Bitwise’s Insight on Bitcoin Acquisition: A Game Changer for Investors

In a significant statement that has the potential to reshape the landscape of Bitcoin investing, Bitwise, a prominent $5 billion asset management firm, has highlighted a crucial facet of Bitcoin acquisition. The firm emphasizes that both governments and large corporations looking to buy Bitcoin will likely need to source their purchases from individual sellers. This insight was shared via a tweet from Bitcoin Magazine, stirring excitement and contemplation within the cryptocurrency community.

Understanding Bitcoin’s Unique Market Dynamics

Bitcoin, often labeled as digital gold, operates on a decentralized network where transactions are peer-to-peer. Unlike traditional assets, Bitcoin does not have a centralized authority managing its supply. This means that the availability of Bitcoin for purchase is significantly influenced by individual holders who choose to sell. As institutional interest in Bitcoin surges, understanding the mechanics of supply and demand becomes essential for potential buyers.

The Implications for Governments and Corporations

Bitwise’s assertion suggests that as entities like governments and large corporations seek to acquire substantial amounts of Bitcoin, they may face challenges in securing these assets directly from the market. The decentralized nature of Bitcoin means that much of its supply is held by individual investors. Consequently, these larger buyers may need to negotiate directly with individual sellers, which could lead to increased competition and higher purchase prices.

This dynamic raises questions about the future of Bitcoin as an investment and its role as a store of value. If institutional demand continues to rise, it could create a scenario where individual sellers have the upper hand in negotiations, potentially driving prices even higher. The fear of missing out (FOMO) among institutional investors could further exacerbate this situation, leading to a rush to acquire Bitcoin before prices escalate.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Individual Sellers

Individual sellers play a crucial role in the Bitcoin ecosystem, especially as demand from larger entities grows. These sellers may be individuals who have held Bitcoin for a long time and are now considering capitalizing on the asset’s appreciation. The decision to sell will depend on various factors, including market sentiment, future price predictions, and individual financial goals.

Moreover, as more individuals become aware of the potential for Bitcoin to appreciate significantly, the supply available for sale may decrease. This could lead to a tighter market where buyers are willing to pay a premium to secure their desired allocations of Bitcoin. For individual sellers, this presents a unique opportunity to capitalize on their investments.

Market Sentiment and Institutional Interest

The statement from Bitwise also reflects the growing sentiment in the market regarding Bitcoin’s long-term potential. Institutions have increasingly recognized Bitcoin not just as a speculative asset, but as a viable alternative to traditional assets like gold. The ongoing adoption of Bitcoin by mainstream financial institutions, coupled with favorable regulatory developments, has enhanced its appeal.

This shift in sentiment is crucial for the future of Bitcoin. As institutions accumulate Bitcoin, the overall market dynamics will likely change. Increased demand from these large players could lead to more significant price volatility, as they may be less willing to sell their holdings compared to individual investors.

The Future of Bitcoin Investment

Looking ahead, the landscape for Bitcoin investment is poised for transformation. The potential for governments and large corporations to source their Bitcoin from individual sellers could create a more fragmented market. This fragmentation may lead to varying price points based on the negotiation power of individual sellers and the urgency of institutional buyers.

Investors, both individual and institutional, must remain vigilant and informed about the market trends and dynamics. Understanding the implications of this statement from Bitwise is crucial for those looking to navigate the evolving world of Bitcoin investment.

Conclusion

The insight shared by Bitwise regarding the acquisition of Bitcoin underscores the unique challenges and opportunities present in the cryptocurrency market. As governments and corporations prepare to enter the Bitcoin space, the reliance on individual sellers may create an interesting and competitive environment for Bitcoin transactions.

In this context, individual investors hold significant power, potentially shaping the future of Bitcoin prices and market dynamics. As the interest in Bitcoin continues to soar, staying informed and adaptable will be essential for all participants in this fast-evolving market.

In summary, Bitwise’s statement serves as a critical reminder of the complexities surrounding Bitcoin acquisition and the importance of understanding the underlying market forces at play. With continued institutional interest and a decentralized supply, the future of Bitcoin investment is ripe with potential and challenges alike.

JUST IN: $5 billion asset manager Bitwise says governments and companies who want to buy bitcoin will have to buy it from individuals willing to sell it pic.twitter.com/csp61EqZXx

— Bitcoin Magazine (@BitcoinMagazine) February 10, 2025

JUST IN: $5 billion asset manager Bitwise says governments and companies who want to buy bitcoin will have to buy it from individuals willing to sell it

When it comes to Bitcoin, the landscape is always shifting, and we just got some intriguing insights from Bitwise, a $5 billion asset management firm. Their recent statement has sparked a lot of discussions in the crypto community. Essentially, they’ve pointed out that if governments and corporations want to acquire Bitcoin, they’ll have to turn to the individuals holding it. This is a big deal, and it leads us to consider various aspects of the Bitcoin market, including its supply dynamics, individual ownership, and the implications of such movements for the broader financial ecosystem.

