Breaking News: Whales Buy 170,762 ETH Worth $442 Million

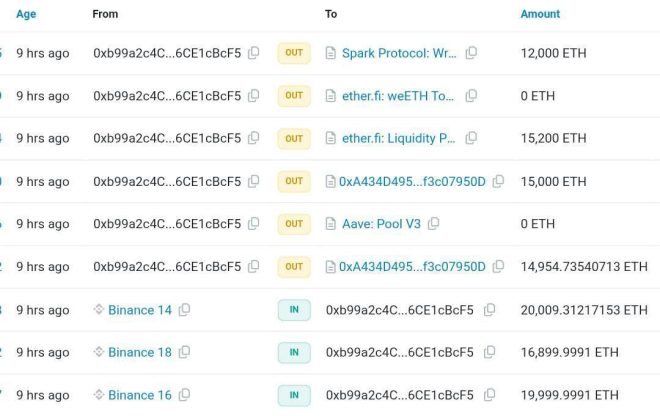

In a significant development in the cryptocurrency market, two major investors, often referred to as "whales," have made headlines by purchasing a staggering 170,762 ETH (Ethereum) worth approximately $442 million in just 72 hours. This bold move comes at a time when retail investors are experiencing heightened panic and are selling off their ETH holdings. The contrast between the actions of these whales and retail investors raises several important questions about market dynamics and future trends in the cryptocurrency space.

Understanding the Whale Impact

Whales are individuals or entities that hold large quantities of cryptocurrency, and their trading decisions can significantly influence market movements. When whales make substantial purchases, it often signals confidence in the asset’s future value. In this case, the whales’ recent acquisition of ETH amidst a wave of retail panic selling suggests a potential bullish outlook for Ethereum.

Whales typically have the resources to weather market volatility better than retail investors, who may be more prone to emotional decision-making. The drastic purchasing behavior of these whales could indicate that they believe the current market conditions present a buying opportunity. This phenomenon has historically preceded price rallies in the cryptocurrency market.

Retail Panic Selling: A Closer Look

The current panic selling among retail investors can be attributed to several factors. Market sentiment is fragile, and news of regulatory scrutiny or macroeconomic challenges often triggers fear among individual investors. When prices decline, many retail investors rush to liquidate their positions to avoid further losses, creating a downward spiral.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In contrast, whales often take advantage of these situations. By purchasing significant amounts of ETH while retail investors are selling, they can acquire assets at a lower price. This strategy allows them to accumulate more cryptocurrency, positioning themselves favorably for future gains when the market rebounds.

The Current State of Ethereum

Ethereum, the second-largest cryptocurrency by market capitalization, has been a focal point for both institutional and retail investors in recent years. Its underlying technology, which supports smart contracts and decentralized applications, has garnered significant interest and investment. However, like all cryptocurrencies, Ethereum is not immune to volatility.

In the past few months, Ethereum has experienced price fluctuations driven by various factors, including regulatory news, technological updates, and broader market trends. The recent whale activity suggests that confidence in Ethereum’s future remains intact, even in the face of selling pressure from retail investors.

What This Means for Investors

For investors observing the current market dynamics, several takeaways emerge from this situation. First, the actions of whales should not be overlooked. Their ability to make large purchases often reflects a calculated strategy based on market analysis and trends. Retail investors may want to consider the implications of whale behavior when making their own investment decisions.

Second, this situation highlights the importance of maintaining a long-term perspective in the cryptocurrency market. While short-term price fluctuations can be alarming, understanding the fundamentals of the asset and the broader market can help investors navigate volatility more effectively.

The Road Ahead for Ethereum

Looking forward, the future of Ethereum appears to be contingent on several factors. The ongoing development of the Ethereum network, including upgrades and improvements to scalability and transaction speed, will play a critical role in attracting new users and investors. Additionally, regulatory developments and macroeconomic conditions will continue to shape the market landscape.

The recent whale activity serves as a reminder that there are opportunities within the chaos of market fluctuations. Investors who can maintain composure and conduct thorough research may find that the current environment presents unique opportunities for growth.

Conclusion

In summary, the recent purchase of 170,762 ETH by two whales amidst retail panic selling underscores the complex dynamics of the cryptocurrency market. While retail investors may be reacting emotionally to market conditions, whales are strategically positioning themselves for potential future gains.

As Ethereum continues to evolve, both retail and institutional investors will be watching closely for signs of recovery and growth. The actions of whales in the current market serve as a crucial indicator of sentiment and potential future trends. For those involved in the cryptocurrency space, understanding these dynamics will be essential for making informed investment decisions.

In the ever-changing world of cryptocurrency, the balance of fear and opportunity will always be present. With whales loading up on ETH, it may be worth considering whether the current market downturn is a temporary setback or a signal of a more significant opportunity on the horizon. Investors should remain vigilant, stay informed, and be prepared to adapt to changing market conditions.

