Summary of IRS Agents’ Role in Immigration Enforcement

In a significant policy development, the Trump administration has proposed an innovative yet controversial approach to immigration enforcement. The administration is seeking to enlist IRS agents to assist in the apprehension and removal of illegal immigrants within the United States. This integration of financial enforcement agents into immigration duties has raised eyebrows and sparked debate across political and social spectrums.

Context of the Proposal

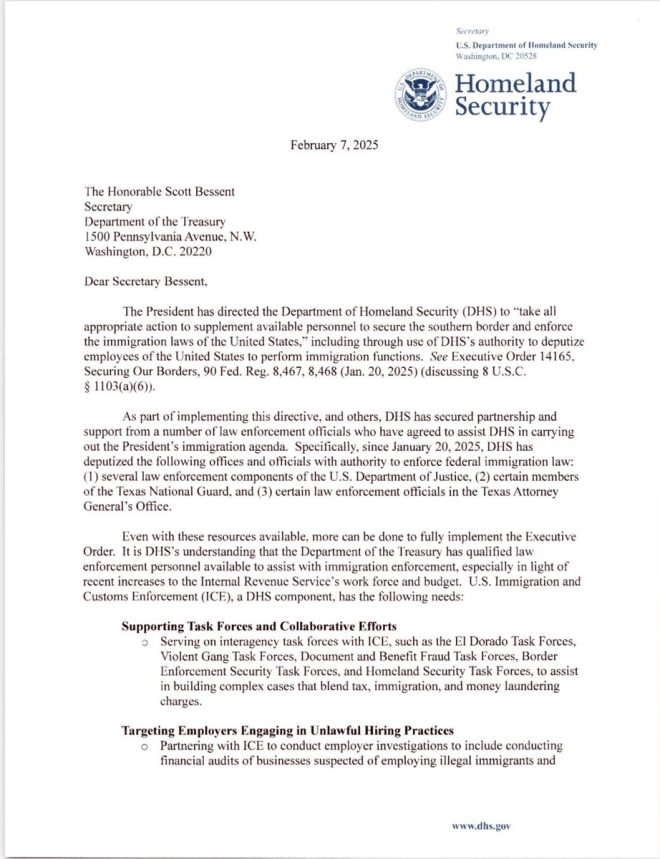

The announcement comes amid ongoing discussions about immigration policy and enforcement strategies in the United States. With the Department of Homeland Security (DHS) under pressure to address illegal immigration effectively, the idea of utilizing IRS agents has surfaced as a potential solution. The letter from DHS Secretary Kristi Noem to Treasury Secretary Scott Bessent outlines the rationale behind this unprecedented move, suggesting that IRS agents possess the investigative skills and resources necessary for tackling issues related to illegal immigration.

Role of IRS Agents

Traditionally, IRS agents are tasked with enforcing tax laws and ensuring compliance among taxpayers. Their expertise lies in financial investigations, audits, and the ability to track down financial irregularities. The proposal to involve these agents in immigration enforcement implies a cross-functional approach that blurs the lines between financial oversight and immigration control. By leveraging the skills of IRS agents, the administration aims to enhance the capacity of Immigration and Customs Enforcement (ICE) in the U.S. interior.

Implications of the Proposal

The implications of deputizing IRS agents for immigration enforcement are manifold and significant. One of the primary concerns raised by critics is the potential for abuse of power and overreach. Critics argue that merging tax enforcement with immigration enforcement could lead to a chilling effect on individuals who fear that their financial information may be used against them in immigration proceedings. This could discourage individuals from filing taxes or seeking financial assistance, ultimately undermining trust in government institutions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Additionally, there are concerns about the ethicality of utilizing IRS resources for purposes outside their established mandate. The potential for mission creep raises questions about the responsibilities of federal agencies and whether this move aligns with the core functions they were designed to perform.

