BlackRock’s Significant Investment in Bitcoin: A Game-Changer for Cryptocurrency

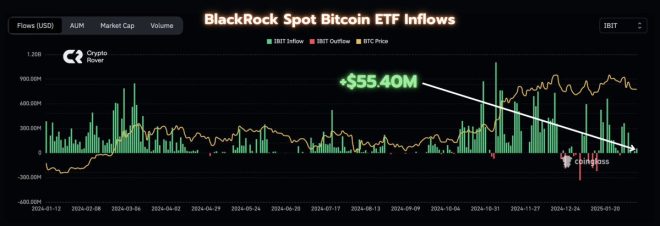

In a groundbreaking move that has sent ripples across the financial world, BlackRock, the world’s largest asset manager, recently announced its acquisition of $55.4 million worth of Bitcoin. This monumental purchase, reported on February 11, 2025, by Crypto Rover on Twitter, underscores the growing institutional interest in cryptocurrencies, particularly Bitcoin, which has seen a resurgence in popularity and value over the past few years.

Background on BlackRock and Bitcoin

BlackRock, with its extensive portfolio managing trillions of dollars in assets, has been a pivotal player in the global financial landscape. The firm has historically approached cryptocurrencies with caution, reflecting concerns about volatility, regulation, and security. However, this latest investment indicates a significant shift in strategy, signaling that BlackRock recognizes Bitcoin’s potential as a legitimate asset class.

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, is the first decentralized digital currency. Over the years, it has evolved from a niche digital asset to a mainstream investment, capturing the attention of institutional investors, hedge funds, and even governments. Its decentralized nature and limited supply have made it an attractive hedge against inflation and economic instability, further driving its adoption.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of BlackRock’s Investment

BlackRock’s purchase of $55.4 million in Bitcoin is more than just a financial transaction; it represents a significant endorsement of the cryptocurrency market. By investing such a substantial amount, BlackRock is likely to encourage other institutional investors to follow suit, which could lead to increased demand and higher prices for Bitcoin.

Institutional Adoption of Cryptocurrencies

The entry of major players like BlackRock into the cryptocurrency space has been a gradual process. Institutions have been exploring ways to integrate digital assets into their portfolios, driven by factors such as diversification, potential returns, and the desire to stay relevant in an increasingly digital world. BlackRock’s investment may serve as a catalyst for broader institutional adoption, leading to more capital flowing into Bitcoin and other cryptocurrencies.

Market Stability and Confidence

One of the lingering concerns about cryptocurrencies has been their volatility. However, the involvement of large financial institutions like BlackRock can help stabilize the market. With significant capital backing, Bitcoin may experience less extreme price fluctuations, fostering a more stable environment for both retail and institutional investors. This increased confidence could encourage more traditional investors to explore the cryptocurrency market, further legitimizing Bitcoin as a viable investment option.

The Future of Bitcoin and Cryptocurrencies

BlackRock’s investment also raises questions about the future trajectory of Bitcoin and other cryptocurrencies. As institutional interest grows, we may see increased regulatory scrutiny, which could lead to clearer frameworks for how cryptocurrencies are treated under the law. This regulatory clarity could further enhance investor confidence and pave the way for more widespread adoption.

The Role of Bitcoin ETFs

BlackRock’s involvement in Bitcoin also brings attention to the potential for Bitcoin exchange-traded funds (ETFs). An ETF would allow investors to gain exposure to Bitcoin without having to purchase the cryptocurrency directly. The approval of Bitcoin ETFs in various markets has been a hot topic, and BlackRock’s presence could influence regulatory bodies to consider such products more favorably.

Competition and Innovation

As major financial institutions like BlackRock enter the cryptocurrency market, competition will likely intensify. This could lead to innovation in financial products related to Bitcoin and other digital assets. Companies may develop new investment vehicles, trading platforms, and services that cater to both institutional and retail investors, expanding the overall ecosystem.

Conclusion

BlackRock’s recent purchase of $55.4 million in Bitcoin marks a significant milestone in the ongoing evolution of the cryptocurrency market. This investment not only highlights the growing acceptance of Bitcoin as a legitimate asset class but also sets the stage for increased institutional participation in the digital currency space.

As more institutions recognize the potential of Bitcoin, we can expect to see a ripple effect that could reshape the financial landscape. The implications of this investment extend beyond BlackRock; they signal a broader acceptance of cryptocurrencies and may pave the way for a new era of digital finance.

In summary, BlackRock’s strategic move into Bitcoin is a clear indicator of the changing tides in the investment world. With the backing of one of the largest asset managers in the world, Bitcoin is poised for continued growth and adoption, potentially transforming the way investors approach digital assets in the years to come.

