Michael Saylor’s Strategy Acquires 7,633 BTC for $742.4 Million

In a significant move that has generated buzz in the cryptocurrency community, Michael Saylor’s Strategy has acquired a staggering 7,633 Bitcoin (BTC), valued at approximately $742.4 million. This acquisition was made at an average price of $97,255 per Bitcoin. The announcement was made via a tweet from Whale Insider, a trusted source in the crypto space, on February 10, 2025, confirming Saylor’s continued commitment to Bitcoin as a major asset.

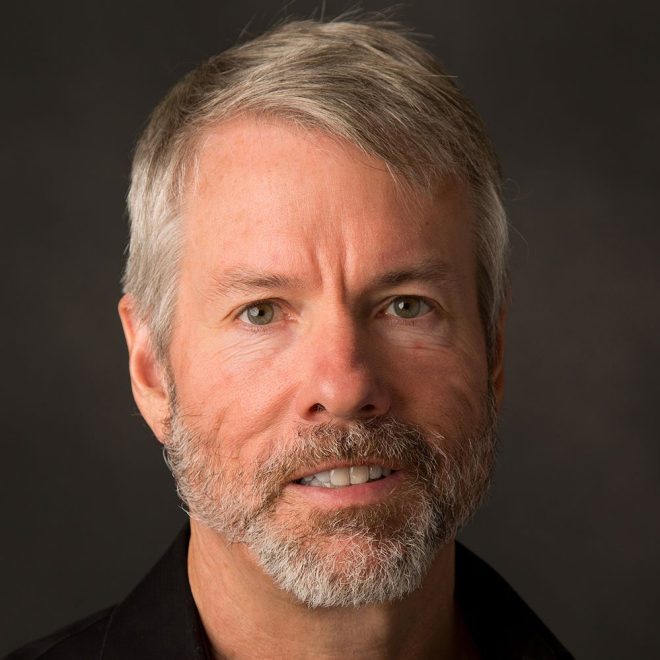

Who is Michael Saylor?

Michael Saylor is a prominent figure in the cryptocurrency world, best known as the co-founder and executive chairman of MicroStrategy, a business intelligence company. His advocacy for Bitcoin has been influential, with Saylor leading MicroStrategy’s significant investments in the digital currency. Saylor’s bullish stance on Bitcoin stems from the belief that it serves as a hedge against inflation and a reliable store of value in the digital age.

The Significance of the Acquisition

The acquisition of 7,633 BTC marks a pivotal moment for Saylor’s strategy and the broader adoption of cryptocurrency. This purchase is not just a one-off investment; it reflects a strategic shift towards embracing digital assets as a core component of corporate treasury management. Saylor’s actions have consistently demonstrated confidence in the long-term value of Bitcoin, positioning it as a prime asset for wealth preservation.

Investors and analysts are watching this move closely, as it could potentially influence other corporations to follow suit in diversifying their assets with cryptocurrency. The substantial amount acquired also highlights the increasing institutional interest in Bitcoin, showcasing its evolution from a speculative asset to a legitimate investment vehicle.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions

The market response to Saylor’s latest acquisition has been mixed, with some investors expressing enthusiasm over the validation of Bitcoin’s worth by a significant corporate player. The price of Bitcoin, which has seen considerable volatility, may experience fluctuations as a result of this high-profile purchase. The ongoing interest from institutional investors like MicroStrategy is crucial for Bitcoin’s legitimacy and price stability.

On the other hand, some market analysts caution that while such acquisitions can bolster Bitcoin’s image, they also contribute to its price volatility. The impact of large purchases can lead to market speculation, affecting everyday investors who may not have the same resources to absorb the shock of sudden price changes.

Bitcoin’s Role in Corporate Strategy

Saylor’s strategy underscores a growing trend among corporations to reconsider their asset allocation strategies in light of economic uncertainty. With inflation concerns and the devaluation of fiat currencies, Bitcoin is increasingly seen as a safe haven. Many companies are now weighing the benefits of holding Bitcoin against traditional assets, recognizing its potential to preserve value over time.

This acquisition by Saylor’s Strategy is likely to inspire other businesses to explore Bitcoin as a viable option for their financial strategies. With more companies entering the crypto space, the landscape is evolving rapidly, and Bitcoin’s role as a staple in corporate treasuries is becoming more pronounced.

Looking Forward: The Future of Bitcoin Investments

As Bitcoin continues to mature, the implications of such significant acquisitions will be felt across the cryptocurrency market. Saylor’s investment strategy could pave the way for further institutional adoption, leading to increased demand and potentially stabilizing Bitcoin’s price in the long run.

Investors should keep an eye on market trends and corporate behaviors as they relate to Bitcoin. The ongoing dialogue surrounding cryptocurrency regulations, technological advancements, and macroeconomic conditions will also play a crucial role in shaping the future of Bitcoin investments.

In conclusion, Michael Saylor’s acquisition of 7,633 BTC for $742.4 million is more than just another purchase; it represents a strategic commitment to Bitcoin as a cornerstone asset in corporate finance. As the cryptocurrency landscape evolves, Saylor’s actions may serve as a catalyst for broader acceptance and integration of Bitcoin into mainstream financial strategies. The move highlights both the potential and the challenges of investing in cryptocurrency, making it an essential topic for investors and industry experts alike.

