SEC Acknowledges CoinShares Spot XRP ETF Filing: A Game-Changer for Cryptocurrency

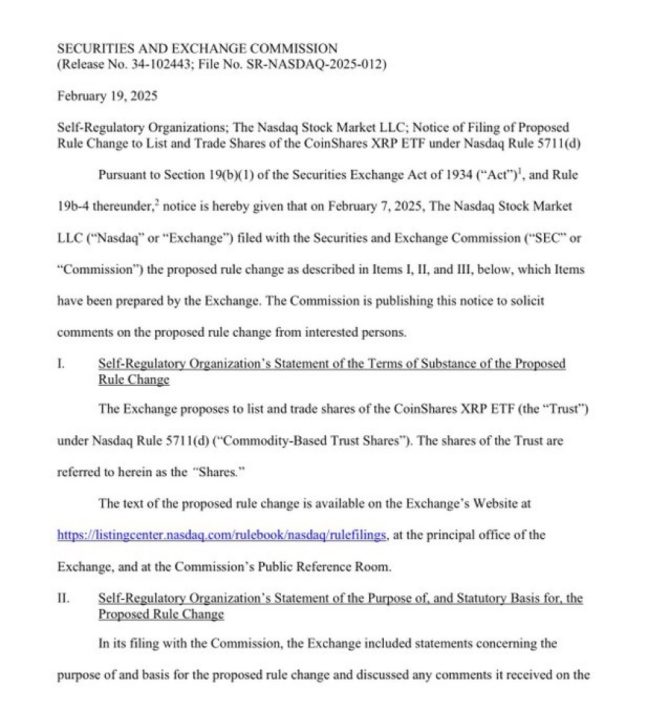

The cryptocurrency market is witnessing a significant development with the U.S. Securities and Exchange Commission (SEC) acknowledging the filing for the CoinShares Spot XRP ETF. This news, shared by Good Morning Crypto on Twitter, has sent ripples through the crypto community, highlighting the growing acceptance and regulatory clarity surrounding digital assets like XRP.

Understanding the SEC’s Role in Cryptocurrency Regulation

The SEC plays a crucial role in regulating financial markets in the United States, including cryptocurrencies. Its acknowledgment of the CoinShares Spot XRP ETF filing signifies an important step toward the mainstream adoption of digital currencies. By permitting such filings, the SEC is indicating a willingness to explore innovative financial products related to cryptocurrencies, which could potentially lead to increased liquidity and investment opportunities in the market.

What is a Spot ETF?

A Spot ETF, or Exchange-Traded Fund, is a type of investment fund that tracks the price of an underlying asset, in this case, XRP. Unlike futures ETFs, which are based on contracts to buy or sell an asset at a future date, a spot ETF holds the actual asset. This allows investors to gain exposure to the asset’s price movements without directly owning the asset itself. The CoinShares Spot XRP ETF aims to provide a straightforward way for investors to participate in the XRP market, potentially attracting a broader audience.

The Significance of XRP in the Cryptocurrency Market

XRP, created by Ripple Labs, is one of the most well-known cryptocurrencies. It is designed to facilitate fast and low-cost international money transfers. The acknowledgment of the CoinShares Spot XRP ETF filing comes at a crucial time for XRP, especially considering its ongoing legal battles with the SEC over its classification as a security. The SEC’s recognition of an ETF linked to XRP could potentially lend credence to its legitimacy as a digital asset and help clear some of the regulatory clouds hanging over it.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions and Implications

The announcement of the SEC’s acknowledgment has led to a surge in interest and activity within the cryptocurrency community. Investors are optimistic that this development could pave the way for more institutional investments in XRP and bolster its price. As more traditional financial institutions look to enter the cryptocurrency space, products like the Spot XRP ETF could become increasingly appealing.

This acknowledgment also suggests that regulatory barriers for cryptocurrencies may be slowly easing. The SEC’s willingness to approve such a fund may encourage other companies to explore similar opportunities, further integrating cryptocurrencies into the broader financial system.

Potential Challenges Ahead

While the SEC’s acknowledgment of the CoinShares Spot XRP ETF filing is promising, several challenges remain. Regulatory scrutiny is likely to continue, and the final approval of the ETF is not guaranteed. Additionally, the ongoing legal battle between Ripple Labs and the SEC could impact the ETF’s launch and XRP’s market performance.

Investors should remain aware of the volatility that often accompanies cryptocurrency markets. Factors such as regulatory news, market sentiment, and technological developments can lead to significant price fluctuations. As such, careful consideration and research are essential for those looking to invest in XRP or any cryptocurrency-related products.

Conclusion

The SEC’s acknowledgment of the CoinShares Spot XRP ETF filing marks a pivotal moment in the cryptocurrency landscape. It showcases a growing acceptance of digital assets within regulated financial markets and opens the door for more innovative investment products. While challenges remain, this development could significantly impact the future of XRP and the broader cryptocurrency market.

As the situation unfolds, investors and crypto enthusiasts should stay informed about regulatory updates and market trends. The potential for increased institutional investment in XRP could alter its trajectory, making it an exciting time for those involved in the cryptocurrency space. The acknowledgment of the CoinShares Spot XRP ETF is not just a win for Ripple and XRP but also a sign of the evolving relationship between traditional finance and the world of digital currencies.

BREAKING: SEC Acknowledges Filing For CoinShares Spot $XRP ETF! pic.twitter.com/72P3hRSWWE

— Good Morning Crypto (@AbsGMCrypto) February 19, 2025

BREAKING: SEC Acknowledges Filing For CoinShares Spot $XRP ETF!