The Supply and Demand Equation

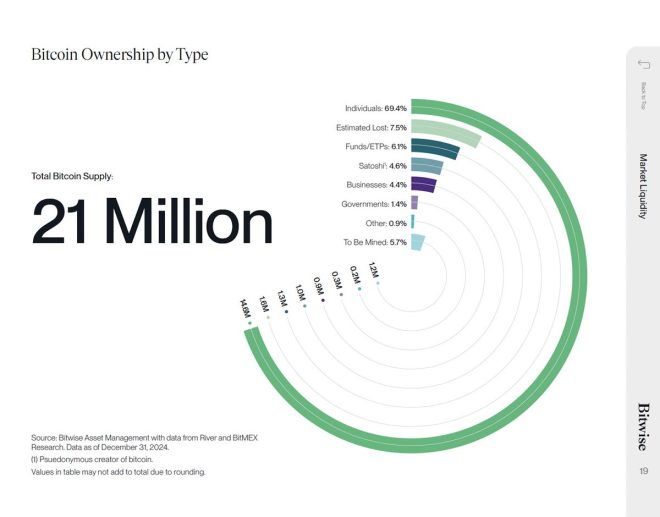

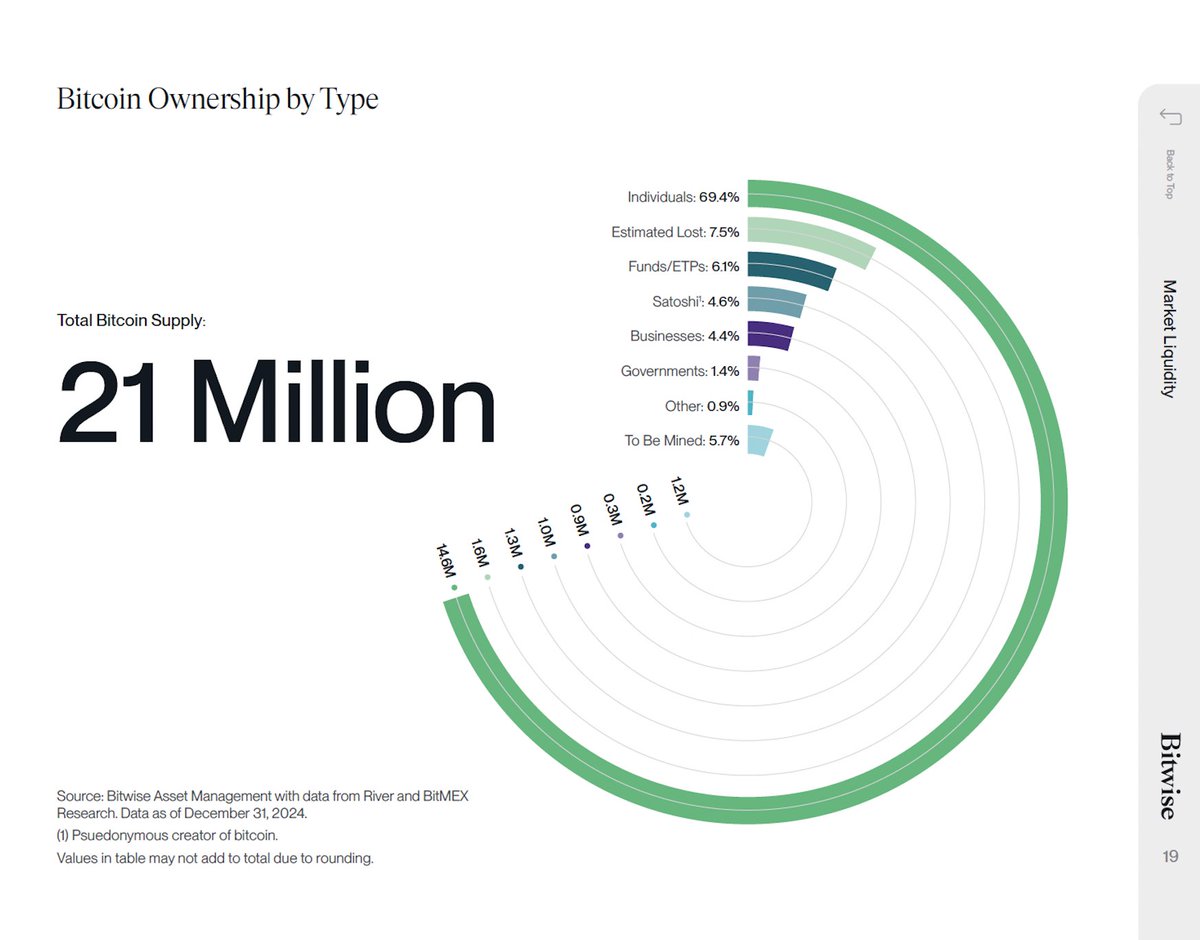

At the heart of any market is the age-old principle of supply and demand. With Bitcoin, the supply is capped at 21 million coins, making it a finite resource. This fixed supply creates a unique scenario where demand can outpace availability, especially as institutional interest surges. When big players like governments and corporations enter the market, they are essentially competing with individual holders who may be reluctant to sell their assets, especially if they believe in Bitcoin’s long-term value.