BREAKING

2 WHALES HAVE BOUGHT 170,762

ETH WORTH $442 MILLION IN THE

PAST 72 HOURS.RETAIL IS PANIC SELLING ETH,

WHALES ARE LOADING UP ETH. pic.twitter.com/zPPNICBfNC— Ash Crypto (@Ashcryptoreal) February 12, 2025

BREAKING

If you’ve been keeping an eye on the crypto market recently, you might have come across some jaw-dropping news. In the past 72 hours, two major players, often referred to as “whales,” have swooped in and purchased a staggering 170,762 ETH, which translates to an incredible $442 million. This recent activity has sent shockwaves through the Ethereum community and raised eyebrows among retail investors. As panic selling grips the retail market, these whales are loading up on ETH like it’s going out of style. Let’s dive into what this all means and why it’s significant for both seasoned investors and newcomers.

2 WHALES HAVE BOUGHT 170,762

For those who may not be familiar, “whales” in the cryptocurrency world refer to individuals or entities that hold large amounts of cryptocurrency. These players have the potential to influence market prices due to their trading volumes. The recent acquisition of 170,762 ETH by just two whales is a clear indication that they see value in Ethereum, likely believing that the current market conditions are favorable for long-term gains. This kind of buying spree usually signals confidence in the asset, especially during times when retail investors might be selling off their holdings in a panic.

One might ask: Why are these whales so bullish when retail investors are skittish? The answer often lies in market psychology. Whales have the resources and the analytical tools to assess market trends more effectively, allowing them to make strategic moves. In contrast, retail investors often react emotionally to market fluctuations, leading to panic selling. This creates a unique opportunity for those who can keep a cool head and make informed decisions.

ETH WORTH $442 MILLION IN THE

The sheer scale of the investment—$442 million worth of ETH—reflects not just confidence but also a calculated risk. Whales typically have a long-term investment horizon, and their buying patterns suggest they believe that Ethereum is currently undervalued or that it has significant upside potential. The Ethereum network has been the backbone of countless decentralized applications (dApps) and remains a leading platform for smart contracts. Its recent upgrades, including the transition to Ethereum 2.0, are aimed at improving scalability and reducing energy consumption, making it an attractive investment.

Moreover, the recent rise in the popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs) has further solidified Ethereum’s position in the crypto landscape. Whales seem to recognize that Ethereum’s use case is expanding, which could lead to increased demand and higher prices in the future. If you want to know more about Ethereum’s potential, check out resources like CoinDesk and Ethereum’s official website for insights and updates.

PAST 72 HOURS.

So, what exactly happened in the last 72 hours? Market analysts have been scrambling to dissect the implications of this massive ETH purchase. The timing of such a significant buy is crucial, especially in a market that has seen its fair share of volatility. Many retail investors are currently caught in a whirlwind of uncertainty, leading to panic selling as they react to market dips. When news like this breaks, it often creates a ripple effect, prompting more retail investors to reconsider their positions.

This environment can be particularly challenging for individual investors who may not have the same level of information or resources as these whales. However, it’s essential for retail investors to remember that the market can be cyclical. What seems like a downturn today can quickly turn into an opportunity tomorrow. Instead of succumbing to panic, it’s often wiser to take a step back and assess the situation. Education and research are key. Resources like Investopedia provide valuable information for those looking to understand market trends and make informed decisions.

RETAIL IS PANIC SELLING ETH,

The panic selling by retail investors is indicative of a broader trend that often occurs during market downturns. Many retail investors may not have the same risk tolerance as institutional players. When prices drop, fear can set in quickly, leading to a rush to sell before further losses accumulate. This behavior is often exacerbated by social media and news outlets that amplify negative sentiment, creating a feedback loop of fear and selling pressure.

For those who find themselves in the midst of panic selling, it’s crucial to remember that emotional decisions rarely lead to favorable outcomes. If you’re considering selling your ETH or any other asset, take a moment to evaluate your goals and the reasons for your investment. Have you done your research? Are you in it for the short term or the long haul? These are questions every investor should ask themselves, especially in times of market turmoil.

WHALES ARE LOADING UP ETH.

While retail investors scramble to sell, these whales are strategically loading up on ETH, creating a stark contrast in market behavior. Their bullish stance is often driven by a combination of market analysis, confidence in Ethereum’s long-term potential, and the understanding that market cycles can offer unique buying opportunities. As retail investors sell off their holdings, whales can acquire assets at lower prices, positioning themselves for future gains.

The actions of these whales also highlight the importance of market sentiment and its influence on trading behavior. As they continue to buy, it could signal to other investors that the time to buy might be now. If the trend continues, we may see a shift in market dynamics where retail investors start to regain confidence, which could lead to a rebound in prices.

What’s Next for Ethereum?

With the crypto market being as volatile as it is, predicting the next move can be tricky. However, the actions of these whales indicate a potential shift in market sentiment. As more institutional and whale investors enter the market, it could lead to a stabilization of prices and perhaps even a rally in the coming weeks or months.

For those who are new to cryptocurrency investing, now is a great time to start educating yourself about the market. Keep an eye on trends, follow news outlets like CoinTelegraph, and engage with communities on platforms like Reddit or Twitter to stay informed. The crypto world is ever-changing, and being well-informed is your best bet for making sound investment decisions.

In the end, whether you’re a whale or a retail investor, understanding the dynamics of the market is essential. As we see this recent surge in whale activity, it’s a reminder of the opportunities that can arise from market volatility. Keep your eyes peeled, stay informed, and who knows—you might just find yourself riding the next wave of Ethereum’s growth.