The landscape of cryptocurrency investing is changing rapidly, and one of the most exciting developments is the news that the U.S. Securities and Exchange Commission (SEC) has acknowledged the filing for the CoinShares Spot $XRP ETF. This news has sent ripples through the crypto community, igniting discussions and speculation about the implications for investors and the broader market. In this article, we’ll break down what this means, why it matters, and how it could affect the future of XRP and cryptocurrency ETFs.

Understanding ETFs and Their Importance in the Crypto Market

Before diving deeper into the implications of this news, let’s first understand what an ETF is. An Exchange-Traded Fund (ETF) is a type of investment fund that is traded on stock exchanges, much like stocks. ETFs hold assets like stocks, commodities, or cryptocurrencies and generally operate with an arbitrage mechanism that helps keep the ETF’s market price in line with its net asset value (NAV).

The introduction of cryptocurrency ETFs has been highly anticipated. They provide a way for traditional investors to gain exposure to cryptocurrencies without having to deal with the complexities of wallets, exchanges, and private keys. By investing in a cryptocurrency ETF, investors can buy shares that represent ownership in a fund that holds the underlying crypto asset. This is particularly appealing for those who may be hesitant to invest directly in digital currencies.

The Significance of the CoinShares Spot $XRP ETF

The acknowledgment of the filing for the CoinShares Spot $XRP ETF by the SEC is a significant milestone. For one, it signals that regulatory bodies are becoming more open to cryptocurrency investment vehicles. The SEC has historically been cautious when it comes to approving crypto-related ETFs, citing concerns about market manipulation, investor protection, and the overall maturity of the crypto market.

By recognizing this filing, the SEC may be indicating a shift in its stance towards cryptocurrency investments, particularly for established assets like XRP. This is especially noteworthy considering the ongoing legal battles XRP has faced, notably the SEC’s lawsuit against Ripple Labs. If the ETF gets approved, it could enhance XRP’s credibility and attract more institutional investors to the asset.

Potential Impacts on XRP Price and Market Sentiment

So, what does this mean for the price of XRP? Well, the acknowledgment of the ETF filing has already sparked excitement in the market, leading to a surge in XRP’s price. Typically, news of ETF approvals or filings tends to lead to bullish sentiment, as investors anticipate more interest and demand for the underlying asset.

Moreover, if institutional investors begin to flock to the CoinShares Spot $XRP ETF, we could see a significant increase in demand for XRP, potentially driving the price even higher. This could also lead to increased liquidity in the market, making it easier for investors to buy and sell XRP without causing significant price fluctuations.

What This Means for Investors

For investors, particularly those who have been watching the developments around XRP closely, this news is a beacon of hope. The acknowledgment of the ETF filing could provide a much-needed boost to XRP’s legitimacy and appeal. Here’s why you might want to pay attention:

1. **Increased Legitimacy**: Approval of the ETF could further legitimize XRP in the eyes of traditional investors who have been cautious about entering the crypto space.

2. **Diversification Opportunities**: The ETF would allow investors to diversify their portfolios by including XRP without the need to hold the asset directly.

3. **Potential for Higher Returns**: As more investors enter the market through the ETF, the potential for price appreciation increases, which could lead to significant returns for early investors.

4. **Ease of Access**: The ETF structure makes it easier for investors to gain exposure to XRP, especially for those who are not tech-savvy or familiar with cryptocurrency exchanges.

The Bigger Picture: Regulatory Landscape and Future Developments

The acknowledgment of the CoinShares Spot $XRP ETF filing is part of a larger trend towards regulatory clarity in the cryptocurrency space. As more countries and regulatory bodies begin to recognize and establish frameworks for digital assets, we can expect to see an influx of new investment products tailored to meet the demands of both institutional and retail investors.

It’s worth noting that while this news is positive, the regulatory landscape is still evolving. Investors should remain vigilant and informed about ongoing developments, as they can significantly impact the cryptocurrency market.

FAQs About the CoinShares Spot $XRP ETF

**Q1: What is CoinShares?**

CoinShares is a digital asset investment firm that specializes in providing institutional investors with access to cryptocurrency investments. They are known for their innovative financial products, including ETFs.

**Q2: How does an ETF work?**

An ETF works by pooling money from multiple investors to purchase a diversified portfolio of assets. Shares of the ETF are then traded on stock exchanges, allowing investors to buy and sell them easily.

**Q3: Is XRP legal to invest in?**

The legal status of XRP has been complex due to ongoing litigation with the SEC. However, if the ETF is approved, it would signal a level of acceptance for XRP as a legitimate investment.

**Q4: What are the risks associated with investing in cryptocurrency ETFs?**

As with any investment, there are risks involved. Cryptocurrency markets can be volatile, and the performance of the ETF will depend on the market dynamics of the underlying asset.

**Q5: How can I invest in the CoinShares Spot $XRP ETF once it’s available?**

Once the ETF is approved and listed on an exchange, you can invest in it through a brokerage account, just like you would with any other stock or ETF.

Final Thoughts on the SEC’s Acknowledgment of CoinShares Spot $XRP ETF

The SEC’s acknowledgment of the CoinShares Spot $XRP ETF is an exciting development that could reshape the landscape of cryptocurrency investments. With the potential for increased legitimacy, heightened interest from institutional investors, and a more accessible investment vehicle for individuals, the future of XRP looks promising.

As always, it’s essential to stay informed and conduct thorough research before making any investment decisions. The world of cryptocurrency is dynamic, and developments like this can create new opportunities for savvy investors. Whether you’re a seasoned crypto enthusiast or just starting, the CoinShares Spot $XRP ETF could be worth keeping an eye on as it unfolds.