BREAKING: BlackRock bought $55.4 MILLION worth of #Bitcoin yesterday. pic.twitter.com/uOO0hkGfgw

— Crypto Rover (@rovercrc) February 11, 2025

BREAKING: BlackRock bought $55.4 MILLION worth of #Bitcoin yesterday.

If you’ve been following the cryptocurrency market, the recent news from BlackRock has likely caught your attention. The investment giant made headlines for purchasing a staggering $55.4 million worth of Bitcoin. But what does this mean for the crypto market and investors alike? In this article, we’ll dive into the details, implications, and what this could mean for the future of Bitcoin and institutional investments in cryptocurrencies.

Understanding BlackRock’s Move into Bitcoin

BlackRock is one of the largest asset management firms in the world, managing trillions of dollars in assets. Their decision to invest in Bitcoin is significant for several reasons. Firstly, it legitimizes Bitcoin as a viable investment option for traditional investors. With BlackRock’s backing, Bitcoin is moving closer to mainstream acceptance, which could encourage even more institutional investors to enter the crypto space.

The fact that BlackRock chose to invest a whopping $55.4 million sends a strong signal to the market. It shows that even the most conservative financial institutions are beginning to see the potential in Bitcoin. This could also lead to increased institutional adoption, which is crucial for the long-term growth of cryptocurrencies.

The Ripple Effects on the Cryptocurrency Market

When a major player like BlackRock makes such a substantial investment, it has a ripple effect throughout the entire cryptocurrency market. Following the announcement, Bitcoin’s price experienced a noticeable uptick. Many investors view BlackRock’s investment as a vote of confidence in Bitcoin’s future, leading to increased buying pressure.

This move could also influence other institutional investors to reevaluate their stance on Bitcoin. If they see a respected firm like BlackRock investing heavily in the cryptocurrency, they may be more inclined to follow suit. This influx of institutional capital could drive Bitcoin’s price higher, potentially leading to new all-time highs in the near future.

BlackRock’s Strategic Vision for Bitcoin

So, why did BlackRock decide to invest in Bitcoin now? One possible reason is the growing acceptance of cryptocurrencies as a hedge against inflation. With rising inflation rates globally, many investors are looking for assets that can maintain their value. Bitcoin, often referred to as “digital gold,” has been viewed by some as a store of value in turbulent economic times.

Additionally, BlackRock’s investment could indicate a broader strategy to diversify their portfolio. By adding Bitcoin to their asset mix, they are not only tapping into a high-growth potential market but also appealing to younger investors who are increasingly interested in cryptocurrencies. This strategy aligns with a growing trend where traditional financial institutions are adapting to changing market dynamics.

Implications for Retail Investors

For retail investors, BlackRock’s significant investment in Bitcoin could serve as a strong indicator of future trends. As institutional interest in cryptocurrencies grows, retail investors might find themselves more motivated to enter the market. However, it’s essential to approach this with caution.

While institutional investments can drive prices up, they can also create volatility. Retail investors should be aware of the risks associated with investing in cryptocurrencies. It’s crucial to conduct thorough research and consider your financial situation before jumping into the crypto market.

The Future of Bitcoin and Institutional Investment

With BlackRock’s recent move, the future of Bitcoin looks promising. As institutional interest continues to grow, Bitcoin may solidify its position as a mainstream asset. This could lead to further innovations in the cryptocurrency market, such as new financial products and services that cater to both institutional and retail investors.

Moreover, as more institutions like BlackRock enter the space, we might see increased regulatory clarity around cryptocurrencies. This could pave the way for a more stable market environment, which is essential for attracting even more institutional capital.

What This Means for the Crypto Community

The crypto community has long awaited validation from traditional financial systems. BlackRock’s investment is a significant step in that direction. It shows that cryptocurrencies are no longer seen as fringe assets but are instead becoming integral to the global financial landscape.

This validation is not only crucial for Bitcoin but for the entire cryptocurrency ecosystem. As institutions recognize the potential of various cryptocurrencies, we could see increased funding for blockchain projects, leading to further innovation and growth within the space.

Conclusion: Keeping an Eye on Bitcoin’s Growth

As BlackRock’s recent investment illustrates, the world of cryptocurrency is evolving rapidly. With major institutions like BlackRock entering the market, Bitcoin’s legitimacy is on the rise, which could attract more investors and drive prices higher.

For those monitoring the cryptocurrency landscape, it’s essential to stay informed about developments like this one. Understanding the implications of institutional investments can help you make more informed decisions, whether you’re a seasoned trader or a newcomer to the crypto world.

In summary, BlackRock’s $55.4 million investment in Bitcoin is a landmark moment for the cryptocurrency market. It signifies growing acceptance among traditional financial institutions and hints at a bright future for Bitcoin and other cryptocurrencies. Keep an eye on how this investment plays out, as it may just be the beginning of a new era for digital assets.

Stay tuned for more updates and insights as the cryptocurrency landscape continues to evolve!