Support for the Proposal

On the other hand, proponents of the initiative argue that this could be an effective means of addressing illegal immigration. They contend that IRS agents are well-equipped to uncover hidden networks that facilitate illegal immigration, including financial transactions that support undocumented individuals. By involving tax enforcement in immigration matters, supporters believe that the administration could dismantle the financial infrastructures that enable illegal immigration.

Furthermore, some supporters argue that this approach could lead to more efficient use of resources. The proposal suggests that IRS agents could help ICE focus on more serious enforcement actions by providing intelligence and insights derived from financial investigations. This could potentially streamline operations and enhance the overall effectiveness of immigration enforcement efforts.

Legal and Ethical Considerations

The legal ramifications of this proposal are complex. Questions arise regarding the authority of IRS agents to perform immigration enforcement duties, as their primary role is to enforce tax laws. This raises concerns about jurisdiction and the potential for violating the rights of individuals during enforcement actions. Furthermore, the integration of IRS agents into immigration enforcement could lead to legal challenges, as advocacy groups may argue that such actions violate individuals’ rights and privacy protections.

Ethically, the proposal raises questions about the role of government in individuals’ lives. Critics are concerned that this initiative could further entrench a culture of fear among immigrant communities, discouraging individuals from participating in civic activities and seeking assistance from government programs. The potential for increased surveillance and enforcement of tax laws among immigrant populations could exacerbate existing disparities and tensions within communities.

Conclusion

The Trump administration’s proposal to involve IRS agents in immigration enforcement represents a significant shift in policy that has sparked considerable debate. While supporters argue that this approach could enhance the effectiveness of immigration enforcement by utilizing the skills of IRS agents, detractors raise serious concerns about the legal, ethical, and social implications of such a move.

As the conversation unfolds, it will be crucial to monitor the potential impacts of this policy on immigrant communities, government institutions, and the broader landscape of U.S. immigration enforcement. The implications of merging tax enforcement with immigration duties could reshape the relationship between government agencies and the public, potentially leading to lasting changes in how both tax and immigration laws are enforced in the United States.

In the coming weeks and months, stakeholders from various sectors—including lawmakers, advocacy groups, and community organizations—will need to engage in dialogue about the effectiveness and appropriateness of this proposal. The outcomes of these discussions will likely influence the future of immigration policy and enforcement in the United States, shaping the experiences of millions of individuals and families across the country.

BREAKING: The Trump admin is seeking to deputize IRS agents to carry out illegal immigration enforcement with ICE in the U.S. interior. In a letter to Treasury Sec. Scott Bessent, DHS Sec. @KristiNoem writes that IRS agents are needed to assist w/ apprehension & removal of… pic.twitter.com/hpxPQcMhWV

— Bill Melugin (@BillMelugin_) February 10, 2025

BREAKING: The Trump admin is seeking to deputize IRS agents to carry out illegal immigration enforcement with ICE in the U.S. interior

In a surprising move that has raised eyebrows across the political spectrum, the Trump administration is reportedly looking to involve the IRS in immigration enforcement. Yes, you read that right! According to a tweet from Bill Melugin, the Department of Homeland Security (DHS) Secretary, Kristi Noem, has reached out to Treasury Secretary Scott Bessent, suggesting that IRS agents could play a role in apprehending and removing undocumented immigrants from the U.S. interior. This proposition has sparked a significant debate about the roles of federal agencies and the implications of merging tax collection with immigration enforcement.

Understanding the Proposal

What does it mean to deputize IRS agents for immigration enforcement? Essentially, this proposal suggests that IRS agents would step outside their traditional roles of tax auditing and collection to assist Immigration and Customs Enforcement (ICE). The idea is to bolster the federal government’s ability to enforce immigration laws by utilizing existing personnel who already have a level of government authority. This raises the question: How would tax agents transition into roles typically filled by immigration officers?

Kristi Noem’s letter highlights the urgent need for more manpower in the immigration enforcement arena. With ongoing debates about border security and the status of undocumented immigrants in the U.S., the administration believes that IRS agents could provide valuable support in these operations. This proposal is controversial and has provoked strong reactions from both supporters and critics, reflecting the deeply divided views on immigration policy in the United States.

