U.S. Stock Futures Rise as Investors Prepare for a Busy Week

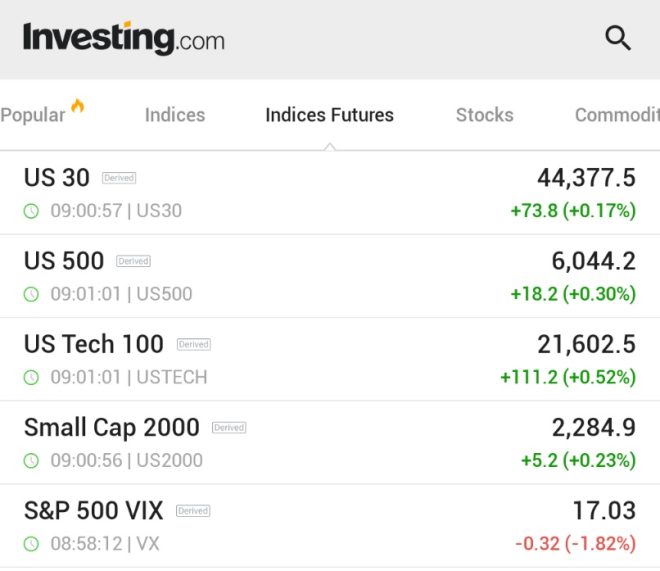

In a significant update from the financial markets, U.S. stock futures have experienced an uptick during Sunday night trading, signaling a positive sentiment among investors. This trend comes in the context of a busy week ahead, where various economic factors are expected to influence market dynamics. Additionally, the Volatility Index (VIX) has shown a decline, further indicating a reduction in market uncertainty and a potential bullish outlook for investors.

Understanding the Market Context

The rise in U.S. stock futures, particularly in popular indices such as the S&P 500 (represented by the ticker symbol $SPY) and the Nasdaq-100 (represented by $QQQ), reflects a broader optimism in the market. Investors are keenly watching for economic indicators and corporate earnings reports that could impact stock prices in the coming days. The anticipation surrounding these events often leads to fluctuations in futures trading, as traders position themselves based on expected outcomes.

Implications of a Declining VIX

The VIX, often referred to as the "fear index," measures market expectations of near-term volatility. A decline in the VIX suggests that investors are feeling more confident about the market’s stability and are less concerned about potential downturns. This can lead to increased buying activity, pushing stock prices higher. For investors monitoring these trends, a falling VIX can be a signal to enter positions or hold onto existing investments.

Factors Driving Market Sentiment

Several key factors typically drive investor sentiment and market movements:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Economic Data Releases: Weekly jobless claims, consumer confidence indices, and inflation reports are just a few examples of the economic indicators that can sway investor sentiment. Positive data can lead to increased confidence, while negative reports might prompt caution.

- Corporate Earnings Reports: As companies announce their quarterly earnings, market participants scrutinize these results for insights into economic health and growth prospects. Strong earnings can boost stock prices, while disappointing results may lead to sell-offs.

- Geopolitical Events: Political stability and international relations play a crucial role in shaping market sentiment. Investors remain vigilant about developments that could introduce uncertainty or risk into the market.

- Monetary Policy: Decisions made by the Federal Reserve regarding interest rates and monetary policy can have a profound impact on market dynamics. Investors closely monitor these announcements, as they can influence borrowing costs and economic growth.

Preparing for a Busy Week

As investors brace for the busy week ahead, it’s essential to stay informed and analyze the potential impact of upcoming events on the market. Key focus areas may include:

- Economic Reports: Look for scheduled releases of important economic data, such as GDP growth rates, inflation rates, and employment figures. These reports will provide insights into the economy’s health and can influence market movements.

- Earnings Season: Companies across various sectors will report their earnings, and the results can significantly impact stock prices. Investors should pay close attention to guidance provided by management, as it can indicate future performance.

- Global Events: Stay updated on global economic developments, trade negotiations, and geopolitical tensions, as these can also affect market sentiment.

Conclusion

In summary, the rise in U.S. stock futures and the decline of the VIX indicate a cautious optimism among investors as they prepare for a week filled with critical economic events and corporate earnings reports. Understanding the factors that drive market sentiment is crucial for investors looking to navigate the complexities of the financial markets. By staying informed and vigilant, investors can better position themselves to capitalize on opportunities as they arise.

