Elon Musk Proposes Federal Reserve Audit with DOGE

In a surprising announcement, Elon Musk has suggested the idea of auditing the Federal Reserve with the involvement of Dogecoin (DOGE), a cryptocurrency he has frequently championed. This provocative statement, shared via Twitter on February 11, 2025, has sparked significant conversation and speculation across various platforms about the implications of such an audit and its potential impact on both the cryptocurrency market and traditional financial systems.

The Context of Musk’s Proposal

Elon Musk, the CEO of Tesla and SpaceX, is known for his influential presence in the cryptocurrency space. His tweets have historically caused volatility in the prices of digital currencies, particularly Dogecoin, which started as a meme but has gained substantial traction and legitimacy over the years. Musk’s suggestion for an audit of the Federal Reserve could be interpreted as a critique of the central banking system, which has faced scrutiny for its monetary policies and the economic impacts of quantitative easing.

The Federal Reserve, as the central bank of the United States, plays a critical role in managing the country’s monetary policy, regulating banks, maintaining financial stability, and providing financial services. However, its operations are often viewed as opaque, leading to calls for greater transparency and accountability. Musk’s proposal to involve Dogecoin in this audit raises intriguing questions about the intersection of cryptocurrency and traditional finance.

The Role of Dogecoin

Dogecoin, originally created as a joke in 2013, has evolved into a serious player in the crypto market, with a loyal community and significant market capitalization. Musk’s association with Dogecoin has helped elevate its profile, turning it into a symbol of the broader cryptocurrency movement. By proposing an audit of the Federal Reserve with DOGE, Musk seems to be advocating for a new paradigm in financial oversight, potentially leveraging the transparency and decentralized nature of blockchain technology.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of a Federal Reserve Audit

- Increased Transparency: One of the primary benefits of auditing the Federal Reserve would be increased transparency regarding its financial operations and decision-making processes. This transparency could help demystify the actions of the central bank and build public trust.

- Impact on Cryptocurrency Legitimacy: If a cryptocurrency like Dogecoin were involved in such a significant financial audit, it could enhance the legitimacy of digital currencies as a whole. It would signal a shift towards the acceptance of cryptocurrencies in traditional finance, which could open doors for greater integration.

- Potential Market Reactions: Musk’s tweet has likely influenced market sentiments, leading to fluctuations in the price of DOGE and other cryptocurrencies. Investors often react swiftly to Musk’s statements, and this proposal may lead to increased trading activity as traders speculate on the outcomes.

- Critique of Central Banking: Musk’s suggestion may be seen as a critique of the existing financial system and a call for reform. By proposing an audit with Dogecoin, he is perhaps advocating for a more decentralized financial system that operates outside the traditional banking structures.

Social Media Reactions

Following Musk’s tweet, social media platforms buzzed with reactions from crypto enthusiasts, financial analysts, and the general public. Many supporters praised Musk for his bold ideas and vision for the future of finance, while critics questioned the feasibility and seriousness of conducting a Federal Reserve audit using a cryptocurrency. This divergence in opinions highlights the polarized views surrounding both Musk and the role of cryptocurrencies in the modern economy.

The Future of Cryptocurrency and Traditional Finance

Musk’s proposal to audit the Federal Reserve with Dogecoin could be a pivotal moment in the ongoing dialogue about the future of finance. As cryptocurrencies continue to gain traction, their integration with traditional financial systems may become inevitable. This integration could lead to more innovative financial products and services, potentially reshaping consumer experiences and economic practices.

Conclusion

Elon Musk’s recent suggestion to audit the Federal Reserve with Dogecoin has ignited discussions about the role of cryptocurrencies in the financial ecosystem. The implications of such an audit could be profound, potentially enhancing the legitimacy of digital currencies and promoting greater transparency in financial operations. As the landscape of finance evolves, the intersection of traditional banking and cryptocurrencies will likely continue to be a focal point for innovation and debate.

In summary, Musk’s statement reflects the growing interest in the accountability of financial institutions and the potential for cryptocurrencies to play a role in reshaping the future of finance. As we move forward, the outcomes of such proposals will be closely watched by both the cryptocurrency community and traditional financial markets.

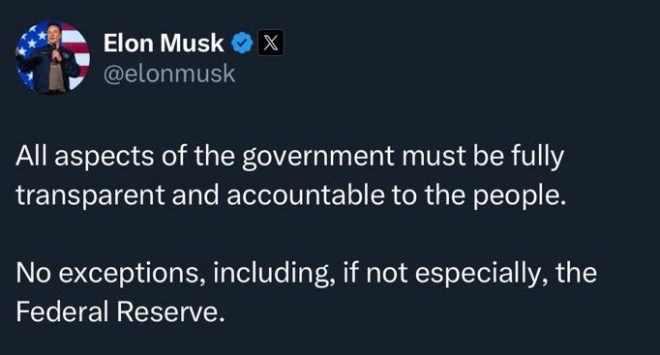

BREAKING: Elon Musk has suggested he and DOGE may audit the Federal Reserve pic.twitter.com/mYci2Mc5Mz

— unusual_whales (@unusual_whales) February 11, 2025

BREAKING: Elon Musk has suggested he and DOGE may audit the Federal Reserve

When it comes to the intersection of cryptocurrency and traditional finance, few names resonate as powerfully as Elon Musk and Dogecoin (DOGE). Recently, Musk stirred the pot with a provocative suggestion: he and DOGE might audit the Federal Reserve. This bold statement has sent shockwaves through both the crypto community and traditional financial circles, igniting discussions about the implications of such an audit. Let’s dive into what this means, why it matters, and how it could reshape our understanding of money in the modern era.

