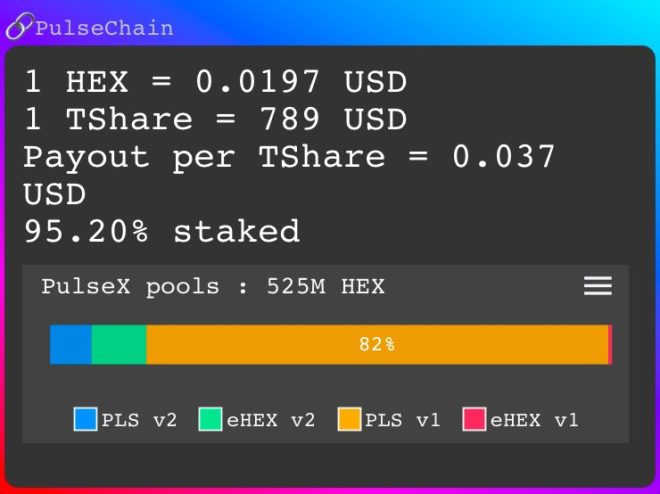

In the rapidly evolving landscape of cryptocurrency, HEX has emerged as a notable player, particularly with the recent news that an impressive 95% of its supply has been taken off the market. This significant development is largely due to the active participation of “daughter wallets” that have been staking HEX for an extended period of 5,555 days. This move not only reflects the commitment of HEX holders but also raises intriguing questions about the future trajectory of this cryptocurrency.

### Understanding HEX’s Market Dynamics

HEX, created by Richard Heart, is a blockchain-based certificate of deposit that offers users the opportunity to earn interest on their holdings through a process known as staking. The recent data indicating that 95% of the HEX supply is no longer available for trading is a game changer. Such a drastic reduction in market supply can lead to increased scarcity, potentially driving up the price as demand remains constant or grows. This aligns with the fundamental economic principle of supply and demand.

### Richard Heart’s Philosophy on Market Trends

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Richard Heart, a prominent figure in the cryptocurrency space, has been vocal about his views on what influences the market. He famously stated, “APY doesn’t matter in the bull run; all that matters is the price chart.” This perspective highlights the prevailing belief among many crypto investors that during bull markets, price appreciation takes precedence over the annual percentage yield (APY) that staking offers. As price charts trend upward, investors tend to focus more on potential profits rather than returns from staking.

### The Future of HEX: Bull Run Potential

With the current market dynamics and the substantial percentage of HEX being staked, many analysts predict a bullish trend for HEX in the near future. The sentiment within the community is that this bull run will leave critics and skeptics of HEX stunned. As the crypto market has shown a propensity for rapid price surges during bullish phases, the decreased supply coupled with increased demand could position HEX for significant price movements.

### The Role of Staking in HEX’s Success

Staking is a crucial component of the HEX ecosystem. By locking up their tokens for an extended duration, users not only contribute to the network’s stability but also stand to gain rewards. The ongoing staking of HEX for 5,555 days emphasizes the commitment of holders to the long-term vision of the cryptocurrency. This long-term perspective is essential in the crypto space, where short-term volatility can often lead to panic selling.

### Community Engagement and Social Sentiment

The HEX community plays a vital role in the currency’s growth and stability. Social media platforms like Twitter have become hotbeds for discussions, updates, and user sentiments. The recent tweet from KatieePCrypto highlights the excitement and optimism surrounding HEX. The community’s engagement is crucial; it fosters a sense of belonging among investors and encourages new participants to join the ecosystem.

### What This Means for New Investors

For new investors considering entering the HEX market, the current scenario presents both opportunities and risks. The decision to invest should be informed by thorough research and an understanding of market trends. With 95% of HEX supply taken off the market, potential investors might see this as a signal of impending price increases. However, they should also be aware of the inherent volatility in the cryptocurrency market.

### Conclusion

In summary, the recent development regarding HEX, with 95% of its supply being taken off the market due to long-term staking, signals a potentially bullish trend for the cryptocurrency. Richard Heart’s emphasis on price charts over APY during bull runs resonates with investors who are eager to capitalize on the market’s upward momentum. As the HEX community continues to engage and support the ecosystem, the future looks promising.

Investors should remain vigilant and conduct thorough research before diving into any cryptocurrency investment. The HEX bull run could indeed leave many skeptics in disbelief, and those who position themselves wisely may reap the benefits in the long run. As always, understanding the underlying technology, market dynamics, and community sentiment is key to navigating the ever-changing world of cryptocurrency.

In conclusion, HEX is gaining traction, and the significant reduction in its available supply coupled with active staking indicates a robust ecosystem poised for growth. Whether you’re a seasoned investor or a newcomer, keeping an eye on HEX’s developments may prove beneficial as the market continues to evolve.

JUST IN: 95% of the HEX supply has now been taken off the market as daughter wallets continued to stake HEX 5555 today.

Richard once said: ‘APY doesn’t matter in the bull run, all that matters is the price chart’.

