Death- Obituary News

Summary of the DOW Theory and its Historical Significance

The DOW Theory, named after its creator Sir Charles Dow, is a crucial framework for understanding stock market movements and trends. Developed in the late 19th and early 20th centuries, this theory laid the foundation for modern technical analysis and investment strategies. In the wake of Lawrence McDonald’s poignant tweet commemorating Sir Charles Dow, it is essential to delve deeper into the DOW Theory’s principles, its evolution, and its relevance in today’s financial landscape.

Understanding the DOW Theory

The DOW Theory is fundamentally based on the analysis of stock market indices, primarily the DOW Jones Industrial Average (DJIA) and the DOW Jones Transportation Average (DJTA). Dow believed that the stock market reflects the overall economic condition. The core tenets of the DOW Theory include:

- Market Movements: The theory posits that market prices move in trends, which can be identified and leveraged for investment decisions. These trends can be upward, downward, or sideways.

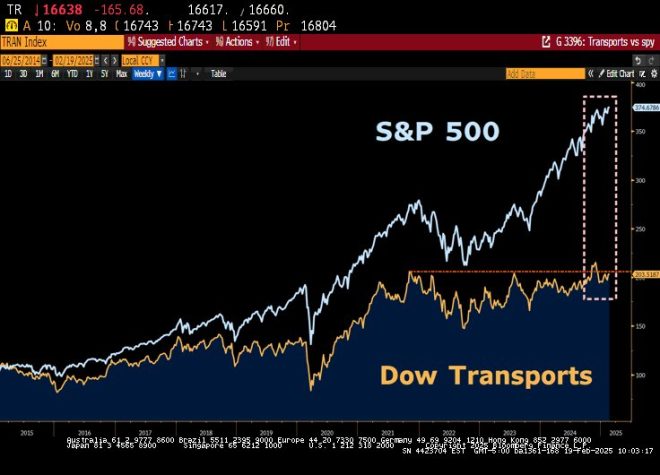

- Confirmation: A significant aspect of the DOW Theory is the idea of confirmation between the DJIA and DJTA. When both indices move in the same direction, it signals a confirmed trend. For example, if both indices are rising, it indicates a strong bullish sentiment in the market.

- Three Phases of Trends: According to Dow, market trends unfold in three phases:

- Accumulation Phase: Smart money begins to buy, often when prices are low.

- Public Participation Phase: This is when the broader public invests, driving prices higher.

- Distribution Phase: The smart money starts selling off as prices peak, often leading to a market correction.

- Volume Analysis: Volume plays a critical role in confirming trends. Increasing volume during a price movement suggests strength, while decreasing volume indicates weakness.

Historical Context and Evolution

Sir Charles Dow co-founded Dow Jones & Company and served as the first editor of The Wall Street Journal. His theories emerged from his observations of the market and its participants’ behaviors. The DOW Theory was first published in a series of editorials in The Wall Street Journal in the early 1900s, and it has since undergone various interpretations and adaptations by subsequent analysts and investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Over the decades, the DOW Theory has adapted to incorporate new market realities and technological advancements. It has inspired countless technical analysis methodologies and remains a cornerstone for many traders and investors. While some critics argue that the DOW Theory is outdated, its fundamental principles still resonate within the financial community.

Relevance in Today’s Market

In today’s digital age, where information is instantaneous and market dynamics are ever-changing, the DOW Theory continues to hold significance. Here are some reasons why it remains relevant:

- Framework for Analysis: The DOW Theory provides a structured approach to market analysis, allowing investors to make informed decisions based on observable patterns and trends.

- Psychological Insights: Understanding market psychology, as emphasized in the DOW Theory, helps investors anticipate market reactions. Recognizing the phases of market trends allows traders to better time their entries and exits.

- Integration with Modern Tools: Many technical analysis tools and indicators, such as moving averages and trend lines, are grounded in the principles of the DOW Theory. Traders can use these tools to enhance their market analyses and improve their strategies.

- Market Sentiment Indicator: The DOW Theory’s emphasis on confirmation between indices serves as a vital indicator of market sentiment. Investors can gauge overall market health by observing the movement of the DJIA and DJTA.

Conclusion

The DOW Theory, established by Sir Charles Dow, remains a foundational concept in stock market analysis and trading. Despite the evolution of financial markets and advancements in technology, the principles of the DOW Theory offer invaluable insights into market behavior. Lawrence McDonald’s tribute serves as a reminder of the enduring legacy of Dow’s work and its significance in guiding investors toward informed decision-making.

Incorporating the DOW Theory into your investment strategy can provide a robust framework for navigating the complexities of the modern market. By understanding the principles of market trends, confirmation, and volume analysis, investors can enhance their ability to identify potential opportunities and mitigate risks. As we reflect on the past and honor the contributions of pioneers like Sir Charles Dow, we must also embrace the lessons of the DOW Theory to foster a deeper understanding of the financial landscape today.

The DOW Theory — Sir Charles Dow is certainly dead. – RIP. pic.twitter.com/VTAGvmlsPb

— Lawrence McDonald (@Convertbond) February 19, 2025

The DOW Theory — Sir Charles Dow is certainly dead.