The Context Behind the Suggestion

Elon Musk has always been a figure of controversy and innovation. Known for his disruptive ideas and ventures, from Tesla to SpaceX, Musk’s interests extend into the realms of cryptocurrency. Dogecoin, initially created as a joke, has become a symbol of the cryptocurrency movement. It’s not just a meme anymore; it’s a legitimate currency with a passionate following. So, when Musk hinted at an audit of the Federal Reserve with DOGE’s involvement, it raised eyebrows everywhere.

The Federal Reserve, as the central bank of the United States, plays a crucial role in managing the country’s monetary policy. Its decisions affect inflation, interest rates, and the overall economic landscape. An audit of such a critical institution is not something to be taken lightly. But why would Musk, a tech entrepreneur, want to get involved in this?

What Would an Audit Entail?

An audit of the Federal Reserve could encompass several aspects. Primarily, it would involve examining the Fed’s financial statements, its monetary policy decisions, and how these decisions affect the economy. The goal would be to ensure transparency and accountability in an institution that wields enormous power over the nation’s finances.

For many advocates of cryptocurrency, including Musk, the push for greater transparency is a fundamental aspect of the movement. Cryptocurrencies thrive on the principles of decentralization and openness. If Musk and DOGE were to audit the Federal Reserve, it could signal a shift towards more transparency in traditional financial systems.

The Potential Impact on Cryptocurrency

If this audit were to happen, the implications for cryptocurrency could be monumental. First off, it could lend legitimacy to cryptocurrencies as a whole. The idea that a major figure like Musk, along with a popular cryptocurrency like DOGE, could take on the Federal Reserve would certainly elevate the status of digital currencies.

Moreover, such a move could encourage more people to explore cryptocurrencies as alternatives to traditional banking systems. If DOGE successfully audits the Fed, it might inspire confidence in cryptocurrencies and potentially lead to wider adoption. This could result in increased investments and innovations within the crypto space.

Public Reaction to Musk’s Suggestion

The public reaction to Musk’s suggestion has been mixed. On social media, many enthusiasts celebrated the idea, seeing it as a bold move that could challenge the status quo. However, skeptics pointed out the impracticalities of the proposal. Some argue that auditing a complex institution like the Federal Reserve is no small feat, and the logistics of involving a cryptocurrency could complicate matters further.

Nevertheless, the fact that Musk has brought this topic into the spotlight is significant. It shows that the conversation around cryptocurrencies and their roles in the financial system is evolving. The more people discuss these ideas, the more likely they are to gain traction, leading to potential changes in policy and public perception.

How Musk and DOGE Could Execute an Audit

If Musk were to pursue this audit, how might it actually come to fruition? One possibility is through the establishment of a coalition of crypto enthusiasts, economists, and finance experts. This group could work together to design an audit framework that addresses both transparency and accountability.

Utilizing blockchain technology could also play a crucial role in this process. Since blockchains are inherently transparent and secure, they could provide a way to track and verify financial transactions in a manner that could be applied to the Fed’s operations. This intersection of traditional finance and modern technology could pave the way for innovative solutions that enhance trust in financial systems.

The Future of Money and Banking

Musk’s suggestion brings forth larger questions about the future of money and banking. As digital currencies continue to rise in popularity, traditional financial institutions will need to adapt to this new landscape. The idea of auditing something as powerful as the Federal Reserve using a cryptocurrency like DOGE could lead to broader discussions about the roles of central banks and the potential for decentralized finance (DeFi).

DeFi has gained traction by offering alternatives to traditional banking services, including lending, borrowing, and trading without intermediaries. If the public sees Musk’s involvement with Dogecoin as a serious challenge to the Fed, it could accelerate the shift towards decentralized financial systems.

The Role of Social Media in Shaping Economic Discourse

It’s important to consider the role of social media in these discussions. Platforms like Twitter have become vital in shaping public opinion on economic issues. Musk, with his enormous following, has the power to sway conversations and bring attention to topics that might otherwise go unnoticed. His suggestion regarding a DOGE audit of the Federal Reserve is a prime example of how social media can influence financial discourse.

In fact, the response to Musk’s tweet showcases the potential of social media to mobilize communities around specific ideas and concepts. It can lead to organized movements that challenge existing structures and propose new alternatives.

What Lies Ahead?

As we look to the future, the potential for Musk and DOGE to influence the Federal Reserve audit discussion is both thrilling and uncertain. While some may dismiss the idea as far-fetched, the reality is that the landscape of finance is changing rapidly. More people are becoming aware of cryptocurrencies and their potential to disrupt traditional systems.

The conversation around auditing the Federal Reserve is not just about accountability; it’s also about envisioning new possibilities for how we manage and perceive money. Whether or not Musk and DOGE take concrete steps toward this audit remains to be seen, but the dialogue they’ve sparked is crucial.

In summary, Elon Musk’s suggestion that he and DOGE may audit the Federal Reserve opens up a world of possibilities. It challenges conventional thought and encourages a re-examination of the financial systems we take for granted. As the lines between cryptocurrency and traditional finance continue to blur, we can expect more exciting developments in the coming years. The future of money might be more decentralized, transparent, and accessible than we ever imagined.