HEX bull run will leave haters in disbelief. pic.twitter.com/9v7V6Wgozv

— KatieePCrypto.pls (@KatieePCrypto) February 12, 2025

JUST IN: 95% of the HEX Supply Has Now Been Taken Off the Market

It’s an exciting time in the world of cryptocurrency, especially for HEX investors. Recent reports have confirmed that **95% of the HEX supply has been taken off the market**, as daughter wallets are actively staking HEX for a whopping 5555 days. This move signals a strong commitment from holders, suggesting that they believe in HEX’s potential for substantial growth. If you’re still trying to wrap your head around what this means for the market, don’t worry—I’ve got you covered.

One of the most notable figures in the HEX community, Richard Heart, once emphasized that “APY doesn’t matter in the bull run, all that matters is the price chart.” This statement resonates particularly well now, as the price action of HEX is drawing attention and sparking conversations across various platforms. Investors are shifting their focus from annual percentage yields (APY) to the actual market trends and price movements, a shift that can often dictate how the market behaves.

Diving Deeper into the Staking Madness

So, what does it mean when we say **daughter wallets are staking HEX 5555**? Well, staking in the cryptocurrency world is essentially locking up your coins to support the network and, in return, earning rewards. The figure 5555 is significant because it represents a commitment to a long-term staking strategy, which can yield substantial returns over time.

When 95% of the HEX supply is taken off the market, it creates a scarcity effect. Basic economics tells us that when supply decreases and demand remains the same—or increases—prices are likely to rise. This is why many investors are feeling bullish about HEX right now. The community is buzzing with optimism, and the sentiment is infectious.

The Bull Run Is Here, and It’s Time to Pay Attention

The phrase “HEX bull run will leave haters in disbelief” is not just a catchy tagline; it reflects a growing sentiment among HEX holders. As more and more of the supply is staked, it creates an environment ripe for a bull market. For those of you who may be new to the crypto scene, a bull market is characterized by rising prices and optimistic investor sentiment.

In this context, HEX is gaining momentum, and it’s hard to ignore the energy surrounding it. Many are starting to realize that the traditional metrics they once relied on, such as APY, may not be as relevant in this unique market phase. Instead, the focus is shifting to the charts and patterns that indicate where HEX might be headed next.

Understanding Richard Heart’s Philosophy

Richard Heart’s philosophy is often a topic of heated debate in the crypto community. His assertion that **APY doesn’t matter in the bull run** challenges conventional wisdom and invites investors to rethink their strategies. While many crypto enthusiasts obsess over yield farming and interest rates, Heart encourages a more straightforward approach: focus on the price action.

This perspective is especially pertinent now, with the current dynamics of the HEX market. By prioritizing price charts over APY, investors can make more informed decisions based on real-time market behavior. If you’ve been waiting for a sign to dive into HEX, this might just be it.

The Community Effect: What’s Driving Interest in HEX?

The HEX community is one of the most passionate and engaged groups in the cryptocurrency space. When you see 95% of the HEX supply taken off the market, it’s a sign that the community believes in the project long-term. This level of commitment from holders often leads to increased interest from potential investors, creating a feedback loop that can propel the price even higher.

Social media platforms are abuzz with discussions about HEX, and many influencers are sharing their bullish sentiments. This kind of grassroots marketing can be incredibly effective, drawing in new investors who might have been on the fence. The sense of community, combined with tangible results like the recent staking activity, creates an ideal environment for growth.

Price Action: What to Watch For

As the HEX bull run unfolds, it’s essential to keep an eye on the price action. Experienced traders often look for specific indicators that can signal when to buy or sell. Watching for bullish patterns on the price chart can help you make informed decisions. Remember, Richard Heart’s advice rings true: during a bull run, the price chart is your best friend.

If you’re not familiar with how to read price charts, now might be a great time to learn. There are numerous resources available online that can help you understand key indicators like support and resistance levels, moving averages, and volume metrics. The more informed you are, the better equipped you’ll be to navigate the market.

The Future of HEX: Where Do We Go From Here?

With 95% of the HEX supply off the market and a community that’s rallying behind it, the future looks promising. However, like all investments, it’s crucial to approach with caution. The crypto market can be incredibly volatile, and while the potential for gains is high, so is the risk.

Investors should always conduct their own research and consider their financial situation before making any investment decisions. Following the trends and remaining engaged with the community can provide insights that might be beneficial as you navigate this exciting landscape.

Final Thoughts

The buzz surrounding HEX is palpable, especially with the recent developments indicating that **95% of the HEX supply has been taken off the market**. This development, combined with Richard Heart’s philosophy that “APY doesn’t matter in the bull run,” sets the stage for what could be an exciting chapter for HEX investors.

As we watch this bull run unfold, it’s essential to stay informed and engaged. Whether you’re a seasoned investor or brand new to the world of cryptocurrency, there’s always something to learn. So, keep your eyes on the price chart and prepare for what lies ahead. The HEX community is rallying, and if the market trends continue, we might just witness something remarkable.

Stay tuned, because in the world of crypto, anything can happen, and the next big opportunity might just be around the corner.