Breaking News: Treasury Department’s $4.7 Trillion Mystery

In a shocking revelation, a recent tweet by Ryan (@rdnewberry) has brought to light a staggering $4.7 trillion discrepancy in the U.S. Treasury Department’s financial records. According to the tweet, the Treasury has lost track of this enormous sum, with payments made that lack any Treasury Account Symbol (TAS) to connect them to specific budget expenditures. This revelation raises serious questions about the oversight and management of taxpayer funds and could have significant implications for fiscal accountability in the United States.

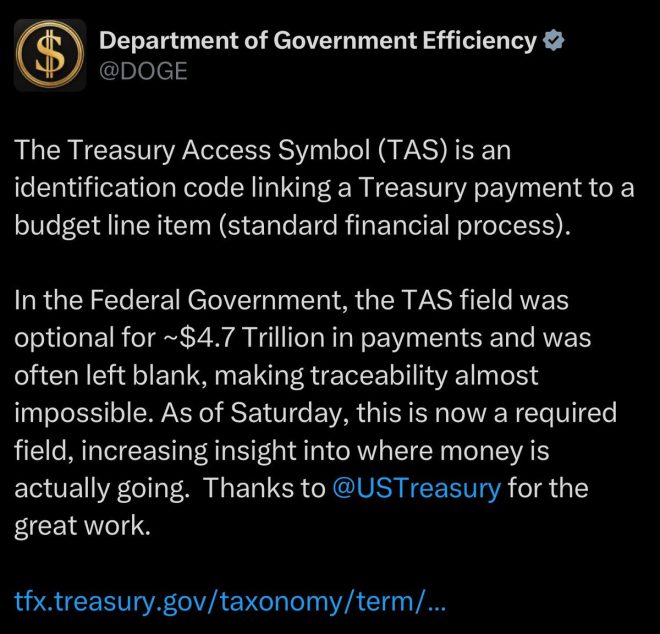

Understanding the Treasury Account Symbol (TAS)

The Treasury Account Symbol (TAS) is a critical component in the financial management of federal funds. It serves as a unique identifier for each federal account, ensuring that all transactions can be tracked and linked to their respective budget allocations. The absence of TAS for $4.7 trillion in payments signifies a major lapse in the Treasury’s accounting practices. This situation not only complicates the tracking of taxpayer dollars but also undermines public trust in government financial management.

Implications of the $4.7 Trillion Discrepancy

The revelation of missing TAS for such a massive amount brings forth several issues:

- Lack of Accountability: Without proper tracking, it becomes challenging to hold agencies accountable for their spending. This could lead to misuse of funds or inefficient allocation of resources.

- Potential for Fraud: The absence of a clear link between payments and budget expenditures raises the risk of fraudulent activities. It becomes easier for individuals or entities to manipulate the system without detection.

- Impact on Fiscal Policy: Understanding where taxpayer money is spent is crucial for shaping effective fiscal policy. This lack of transparency makes it difficult for policymakers to make informed decisions regarding budget allocations.

- Public Trust Erosion: Taxpayers expect their government to manage funds responsibly. Discovering such a significant oversight can lead to public outrage and decreased trust in governmental institutions.

DOGE’s Role in Financial Oversight

Interestingly, the tweet hints at DOGE (Dogecoin) gaining access to IRS data shortly. This connection raises questions about the role of cryptocurrency in financial oversight. As digital currencies continue to gain popularity, their integration into traditional financial systems may provide new avenues for tracking and managing funds.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Rise of Cryptocurrency in Financial Management

Cryptocurrencies like Dogecoin have gained prominence not just as a form of currency but also as tools for financial transparency. By leveraging blockchain technology, cryptocurrencies offer a decentralized and immutable ledger that can enhance accountability. If DOGE gains access to IRS data, it could potentially play a role in ensuring that taxpayer funds are appropriately tracked and managed.

The Need for Improved Financial Management

The revelation of the $4.7 trillion discrepancy emphasizes the urgent need for improved financial management and transparency within the U.S. Treasury. Key steps to address this issue include:

- Enhanced Tracking Systems: Implementing advanced tracking systems that ensure every payment is linked to its corresponding TAS can mitigate the risk of discrepancies.

- Regular Audits: Conducting regular audits of financial records will help identify any lapses in accounting practices and reinforce accountability.

- Increased Transparency: Providing the public with access to detailed information regarding government spending can help rebuild trust and ensure that taxpayer dollars are being used effectively.

- Embracing Technology: Utilizing blockchain and other technologies can enhance the accuracy and efficiency of financial management, making it easier to track and audit payments.

Conclusion

The revelation of the U.S. Treasury Department losing track of $4.7 trillion in payments is alarming and highlights significant flaws in the current financial management systems. The lack of Treasury Account Symbols for these transactions raises serious concerns about accountability, potential fraud, and the overall integrity of government finances. As the situation unfolds, the involvement of cryptocurrency like DOGE in accessing IRS data could pave the way for innovative solutions to restore transparency and trust in government spending.

