Understanding the Surge of Pig Butchering Scams: A 2024 Overview

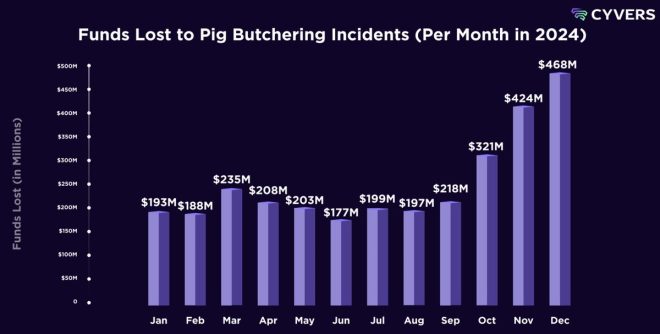

In 2024, pig butchering scams emerged as a significant threat, resulting in staggering losses of $5.5 billion, making them the largest risk for retail investors and trading platforms in 2025. This alarming statistic, shared by Cointelegraph, underscores the urgent need for awareness and preventative measures against these sophisticated fraud schemes.

What Are Pig Butchering Scams?

Pig butchering scams are a type of investment fraud where scammers engage potential victims in a seemingly friendly manner, often through social media or dating apps. The term "pig butchering" metaphorically represents the process of "fattening up" victims by building trust and rapport before "butchering" them financially. Scammers lure victims into investing money by promising high returns, but ultimately, the funds are stolen.

The Mechanics of the Scam

The mechanics of pig butchering scams typically involve several steps:

- Initial Contact: Scammers often initiate contact through social media, dating apps, or even email. They present themselves as trustworthy individuals, sometimes even posing as successful investors.

- Building Trust: Once contact is established, the scammer builds a relationship with the victim, often sharing fake success stories and investment opportunities. This phase can last for weeks or even months.

- Investment Proposal: After establishing trust, the scammer introduces investment opportunities, often linked to cryptocurrency or forex trading. They may create fake platforms or apps that appear legitimate.

- Withdrawal Obstacles: Victims are encouraged to invest larger sums of money. When they attempt to withdraw their "profits," scammers create obstacles, claiming various fees or taxes need to be paid first.

- The Exit: Ultimately, victims discover that their money is gone, and their supposed investment platform is a scam.

The Impact of Pig Butchering Scams

The impact of pig butchering scams is extensive, affecting not only individual investors but also the broader financial ecosystem.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Financial Losses

The staggering $5.5 billion loss in 2024 highlights the scale of these scams. Victims, often individuals seeking financial independence or growth, find themselves in dire situations after losing their hard-earned money.

Erosion of Trust

These scams erode trust in legitimate investment platforms. As more individuals fall prey to such schemes, skepticism grows among potential investors, leading to hesitance in participating in legitimate investment opportunities.

Regulatory Challenges

The rise of pig butchering scams poses regulatory challenges for financial authorities. Scammers often operate across borders, making it difficult for regulators to track and shut down these fraudulent operations.

Identifying and Avoiding Pig Butchering Scams

Awareness is the first line of defense against pig butchering scams. Here are some key indicators to help identify potential scams:

- Too Good to Be True: If an investment opportunity promises extraordinarily high returns with little to no risk, it’s likely a scam.

- Unsolicited Contact: Be wary of unsolicited messages from strangers, especially those encouraging you to invest in opportunities.

- Pressure Tactics: Scammers often create a sense of urgency, pressuring victims to invest quickly without proper research.

- Lack of Transparency: Legitimate investment platforms provide clear information about their operations, fees, and risks. If a platform lacks transparency, proceed with caution.

- Social Media Red Flags: Be cautious of profiles that lack verifiable information or have a history of suspicious activity.

Protecting Yourself from Scams

To protect yourself from pig butchering scams, consider the following strategies:

Do Your Research

Before investing, conduct thorough research on the platform and its operators. Look for reviews, regulatory registrations, and any history of fraudulent activity.

Use Trusted Platforms

Invest only through well-established and regulated platforms. Research the platform’s reputation, customer service, and security measures.

Be Skeptical of Unsolicited Offers

If you receive unsolicited offers, approach them with skepticism. Legitimate investment opportunities rarely come from strangers.

Educate Yourself

Stay informed about current scams and fraudulent tactics. Understanding the landscape of investment scams can empower you to make informed decisions.

Report Suspicious Activity

If you encounter a potential scam, report it to the appropriate authorities. This helps protect others from falling victim to similar schemes.

Conclusion: Staying Vigilant in 2025

As we move into 2025, the threat of pig butchering scams remains prevalent. With $5.5 billion lost in 2024, it’s crucial for investors to remain vigilant. By understanding the mechanics of these scams, identifying red flags, and implementing protective measures, individuals can safeguard their investments and contribute to a more secure financial environment. Awareness, education, and proactive measures are key in combating these fraudulent schemes and protecting personal finances in an increasingly digital world.

JUST IN: Pig butchering scams stole $5.5B in 2024, making them the biggest threat to retail investors and platforms in 2025, per Cyvers. pic.twitter.com/Oz7916PSIc

— Cointelegraph (@Cointelegraph) February 20, 2025

JUST IN: Pig butchering scams stole $5.5B in 2024, making them the biggest threat to retail investors and platforms in 2025, per Cyvers.

