Breaking News: Treasury Department Loses Track of $4.7 Trillion

In a startling revelation that has sent shockwaves through both financial markets and social media platforms, it has been reported that the U.S. Treasury Department has lost track of a staggering $4.7 trillion. This news broke on February 18, 2025, when a tweet from user aka (@akafaceUS) brought this alarming information to public attention. The implications of this significant financial oversight could have far-reaching consequences for the U.S. economy and its fiscal policies.

The Context of the Disclosure

The tweet, which included a striking image and gained significant traction on Twitter, raises questions about the transparency and management of government funds. The amount in question, $4.7 trillion, represents a substantial portion of the federal budget and underscores potential issues within the Treasury’s financial tracking systems. With the government already facing scrutiny over various spending programs and budget deficits, this revelation could intensify calls for reform and improved accountability.

Understanding the Impact of the Loss

Economic Consequences

The revelation that the Treasury Department has lost track of such a significant sum raises concerns about potential economic repercussions. Investors and analysts may react to this news by reassessing their confidence in government financial management. Stock markets could experience volatility as investors weigh the implications of this oversight on inflation, interest rates, and overall economic stability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Public Trust and Government Accountability

Public trust in government institutions is crucial for a functioning democracy. An error of this magnitude could erode confidence in the Treasury Department and its ability to manage the nation’s finances effectively. Citizens may call for increased oversight, audits, and transparency in how federal funds are tracked and utilized. This situation could also lead to a renewed debate on the need for financial reforms within the government.

Treasury Department’s Response

In the wake of this news, it is expected that the Treasury Department will need to respond swiftly to address the concerns raised by the public and the media. Officials may be called to testify before Congress to explain how such a significant amount could go untracked and what measures will be implemented to prevent similar occurrences in the future.

Potential Reforms

The loss of $4.7 trillion may prompt legislative efforts aimed at reforming the financial systems within the Treasury. Possible reforms could include enhanced auditing processes, improved financial tracking technologies, and stricter regulations governing federal budget management. These measures could help restore public confidence in the government’s ability to manage taxpayer dollars responsibly.

The Role of Social Media in Spreading the News

The rapid dissemination of this news via social media highlights the critical role that platforms like Twitter play in shaping public discourse. With users sharing information and opinions at lightning speed, the impact of such revelations can be amplified, prompting discussions across various forums. This event serves as a reminder of the power of social media in bringing transparency to government actions and holding institutions accountable.

Conclusion

The revelation that the Treasury Department has lost track of $4.7 trillion is a significant development that could have lasting implications for the U.S. economy and government accountability. As discussions unfold around this issue, it is clear that both the public and officials will be closely monitoring the government’s response. The need for transparency and responsible financial management has never been more critical, and this incident may serve as a catalyst for meaningful reforms in the future.

In summary, this incident is not merely a financial oversight; it is a wake-up call for government institutions to prioritize accountability and transparency in their financial dealings. The public’s trust in government hinges on its ability to manage resources effectively, and the Treasury Department now faces the challenge of restoring that trust in the wake of this monumental loss.

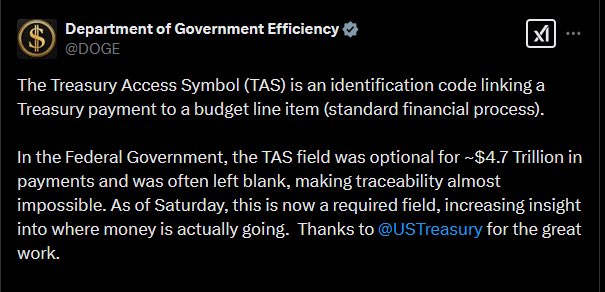

BREAKING: DOGE has revealed that the Treasury Department lost track of $4.7 trillion! pic.twitter.com/KxcPeHAcIO

— aka (@akafaceUS) February 18, 2025

BREAKING: DOGE has revealed that the Treasury Department lost track of $4.7 trillion!

In a stunning announcement that has sent shockwaves through both the financial world and the online community, Dogecoin (DOGE) has disclosed that the Treasury Department has seemingly lost track of a staggering $4.7 trillion. This revelation, shared via a tweet by the user aka (@akafaceUS), has ignited conversations about financial accountability, transparency, and the implications of such a significant amount of money being unaccounted for.