Moving forward, it is imperative for the Treasury to adopt more robust systems and practices to ensure that taxpayer dollars are accounted for and managed responsibly. With proper oversight and the integration of technology, the U.S. government can work towards regaining public trust and reinforcing the credibility of its financial management processes.

BREAKING: DOGE just revealed that the Treasury Department lost track of $4.7 trillion! More accurately, $4.7 trillion in payments were made without any TAS to link the payments to specific budget expenditures.

Also, DOGE expected to gain access to IRS data shortly. pic.twitter.com/FAhkeVEG3F

— Ryan (@rdnewberry) February 18, 2025

BREAKING: DOGE Just Revealed That the Treasury Department Lost Track of $4.7 Trillion!

If you haven’t heard the latest buzz in the financial and cryptocurrency world, let me fill you in. Recently, a shocking statement from DOGE claimed that the Treasury Department has lost track of a staggering **$4.7 trillion**! Yes, you read that right—$4.7 trillion in payments have been made without any Transaction Accounting System (TAS) to connect these payments to specific budget expenditures. This revelation has sent shockwaves through both the traditional financial sectors and the crypto community alike.

What Does This Mean for the Treasury Department?

First off, this isn’t just about a missing dollar amount. When we talk about **$4.7 trillion**, we’re diving into serious governmental budgeting and accountability issues. The absence of a TAS means that there’s no clear way to trace where that money went, how it was spent, or even if it was spent in accordance with budgetary guidelines. We’re looking at a potential breakdown in financial management that could raise eyebrows in Congress and beyond.

Imagine trying to manage your personal finances without a system to track your income and expenses. You’d likely end up in a mess, and the same goes for a massive entity like the Treasury Department. The implications are huge, and could involve a call for more stringent regulations and oversight in the future.

A Closer Look: How Did This Happen?

So how did we get to this point? It seems that the Treasury has been operating without a reliable way to track these payments properly. Whether it’s due to outdated technology, lack of personnel training, or simple bureaucratic inefficiencies, the reasons could be many. What’s clear is that something is fundamentally wrong when a department can’t keep track of trillions of dollars.

Interestingly, this revelation also hints at the potential for systemic issues within governmental financial practices. If **$4.7 trillion** can go missing without a trace, what other financial discrepancies might be lurking in the shadows?

DOGE Expected to Gain Access to IRS Data Shortly

In another intriguing twist, it appears that DOGE is on the brink of gaining access to IRS data. This could be a game-changer. With access to IRS data, DOGE would have the means to correlate its findings with taxpayer information, potentially unveiling even more about governmental financial practices and accountability.

Imagine the implications of having such data at hand! It could open the door to uncovering how much taxpayer money is being mishandled or lost in the abyss of bureaucratic inefficiency. If DOGE can successfully navigate this landscape, it might very well become a watchdog for fiscal responsibility.

The Role of Cryptocurrency in Financial Transparency

Now, let’s talk about cryptocurrencies like DOGE. One of the reasons many people are drawn to crypto is its potential for transparency and accountability. Blockchain technology offers a way to track transactions without the risk of them being lost in a bureaucratic shuffle.

With DOGE stepping into the spotlight, could we see a shift towards a more transparent financial system? If DOGE can provide insights into governmental financial practices, it may set a precedent for other cryptocurrencies to follow. This could encourage more people to adopt blockchain technology, not just for investment, but as a tool for promoting accountability and transparency in financial dealings.

What Can We Learn From This?

This situation serves as a wake-up call for both governmental departments and financial institutions. It underscores the importance of robust financial tracking systems, whether in traditional finance or cryptocurrencies. With **$4.7 trillion** at stake, the stakes couldn’t be higher.

Additionally, it highlights the role of technology in improving financial management. If the Treasury had a more modern and efficient system in place, it might have avoided this predicament altogether. As we continue to see tech innovations in the financial sector, it’s crucial for government agencies to stay updated and implement effective systems.

Public Reaction and Future Implications

Reactions to this news have been nothing short of explosive. People are outraged that such a significant amount of taxpayer money could go unaccounted for. Social media platforms are buzzing with discussions and debates around this subject. Many are questioning the competence of those in charge and calling for greater transparency and accountability from the government.

The implications of this revelation could lead to a broader push for reform in how the government manages its finances. If DOGE can leverage this situation to push for changes in financial regulations, we might see a ripple effect that transforms the landscape for years to come.

Keeping an Eye on Future Developments

As we monitor this unfolding situation, the focus will likely be on how the Treasury Department responds to these allegations. Will there be an internal investigation? Will there be calls for congressional hearings? And most importantly, will steps be taken to rectify this issue and prevent it from happening in the future?

DOGE’s expected access to IRS data could also create a new layer of scrutiny over government spending. The crypto community is watching closely, as the outcomes could significantly impact both the future of cryptocurrencies and governmental accountability.

In summary, the revelation that the Treasury Department has lost track of **$4.7 trillion** is monumental. With DOGE stepping in to shine a light on this issue, we could be entering a new era of financial accountability. As we stay tuned to see how this situation develops, one thing is clear: the intersection of cryptocurrency and traditional finance is a space to watch, as it could lead to significant changes in how we view and manage public funds.