If you’re a retail investor or someone who dabbles in the financial markets, you may have heard the term “pig butchering scam” making waves recently. In 2024 alone, these scams managed to siphon off a staggering $5.5 billion, making them a formidable threat for anyone involved in retail investing. According to a [report by Cyvers](https://www.cyvers.com), this type of scam is expected to become even more prevalent in 2025. So, what exactly is a pig butchering scam, and how can you protect yourself from becoming a victim?

Understanding Pig Butchering Scams

First off, let’s break down what pig butchering scams actually are. The term originates from the idea of “fattening up” victims before ultimately “butchering” them—essentially leaving them empty-handed. In a typical scenario, scammers will build a rapport with their targets through social media or dating apps, creating a false sense of trust. Once they’ve established this relationship, they introduce investment opportunities that seem too good to be true.

The tactics used in these scams are often sophisticated and can involve fake websites, fake testimonials, and even fake customer service. Victims are lured in with promises of high returns on investments, only to find out later that they’ve been duped.

The Scale of the Problem

According to [Cointelegraph](https://cointelegraph.com), the $5.5 billion lost to pig butchering scams in 2024 is not just a number; it represents countless individuals and families affected by financial loss. These scams have grown in sophistication, often targeted at individuals who are new to investing or who may not have the experience to distinguish between legitimate investment opportunities and scams.

This growing trend is particularly alarming for retail investors who are often more vulnerable compared to institutional investors. Lack of experience, coupled with the emotional appeal of quick profits, makes it easy for scammers to exploit the unsuspecting.

Why Are Pig Butchering Scams So Effective?

One reason these scams are so effective is that they leverage emotional manipulation. Scammers often spend weeks or even months building relationships with their victims, presenting themselves as trustworthy confidants. This emotional investment makes it harder for victims to see the warning signs.

Additionally, scammers are increasingly using advanced technology to make their schemes appear legitimate. They can create professional-looking websites and use various online platforms to send convincing communications. This tech-savvy approach can make it challenging for even the most cautious individuals to spot fraud.

How to Identify a Pig Butchering Scam

So, how can you tell if you’re being targeted by a pig butchering scam? Here are some red flags to watch out for:

1. **Unsolicited Contact**: If someone reaches out to you out of the blue, whether through social media or messaging apps, be cautious. Scammers often initiate contact this way.

2. **Too Good to Be True**: If an investment opportunity promises guaranteed returns with little to no risk, it’s likely a scam. Always be skeptical of offers that sound too good to be true.

3. **Pressure to Invest Quickly**: Scammers create a sense of urgency to push you into making hasty decisions. If someone is pressuring you to invest quickly, take a step back.

4. **Lack of Transparency**: If you can’t easily find information about the investment or the company behind it, be wary. Legitimate investments will have clear information available.

5. **Inconsistent Information**: If the information you receive from your “investment advisor” keeps changing or contradicts itself, that’s a major red flag.

Protecting Yourself from Pig Butchering Scams

Now that you know what to look for, let’s discuss some strategies to protect yourself from falling victim to pig butchering scams.

1. **Do Your Research**: Before investing in anything, take the time to research the company or individual. Look for reviews, testimonials, and any news articles.

2. **Consult Professionals**: If you’re unsure about an investment, consult a financial advisor. They can provide expert insight and help you make informed decisions.

3. **Trust Your Instincts**: If something feels off, trust your gut. It’s better to be cautious than to rush into a potentially harmful situation.

4. **Educate Yourself**: The more you know about investment opportunities, the better equipped you’ll be to spot scams. Consider taking courses or reading books on investing.

5. **Report Suspicious Activity**: If you encounter a potential scam, report it to the authorities. This can help protect others from falling victim to the same scam.

The Role of Technology in Combating Scams

As pig butchering scams become more sophisticated, so does the technology to combat them. Various organizations and platforms are now employing machine learning algorithms to identify fraudulent activities. These technologies analyze patterns and flag suspicious behavior, providing an additional layer of protection for investors.

Social media companies are also beginning to take responsibility for the content shared on their platforms. Enhanced reporting tools and user education initiatives can help reduce the prevalence of scams.

Regulatory Measures and Future Outlook

In response to the rise of pig butchering scams, regulatory authorities are beginning to step up their efforts to protect consumers. Stricter regulations around online investments and increased penalties for fraudulent activities are being discussed.

However, it’s important to remember that regulation alone won’t solve the problem. Continued public awareness and education are crucial for keeping investors informed about potential scams.

Conclusion

As we move further into 2025, the threat posed by pig butchering scams remains a significant concern for retail investors. With losses amounting to $5.5 billion in 2024, this type of scam is not just a fleeting issue; it’s a growing epidemic that requires attention. By staying informed, exercising caution, and reporting suspicious activities, you can better protect yourself and your investments.

Scammers are constantly evolving their tactics, and so should your approach to investing. Equip yourself with knowledge, trust your instincts, and don’t let the allure of quick returns blind you to the risks involved. Remember, when it comes to investing, it’s better to play it safe than to become a statistic. Stay vigilant, and you can navigate the investment landscape more securely.