The tweet, which can be viewed [here](https://twitter.com/akafaceUS/status/1891648901192540232?ref_src=twsrc%5Etfw), has quickly gone viral, with users across platforms expressing both disbelief and concern. But what does this really mean for the average person and the broader economy? Let’s dive into the details and implications of this shocking news.

Understanding the Context of the $4.7 Trillion Loss

To fully grasp the gravity of the situation, we need to understand how the Treasury Department manages public funds. The U.S. Treasury is responsible for the government’s finances, including managing federal revenue, expenses, and debt. When a significant amount like $4.7 trillion goes missing or is unaccounted for, it raises serious questions about financial oversight and management.

But what could lead to such a monumental misplacement of funds? While the tweet does not provide specifics, it’s not unheard of for large government organizations to struggle with accounting discrepancies. Various factors, such as outdated systems, bureaucratic inefficiencies, or even potential fraud, could contribute to a situation where funds are unaccounted for.

The Implications for the Economy

The news of a $4.7 trillion discrepancy isn’t just a headline; it has real implications for the economy. For one, such a revelation could undermine public trust in the government’s ability to manage finances effectively. When citizens lose faith in their government, it can lead to decreased consumer confidence. This can affect spending habits and, ultimately, economic growth.

Moreover, this situation could prompt calls for increased oversight and reform within the Treasury Department. If the public perceives that the government is not managing taxpayer money responsibly, there could be a push for more stringent policies and regulations.

The Role of Cryptocurrency and DOGE in This Narrative

In this digital age, cryptocurrency has become a significant player in financial discussions. DOGE, initially created as a joke, has unexpectedly garnered a massive following and has become a symbol of community-driven finance. The fact that DOGE is the medium through which this news was communicated underscores the growing influence of cryptocurrency in mainstream financial discourse.

Cryptocurrencies like DOGE have the potential to disrupt traditional financial systems. They offer transparency, decentralization, and a level of accessibility that traditional banking often lacks. As people begin to question the reliability of government financial institutions, many are turning to alternative forms of currency and investment.

Public Reaction and the Meme Culture

Immediately following the tweet, social media erupted with memes, jokes, and serious discussions about the implications of such a financial blunder. This is a testament to how deeply intertwined meme culture is with contemporary news. The way information spreads in our society often reflects humor and skepticism, especially when it comes to government accountability.

People are using humor as a coping mechanism, but it’s essential to recognize the underlying seriousness of the situation. While memes are entertaining, they can also serve as a vehicle for critical discourse about financial literacy and government responsibility.

The Future of Financial Oversight

As discussions unfold about the $4.7 trillion that the Treasury Department reportedly lost track of, the future of financial oversight will undoubtedly be a hot topic. This incident may serve as a wake-up call for government officials and agencies to reevaluate their accounting practices.

Enhanced technology, better training for personnel, and a commitment to transparency could be essential steps toward preventing such issues in the future. The government must adopt innovative practices to ensure that taxpayer money is managed responsibly and efficiently.

What This Means for Dogecoin and Cryptocurrency

For Dogecoin, this revelation could have both positive and negative ramifications. On one hand, the coin may garner more attention as a serious contender in discussions about alternative currencies. Investors might see DOGE as a viable option, especially when traditional financial institutions are called into question.

On the flip side, if the public perceives cryptocurrencies as speculative and volatile, it could lead to skepticism about their reliability as an investment. However, the resilience of DOGE and its community suggests that it will continue to thrive regardless of external factors.

Conclusion

The announcement that the Treasury Department has lost track of $4.7 trillion, as revealed by DOGE, presents an unprecedented situation that raises vital questions about financial accountability and the future of money management. It reminds us of the importance of transparency in government operations and the potential of cryptocurrencies to reshape financial narratives.

As the world watches closely, the need for reform and innovative solutions in financial oversight becomes increasingly clear. Whether you’re an investor, a casual observer, or someone who simply wants to understand more about the implications of this news, it’s crucial to stay informed and engaged. After all, the economy affects us all, and understanding it is key to navigating our financial future.

Stay tuned for more updates as this story develops, and don’t forget to keep the conversation going!