As the week unfolds, market participants will closely monitor economic indicators, corporate earnings, and geopolitical developments, all of which can influence the trajectory of U.S. stock markets. Staying attuned to these dynamics will be key for anyone looking to make informed investment decisions.

JUST IN:

*U.S. STOCK FUTURES RISE IN SUNDAY NIGHT TRADE, VIX FALLS AS INVESTORS BRACE FOR BUSY WEEK$SPY $QQQ $VIX pic.twitter.com/6SKvRuyLRZ

— Investing.com (@Investingcom) February 10, 2025

JUST IN:

U.S. stock futures are on the rise in Sunday night trade, and if you’re tracking the financial markets, you might want to pay attention! The VIX, often referred to as the “fear index,” is falling as investors prepare for a busy week ahead. This uptick in futures and decline in volatility could signal a shift in market sentiment, making it an exciting time for traders and investors alike.

*U.S. STOCK FUTURES RISE IN SUNDAY NIGHT TRADE, VIX FALLS AS INVESTORS BRACE FOR BUSY WEEK

As we dive deeper into the world of U.S. stock futures, it’s important to understand what these movements mean for investors. With the market gearing up for a busy week, signals like rising futures and a declining VIX can provide valuable insights into potential market behavior. The Dow Jones Industrial Average, Nasdaq, and S&P 500 are all key indices to watch, especially if you’re invested in popular ETFs like SPY and QQQ.

$SPY $QQQ $VIX

When we talk about SPY and QQQ, we’re discussing two of the most widely traded exchange-traded funds (ETFs) in the market. SPY tracks the S&P 500, while QQQ tracks the Nasdaq-100 Index. Both are essential for investors looking to gain exposure to large-cap U.S. stocks. As the futures rise, it indicates that traders are optimistic about the upcoming week, potentially driven by earnings reports, economic data releases, or geopolitical events.

Understanding the VIX

The VIX, or CBOE Volatility Index, measures market expectations of near-term volatility based on S&P 500 index options. A falling VIX typically suggests that investors are becoming less fearful about market fluctuations. This can lead to increased buying activity, which further drives stock prices higher. The recent drop in the VIX signals a confidence boost among investors, possibly indicating a more stable outlook for the market.

What’s Driving the Market?

The events that unfold in the coming week can significantly impact the market. Investors are often influenced by a variety of factors, including economic indicators, corporate earnings, and other news. For instance, if major companies report better-than-expected earnings, we could see a surge in stock prices, further contributing to the positive sentiment reflected in rising futures.

Market Trends to Watch

As we brace for a busy week, there are several market trends to keep an eye on. Look out for upcoming earnings reports from big players in the tech and finance sectors, as these can set the tone for market performance. Additionally, economic data releases, such as unemployment rates, inflation figures, and consumer confidence indices, can provide insights into the overall economic health and influence investment decisions.

How to Navigate a Busy Week

For investors, navigating a busy week can feel overwhelming. Here are a few tips to help you stay on top of things:

- Stay Informed: Keep up with the latest market news and reports. Reliable sources like Investing.com can provide timely updates and analyses.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Ensure that your investments are spread across various sectors to mitigate risk.

- Set Clear Goals: Define your investment goals. Are you looking for short-term gains or long-term growth? Your strategy should align with your objectives.

- Review Your Strategy: Regularly assess your investment strategy. Are your current holdings performing as expected? If not, it might be time to reevaluate.

Potential Risks Ahead

Despite the positive signals from rising stock futures and a declining VIX, it’s crucial to remember that the market can be unpredictable. Risks can come from various angles, including geopolitical tensions, economic downturns, or unexpected corporate earnings. Keeping an eye on market sentiment is essential, but so is being prepared for potential downturns.

Conclusion

In summary, the recent rise in U.S. stock futures and the fall in the VIX suggest a cautiously optimistic outlook as investors prepare for a busy week. Keeping abreast of market trends, understanding the significance of the VIX, and navigating potential risks can help you make informed investment decisions. As the week unfolds, stay tuned for the latest updates and strategies, and remember that being proactive in your investment approach can lead to success in the long run.

For more information on the latest market movements and updates, check out Investing.com for real-time data and expert analysis.