Potential Implications for IRS Agents

If IRS agents are indeed tasked with immigration enforcement roles, it could fundamentally change the nature of their work. Traditionally, IRS agents focus on gathering tax revenue and enforcing tax laws. However, transitioning to immigration enforcement may not only require additional training but could also place these agents in morally complex situations that challenge their professional ethics.

The concern here is not just about the practicalities of such a shift. There’s a larger question about the implications for trust between the public and tax authorities. Many people are already wary of the IRS due to its reputation as a strict tax collector. Adding immigration enforcement to their responsibilities could exacerbate fears and lead to a chilling effect on individuals who might otherwise feel comfortable coming forward for tax matters.

Public Reaction to the Proposal

The proposal has been met with a mix of skepticism and support. On one side, proponents argue that it could enhance national security and ensure that immigration laws are more strictly enforced. They believe that leveraging existing government resources is a logical step toward addressing the challenges posed by undocumented immigrants.

On the other hand, critics argue that this move blurs the lines between different governmental functions. They worry that it could lead to a situation where everyday citizens fear interactions with the IRS, viewing them not just as tax collectors but also as enforcers of immigration laws. This could foster an environment of fear and distrust, particularly among minority communities who may already feel marginalized by current immigration policies.

The Role of ICE in Immigration Enforcement

To understand the full scope of this proposal, it’s essential to look at the current role of ICE in immigration enforcement. ICE is primarily responsible for investigating and enforcing immigration laws, including apprehending and removing undocumented immigrants. Typically, ICE agents have specialized training in handling these sensitive matters, which raises the question of whether IRS agents could effectively perform these duties.

The suggestion that IRS agents could assist ICE is part of a broader conversation about how the U.S. government approaches immigration enforcement. Many advocates for reform argue that the current system is flawed and that a more humane approach is needed—one that focuses on integration rather than punitive measures. Involving IRS agents in these processes could further complicate this ongoing debate.

Legal and Ethical Considerations

When discussing the potential deputization of IRS agents, it’s crucial to consider the legal and ethical implications. From a legal standpoint, there are questions about what authority IRS agents would have in carrying out immigration enforcement. Would they have the power to detain individuals? What legal protections would be in place to prevent abuse of this new power?

On the ethical side, there is a serious concern about the implications for civil liberties. Many fear that merging tax enforcement with immigration enforcement could lead to racial profiling and other forms of discrimination. This is particularly pertinent given the history of aggressive immigration enforcement practices that disproportionately affect communities of color.

The Future of Immigration Enforcement in the U.S.

The discussion surrounding the potential involvement of IRS agents in immigration enforcement is part of a larger narrative about the future of immigration policy in the United States. As the nation grapples with questions about border security, the status of undocumented immigrants, and the role of various federal agencies, proposals like this one will continue to be hotly debated.

Advocates for comprehensive immigration reform argue that the focus should be on creating pathways to citizenship and integrating immigrants into society rather than enforcing punitive measures. The idea of utilizing IRS agents for immigration enforcement could be seen as a step backward in this regard.

What’s Next?

As this story unfolds, it will be interesting to see how lawmakers, advocacy groups, and the public respond to this proposal. Will there be pushback from within the IRS? How will this affect the ongoing discussions about immigration reform in Congress? These questions remain unanswered, but one thing is clear: the intersection of tax and immigration policy is a complex and contentious issue that warrants careful consideration.

With the Trump administration’s proposal still in the early stages, it’s vital for the public to stay informed and engaged in discussions about immigration enforcement in the U.S. As the dynamics of federal policy continue to shift, understanding the implications of such changes will be key to navigating this ever-evolving landscape.

Stay tuned as more details emerge about this developing story and its potential impacts on both IRS agents and immigration enforcement in the United States. The conversation surrounding this proposal will undoubtedly shape the future of immigration policy in ways we can only begin to imagine.