that knowledge is your best tool in these uncertain times.