JUST IN: Michael Saylor’s Strategy acquires 7,633 BTC worth $742.4M, at an average price of $97,255. pic.twitter.com/BBgS1Feplm

— Whale Insider (@WhaleInsider) February 10, 2025

JUST IN: Michael Saylor’s Strategy Acquires 7,633 BTC Worth $742.4M, at an Average Price of $97,255

The cryptocurrency market is always buzzing with activity, and the latest news from Michael Saylor is making waves. Recently, it was reported that Saylor’s strategy has led to the acquisition of a whopping 7,633 Bitcoin (BTC), valued at approximately $742.4 million, with an average price tag of $97,255 per coin. This significant move has sparked discussions among crypto enthusiasts and investors alike, and for good reason. Let’s dive into what this acquisition means for the market, for Saylor, and for Bitcoin as a whole.

Understanding Michael Saylor’s Bitcoin Strategy

Michael Saylor, co-founder of MicroStrategy, has become a prominent figure in the Bitcoin space. His unwavering belief in Bitcoin as a store of value has led his company to invest heavily in the cryptocurrency. This recent acquisition of 7,633 BTC is just another chapter in Saylor’s ongoing journey with Bitcoin. But what drives this strategy?

Saylor’s approach revolves around the principle that Bitcoin is a hedge against inflation and a superior asset compared to traditional fiat currencies. With rising inflation rates and economic uncertainties, many investors, including Saylor, see Bitcoin as a way to preserve wealth. By acquiring Bitcoin at an average price of $97,255, Saylor is betting that the cryptocurrency will continue to appreciate in value over time. His long-term vision is clear: he believes Bitcoin is the future of money.

The Implications of Acquiring 7,633 BTC

This acquisition is monumental for several reasons. First and foremost, it signals strong confidence in Bitcoin’s future. When a prominent figure like Saylor makes such a large investment, it can influence market sentiment. Investors often follow the lead of influential figures, and Saylor’s bullish stance may encourage others to consider investing in Bitcoin as well.

Secondly, with Bitcoin’s supply capped at 21 million coins, each major acquisition can have a significant impact on the market. As more entities, including corporations and institutions, buy into Bitcoin, the available supply diminishes, potentially driving the price up. This recent acquisition by Saylor could be seen as a catalyst for further price increases in the future.

Bitcoin’s Market Position and Future Prospects

With Saylor’s latest purchase, Bitcoin continues to solidify its position as a leading digital asset. Despite fluctuations in price, Bitcoin has proven its resilience and adaptability. Investors around the world are increasingly recognizing its potential as a long-term investment, akin to digital gold.

The market dynamics are constantly changing, but the fundamentals remain strong. Institutional interest in Bitcoin is at an all-time high, with companies like MicroStrategy leading the charge. This trend likely indicates that Bitcoin will continue to attract significant investments, which could further enhance its market position.

What This Means for MicroStrategy

For MicroStrategy, this acquisition is not just about holding Bitcoin; it’s a core part of the company’s strategy. Saylor has made it clear that MicroStrategy’s goal is to acquire and hold Bitcoin as a primary treasury reserve asset. This approach distinguishes MicroStrategy from traditional companies that may hold cash or other assets.

With the recent acquisition, MicroStrategy’s total Bitcoin holdings have now surpassed 100,000 BTC, making it one of the largest institutional holders of Bitcoin globally. This not only strengthens the company’s balance sheet but also positions it as a leader in the corporate adoption of cryptocurrencies.

Understanding the Average Purchase Price

The average purchase price of $97,255 per Bitcoin is noteworthy. This figure reflects the volatility of the cryptocurrency market. Bitcoin’s price has experienced dramatic fluctuations, and acquiring BTC at this price point suggests that Saylor is confident in Bitcoin’s long-term growth potential.

Investors often weigh the risks and rewards of entering the market at different price points, and Saylor’s strategy seems to indicate that he’s willing to take calculated risks based on his analysis of market trends and economic conditions.

The Broader Impact on the Cryptocurrency Ecosystem

Michael Saylor’s acquisition of 7,633 BTC does not exist in a vacuum. It’s part of a larger narrative surrounding cryptocurrency adoption. As more institutional investors enter the space, the legitimacy of Bitcoin and other cryptocurrencies continues to grow.

This trend is crucial for the overall health of the cryptocurrency ecosystem. Increased adoption can lead to better infrastructure, more trading platforms, and enhanced regulatory clarity. These developments can further facilitate the growth of the market and attract more retail investors.

Community Reactions to the Acquisition

The crypto community is buzzing with opinions about this acquisition. Supporters of Saylor praise his commitment to Bitcoin, viewing his actions as a strong endorsement of the cryptocurrency’s future. Many believe that his strategy will inspire other companies to follow suit and invest in Bitcoin as a treasury asset.

On the flip side, skeptics question the sustainability of such high valuations and the risks associated with investing heavily in a volatile asset like Bitcoin. They argue that while Saylor’s strategy may work for him, it may not be suitable for all investors.

Conclusion: The Future of Bitcoin and Michael Saylor’s Vision

Michael Saylor’s acquisition of 7,633 Bitcoin at an average price of $97,255 is a significant move that underscores his belief in Bitcoin as a premier asset for wealth preservation. As the cryptocurrency market evolves, Saylor’s strategy may set a precedent for other investors and companies looking to hedge against economic uncertainties.

With strong institutional backing and growing acceptance, Bitcoin seems poised for continued relevance in the global financial landscape. As we watch the market unfold, one thing is clear: Michael Saylor is not just betting on Bitcoin; he’s paving the way for its future.

For more details, you can check out the original tweet from [Whale Insider](https://twitter.com/WhaleInsider/status/1888934277636563209?ref_src=twsrc%5Etfw).