Elon Musk’s Controversial Endorsement of Ron Paul for Federal Reserve Leadership

In a surprising turn of events, tech mogul Elon Musk has expressed his desire for former Congressman Ron Paul to lead the Federal Reserve. This news has sparked widespread discussion and debate across social media platforms, particularly on Twitter, where Musk’s announcement was met with a mix of skepticism and intrigue.

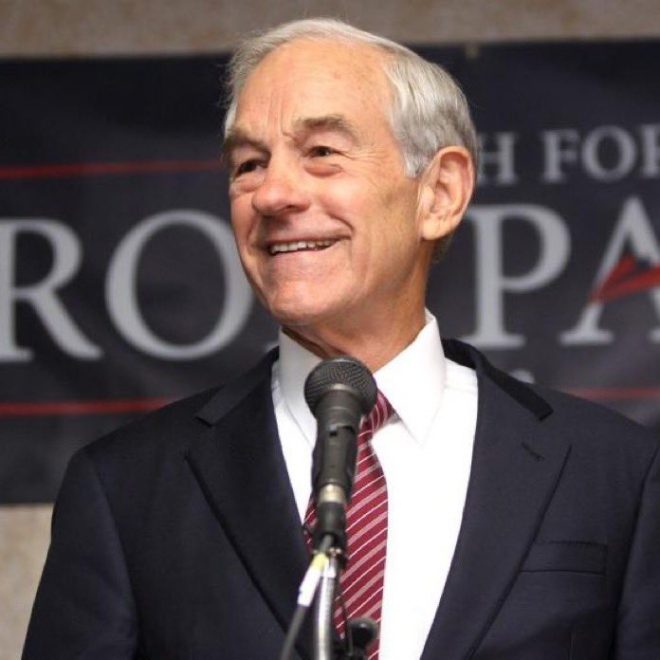

Who is Ron Paul?

Ron Paul is a well-known figure in American politics, recognized for his libertarian views and his long-standing criticism of the Federal Reserve. Over the years, Paul has been a vocal advocate for monetary reform, often calling for the abolition of the central banking system. His stance has been that the Federal Reserve’s policies contribute to economic instability and inequality, arguing that a return to a gold standard would bring about a more stable and reliable monetary system.

The Implications of Musk’s Endorsement

Musk’s endorsement raises significant questions about the direction he envisions for the U.S. economy. By recommending a figure who has long advocated for dismantling the very institution he is being suggested to lead, Musk appears to be promoting a radical shift in economic policy. This endorsement has led many to wonder how such a transition would affect the stability of the economy, especially considering the Fed’s crucial role in managing inflation and regulating the banking system.

Critics of Musk’s proposition argue that appointing someone like Paul, who has consistently called for the end of the Federal Reserve, could lead to uncertainty in financial markets. The Federal Reserve is responsible for setting interest rates, controlling inflation, and fostering a stable financial environment. A leader who opposes these fundamental functions might not only destabilize current economic policies but also instigate turmoil in global markets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Public Reaction to the Proposal

The public response to Musk’s tweet has been mixed. Some users have expressed excitement about the potential for a leader who would prioritize free-market principles and reduce governmental intervention in the economy. They argue that Paul’s libertarian philosophy aligns with a growing desire among citizens for economic reform and transparency within financial institutions.

Conversely, many others have reacted with disbelief and concern. Critics argue that putting someone at the helm of the Federal Reserve who has a history of advocating for its abolition sends a contradictory message about economic stability and governance. Comments on social media have highlighted the perceived absurdity of appointing a candidate whose mission is fundamentally at odds with the institution’s core functions.

The Future of Economic Governance

Musk’s endorsement of Ron Paul may symbolize a broader trend of dissatisfaction with traditional economic policies and institutions. As more individuals question established systems and advocate for significant changes, the conversation around the role of the Federal Reserve and monetary policy is likely to intensify.

This situation also emphasizes the growing influence of tech leaders like Musk in political discourse. As a billionaire entrepreneur with a massive social media following, Musk’s opinions can shape public sentiment and potentially influence political outcomes. His endorsement of Paul may encourage other influential figures to speak out on similar issues, further fueling the debate about the future of economic governance in the United States.

Conclusion

Elon Musk’s suggestion for Ron Paul to lead the Federal Reserve has ignited a conversation about the future of economic policy in America. While some view it as a bold move towards much-needed reform, others see it as a perilous gamble that could undermine the stability of the financial system. As public discourse around this topic continues to evolve, it will be essential to consider the implications of such a leadership change and what it could mean for the U.S. economy and its citizens.

This situation serves as a reminder of the complexities surrounding economic governance and the diverse opinions that exist regarding the role of institutions like the Federal Reserve. With influential figures like Musk entering the conversation, it is clear that the dialogue around monetary policy will remain a hot topic in the years to come.

In summary, while Musk’s endorsement of Ron Paul may resonate with those seeking fundamental change, it also raises significant questions about the future of economic stability in America. The dialogue surrounding this issue will undoubtedly continue to evolve, reflecting the dynamic nature of politics and economics in the modern era.

JUST IN: Elon Musk wants Ron Paul to run the Federal Reserve.

Yes, the guy who’s been ranting about abolishing the Fed for decades is now Musk’s pick to lead it.