On February 19, 2025, a poignant tweet from Lawrence McDonald stirred the financial community with the words, “The DOW Theory — Sir Charles Dow is certainly dead. – RIP.” This statement serves as a reminder of the profound impact that Charles Dow had on the world of finance and investing. Dow, who was co-founder of Dow Jones & Company and the creator of the Dow Jones Industrial Average, passed away long ago, yet his theories and methodologies continue to resonate with traders and investors alike.

The Legacy of Sir Charles Dow

Charles Dow was instrumental in shaping the modern stock market. He introduced several concepts that have become foundational in technical analysis. The DOW Theory, which is often cited by traders, is a series of principles that aim to predict market trends by analyzing price movements. Dow believed that the stock market reflects all available information, and his theory emphasizes the importance of market trends.

Understanding the DOW Theory

The DOW Theory consists of a few core tenets that traders should grasp to effectively use its principles. First, it asserts that the market has three trends: primary, secondary, and minor. The primary trend is the long-term direction of the market, secondary trends are shorter corrections within the primary trend, and minor trends are short-term fluctuations.

Another critical aspect of the DOW Theory is the confirmation principle, which states that a trend must be confirmed by both the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). If both averages are moving in the same direction, this lends credibility to the trend.

The Relevance of the DOW Theory Today

Even though Charles Dow has been gone for years, the principles behind the DOW Theory are still applicable in today’s trading environment. Many investors and analysts rely on these principles to gauge market sentiments and make informed decisions. The beauty of the DOW Theory lies in its simplicity and its focus on price movements rather than external factors, which can be subject to bias and misinterpretation.

Market Trends and Investor Sentiment

Understanding market trends is crucial for investors. The DOW Theory teaches us that markets often move in cycles, and recognizing these cycles can help traders position themselves effectively. For instance, during a bullish phase, prices generally rise, and investors might consider buying stocks. Conversely, during bearish phases, prices decline, and it might be wise to sell or hold off on new investments.

Analyzing Price Movements

One of the most significant contributions of the DOW Theory is its emphasis on price movements as indicators of investor sentiment. By analyzing how prices change over time, traders can get a clearer picture of market dynamics. Dow believed that prices reflect all known information, meaning that if a stock is rising, it indicates that investors are optimistic about its future performance.

The Role of Volume in DOW Theory

Volume is another key component of the DOW Theory. Dow argued that price movements accompanied by high volume are more significant than those with low volume. A price rise on high volume suggests strong buying interest, while a price drop on high volume indicates strong selling pressure. This understanding can help traders make better decisions based on market conditions.

Challenges to the DOW Theory

While the DOW Theory has stood the test of time, it is not without its challenges. Critics point out that markets can be influenced by irrational behavior, making them unpredictable. Additionally, the rise of algorithmic trading and high-frequency trading has added layers of complexity that Charles Dow could not have foreseen. Nevertheless, many traders still find value in the foundational principles he established.

The Future of Market Analysis

As we move forward, the principles of the DOW Theory remain relevant. New technologies and tools continue to emerge, enabling traders to analyze market data more efficiently. However, the core tenets of the DOW Theory – understanding trends, the significance of price movements, and the importance of volume – will always hold value. After all, at the heart of trading is the human element, and understanding market psychology is crucial for success.

Honoring the Memory of Sir Charles Dow

With Lawrence McDonald’s tweet, we are reminded not just of the passing of an influential figure in finance but also of the lasting impact of his work. Charles Dow’s contributions have become a bedrock for modern investing strategies, and his principles continue to guide traders today. In a world that is constantly evolving, taking a moment to appreciate where we came from can provide valuable perspective.

Practical Applications of the DOW Theory

For those looking to incorporate the DOW Theory into their trading strategies, consider the following practical applications:

- **Trend Analysis**: Regularly assess the primary, secondary, and minor trends in the market to inform your trading decisions.

- **Confirming Signals**: Always look for confirmation between the DJIA and DJTA before acting on a trend.

- **Volume Monitoring**: Pay attention to trading volume when evaluating price movements to gauge the strength of a trend.

Community and Resources

Joining trading communities or forums can also be beneficial. Engaging with fellow traders can provide insights and enhance your understanding of the DOW Theory. There are numerous online resources, such as Investopedia and MarketWatch, that offer in-depth articles and tutorials on the topic. Learning from experts and sharing experiences can help you refine your trading strategies.

Final Thoughts

While the tweet by Lawrence McDonald is a somber reminder of the passage of time, it also serves as a celebration of the enduring legacy of Sir Charles Dow. The DOW Theory is not just a set of principles; it’s a reflection of the market’s behavior and a guide for those willing to navigate its complexities. By honoring Dow’s contributions and applying his teachings, traders can continue to thrive in the ever-changing world of finance.

“`

This HTML structure provides a comprehensive overview of the DOW Theory, its relevance, and practical applications, while keeping readers engaged with a conversational tone. The article maintains a focus on the legacy of Sir Charles Dow, ensuring that it is not only informative but also respectful of his contributions to the field.