Bitwise’s assertion highlights a crucial point: the dynamics of Bitcoin trading and ownership heavily favor individuals at this stage. This isn’t just a theoretical musing; it’s a reality that can affect market prices, liquidity, and the overall sentiment surrounding Bitcoin.

Individual Holders: The Key Players

The role of individual holders in the Bitcoin ecosystem cannot be overstated. Many of these individuals, often referred to as “HODLers,” have a long-term vision for their investments. They believe that Bitcoin will appreciate over time and are thus unwilling to part with their holdings easily. This creates a bottleneck for larger entities looking to acquire significant amounts of Bitcoin.

Additionally, the psychology of individual investors plays a significant role here. Many Bitcoin holders see themselves as part of a movement that challenges traditional financial systems. This sense of community and purpose can make them even less inclined to sell. The notion that governments and corporations must negotiate with these individual holders adds an interesting layer to the narrative around Bitcoin ownership and control.

Implications for Governments and Corporations

For governments and corporations, acquiring Bitcoin from individuals presents both challenges and opportunities. On one hand, it can lead to increased competition, driving prices up as they bid against each other and individual holders. On the other hand, this situation might incentivize these entities to engage more deeply with the cryptocurrency community.

Governments could explore regulatory frameworks that make it easier for individuals to sell their Bitcoin while ensuring compliance with laws and regulations. This could include creating platforms for secure transactions or even offering incentives for individuals to sell to public entities. Similarly, corporations might consider collaborating with crypto exchanges or platforms to facilitate these transactions.

The Future of Bitcoin Ownership

As we move forward, the implications of Bitwise’s statement could reshape how we view Bitcoin ownership. If governments and corporations are forced to negotiate with individuals, we may see a more decentralized approach to Bitcoin transactions. This could lead to a more vibrant market where individual holders have a greater say in pricing and selling their assets.

Moreover, this scenario could further legitimize Bitcoin in the eyes of mainstream finance. When major players are actively engaging with individual holders, it signals a shift in perception, moving Bitcoin from a fringe asset to a staple in financial portfolios.

Bitcoin and Institutional Adoption

The institutional adoption of Bitcoin has been a hot topic in recent years. Companies like Tesla, MicroStrategy, and Square have made headlines for adding Bitcoin to their balance sheets. The trend is likely to continue, and as these institutions seek to acquire more Bitcoin, the dynamics described by Bitwise will become even more pronounced.

This situation creates a fascinating interplay between individual investors and institutional demands. If large-scale buyers are struggling to acquire Bitcoin directly from exchanges due to limited supply, they may turn to OTC (over-the-counter) markets, where they can negotiate directly with holders. This could lead to a new era of Bitcoin trading, one that emphasizes personal relationships and negotiations over traditional market dynamics.

The Role of Exchanges and Marketplaces

As the demand from governments and corporations increases, cryptocurrency exchanges and marketplaces will play a crucial role in facilitating transactions. These platforms must adapt to the evolving landscape by ensuring they can handle large trades without negatively impacting market prices.

Exchanges could also implement features that cater to institutional buyers, such as advanced trading tools, analytics, and secure custodial services. By doing so, they can position themselves as essential players in the Bitcoin acquisition process, helping to bridge the gap between individual holders and large-scale buyers.

A Community-Centric Approach

One of the most exciting aspects of Bitwise’s statement is the potential for a community-centric approach to Bitcoin ownership. If individual holders become the primary source for Bitcoin purchases by larger entities, we might see more initiatives aimed at empowering these holders. Community-driven projects that facilitate education, trading, and networking could emerge, further solidifying the bond between individuals in the crypto space.

This community-centric approach could also lead to more transparent and fair pricing mechanisms. If individual holders are actively engaged in negotiations with larger entities, it could help prevent the kind of market manipulation that has plagued traditional financial systems.

Conclusion: Navigating the New Bitcoin Landscape

The insights from Bitwise present a thought-provoking view of the future of Bitcoin ownership and trading. As governments and corporations vie for Bitcoin, the importance of individual holders has never been more pronounced. The dynamics of this market will evolve, driven by the interplay between individual and institutional interests.

Whether you’re a seasoned investor or just getting started, understanding these shifts will be crucial for navigating the evolving landscape of Bitcoin and cryptocurrency. Embrace the changes, stay informed, and engage with the community as we collectively shape the future of this revolutionary asset.