Because nothing says “stable economy” like handing the keys to someone who wants to burn the whole thing down. pic.twitter.com/9QRAHm81RP

— Brian Allen (@allenanalysis) February 10, 2025

JUST IN: Elon Musk wants Ron Paul to run the Federal Reserve

It’s a headline that’s creating quite the stir: “ JUST IN: Elon Musk wants Ron Paul to run the Federal Reserve.” You might be scratching your head, wondering why the billionaire CEO of Tesla and SpaceX would throw his weight behind a former congressman known for his libertarian views and long-standing criticism of the Federal Reserve, which he has been ranting about abolishing for decades. It’s a curious match, to say the least.

Elon Musk has always been a figure who enjoys stirring the pot, whether it’s through his ambitious ventures in technology or his controversial tweets. And now, with this pick, he’s diving into the realm of monetary policy, a field that can impact the entire economy. It raises the question: what could this mean for the future of the Federal Reserve and the U.S. economy as a whole?

Yes, the guy who’s been ranting about abolishing the Fed for decades is now Musk’s pick to lead it

Ron Paul, a former Republican congressman from Texas, has gained a reputation as a staunch critic of the Federal Reserve. His views on the central bank have been consistent over the years, advocating for a return to the gold standard and warning against the dangers of fiat currency. So, it’s a bit ironic to see him as a potential leader of the institution he has vehemently opposed.

This kind of irony isn’t lost on many observers. It raises eyebrows and prompts speculation about Musk’s intentions. Is he genuinely interested in a radical shift in monetary policy? Or is this merely a publicity stunt aimed at generating conversation and drawing attention to broader economic issues? After all, Musk’s actions often reflect a penchant for shaking things up, and this is no exception.

Because nothing says “stable economy” like handing the keys to someone who wants to burn the whole thing down

The thought of appointing someone like Ron Paul to such a pivotal position is enough to make many economists and financial analysts nervous. A leader of the Federal Reserve typically needs to be someone who can navigate the complex landscape of monetary policy, balancing inflation, employment, and economic growth. Paul’s anti-Fed stance might suggest a desire to dismantle the very structures that many believe are essential for economic stability.

Critics argue that placing someone with such radical views in charge of the Fed could lead to unpredictable outcomes. The Federal Reserve plays a crucial role in managing the U.S. economy, influencing interest rates, controlling inflation, and acting as a lender of last resort during financial crises. If Paul were to implement his vision, it could disrupt the delicate balance that has been maintained over decades.

Yet, supporters of Paul might argue that his unorthodox approach could bring about necessary reforms. The current system has its flaws, and perhaps a fresh perspective is what’s needed to address the long-standing issues that have plagued the economy. It’s a debate that’s sure to spark heated discussions among economists, politicians, and everyday citizens alike.

The Impact on the U.S. Economy

So, what would Ron Paul’s leadership mean for the U.S. economy? If we take a closer look at his philosophy, it becomes clear that he advocates for a minimalistic approach to government intervention. He believes that the free market should dictate the economy without excessive regulation or manipulation from the Fed.

In theory, this could lead to a more efficient allocation of resources and potentially stimulate economic growth. However, the reality of such a shift is far more complex. The potential for increased volatility in the markets and economic uncertainty could outweigh the benefits of a free-market approach. It’s a gamble, and like any gamble, the stakes are high.

Moreover, during times of economic crisis, the Federal Reserve has often stepped in to stabilize the economy. Whether through lowering interest rates or implementing quantitative easing, the Fed has tools at its disposal to manage economic downturns. A leader who is fundamentally opposed to these interventions may leave the economy vulnerable during critical periods.

The Public Reaction

Public reaction to Musk’s endorsement of Ron Paul has been mixed. Supporters of Paul celebrate the idea of shaking up the status quo, believing that his leadership could lead to more honest monetary practices. On the other hand, skeptics worry about the ramifications of appointing someone who has openly criticized the very institution he would be leading.

Social media has exploded with opinions on this topic, ranging from praise for Musk’s boldness to outright disdain for the potential chaos that could ensue. It’s a reflection of the polarized nature of today’s political climate, where any significant change is met with a barrage of opinions from all sides.

The Bigger Picture

This situation is not just about Ron Paul or Elon Musk; it’s a microcosm of the broader debates surrounding economic policy in the United States. It brings to the forefront questions about the role of the Federal Reserve, the effectiveness of current monetary policy, and the influence of powerful individuals in shaping these discussions.

As we move forward, it’s essential to consider the implications of such a radical appointment. Whether it’s about reforming the Fed or maintaining its current structure, the discussions surrounding this topic will undoubtedly shape the future of economic policy in the U.S.

Musk’s choice, whether taken seriously or not, invites a larger conversation about accountability, transparency, and the role of government in managing the economy. These conversations are vital, and they deserve our attention as we navigate the complex web of economic issues facing our nation.

The Conclusion: A Call for Discussion

While the idea of Ron Paul heading the Federal Reserve may seem far-fetched to some, it’s an opportunity to engage in meaningful discussions about the future of our economy. Whether you’re a supporter of Paul’s views or a staunch defender of the current system, it’s crucial to explore these ideas further.

Let’s not shy away from debates that could shape our economic landscape. After all, the economy affects us all, and understanding these dynamics is key to making informed decisions about our financial futures. As new developments unfold, keeping an eye on the implications of such bold suggestions will be vital.

Where do you stand on this issue? Are you excited about potential changes, or do you prefer the stability of the current system? The discussion is just beginning, and your voice matters in this critical conversation.