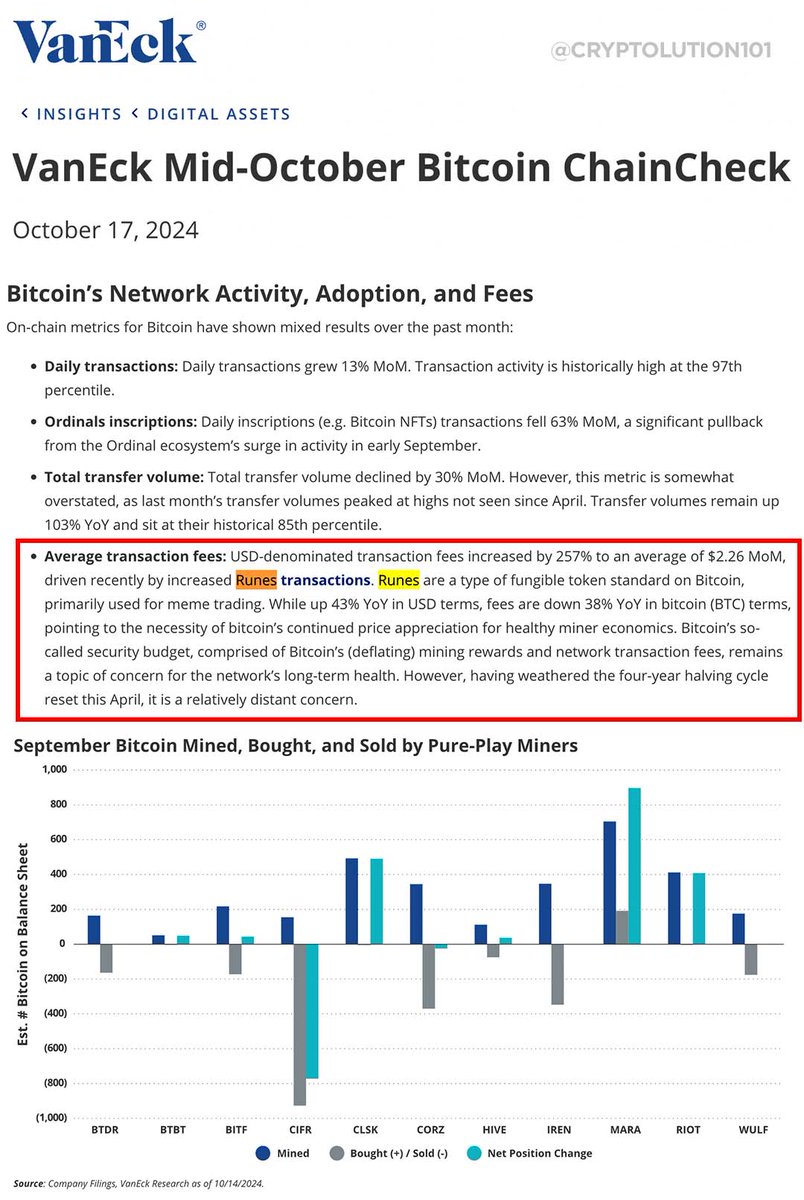

In a recent tweet shared by Vincent (Cryptolution) on October 17, 2024, it was claimed that According to a mid-October report by VanEck_us, USD-denominated transaction fees have skyrocketed by a staggering 257% to an average of $2.26 month over month. The surge in transaction fees was reportedly driven by a notable increase in #Runes transactions. While this information is intriguing, it is important to note that there is no concrete proof provided in the tweet to validate these claims. However, the potential implications of such a significant increase in transaction fees are certainly worth exploring.

The sudden and substantial rise in USD-denominated transaction fees, as purported in the tweet, could have various implications for the cryptocurrency market and the broader financial landscape. Transaction fees play a crucial role in the efficiency and cost-effectiveness of conducting transactions within the cryptocurrency space. A significant increase in transaction fees could potentially deter users from engaging in transactions, particularly those involving smaller amounts or frequent trading. This, in turn, could impact the overall liquidity of the market and potentially lead to a slowdown in trading activity.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

Furthermore, the reported increase in transaction fees driven by #Runes transactions raises questions about the underlying factors contributing to this trend. #Runes, which is mentioned in the tweet, appears to be a specific type of transaction that has been instrumental in driving up fees. Understanding the nature of #Runes transactions and why they are contributing to the surge in fees could provide valuable insights into the dynamics of the cryptocurrency market and the factors influencing transaction costs.

It is also essential to consider the broader implications of rising transaction fees within the context of the cryptocurrency industry’s evolution and maturation. As the cryptocurrency market continues to grow and attract more participants, the scalability and cost efficiency of transactions become increasingly important factors to consider. High transaction fees could potentially hinder the mainstream adoption of cryptocurrencies and limit their utility as a medium of exchange. Finding ways to address and mitigate rising transaction costs could be crucial for ensuring the long-term viability and sustainability of cryptocurrencies as a viable alternative to traditional financial systems.

Despite the lack of concrete evidence provided in the tweet, the claim of a significant increase in USD-denominated transaction fees is certainly a topic worth investigating further. Understanding the factors driving this trend and the potential implications it could have on the cryptocurrency market and broader financial ecosystem is essential for making informed decisions and navigating the evolving landscape of digital assets.

In conclusion, the alleged surge in transaction fees as reported in the tweet by Vincent (Cryptolution) highlights the importance of monitoring and analyzing trends within the cryptocurrency market. While the veracity of the claims made in the tweet remains unconfirmed, the potential implications of rising transaction fees are significant and warrant further exploration. By delving deeper into the factors driving this trend and its potential impact on the cryptocurrency ecosystem, stakeholders can gain valuable insights into the dynamics of the market and make informed decisions to navigate a rapidly changing and evolving landscape.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

JUST IN: @VanEck_us Mid-October report states "USD-denominated transaction fees increased by 257% to an average of $2.26 MoM, driven recently by increased #Runes transactions."

Source:

JUST IN: @VanEck_us Mid-October report states “USD-denominated transaction fees increased by 257% to an average of $2.26 MoM, driven recently by increased #Runes transactions.”

Source: pic.twitter.com/dpwTVzemYM

— Vincent (Cryptolution) (@cryptolution101) October 17, 2024

The cryptocurrency world is constantly evolving, with new trends and developments emerging all the time. Recently, a report from VanEck in mid-October has shed light on a significant increase in USD-denominated transaction fees, driven by an uptick in Runes transactions. This news has sent shockwaves through the industry, prompting many to wonder about the implications of this sudden surge in fees. In this article, we will delve into the details of this report, exploring the reasons behind the increase in transaction fees and what it means for the world of cryptocurrency.

## What is VanEck’s Mid-October Report?

VanEck is a well-known investment management firm that specializes in exchange-traded funds (ETFs) and other financial products. Their mid-October report has revealed a startling statistic – USD-denominated transaction fees have increased by 257% to an average of $2.26 month over month. This sharp rise in fees has been attributed to a surge in Runes transactions, a popular form of cryptocurrency.

The report has sparked speculation and concern among investors and industry experts, who are trying to make sense of this sudden increase in transaction costs. To better understand the implications of this development, it is important to delve deeper into the world of cryptocurrencies and how transaction fees play a crucial role in their functioning.

## What are Runes Transactions?

Runes transactions refer to transactions involving a specific type of cryptocurrency known as Runes. Runes is a digital asset that operates on a decentralized blockchain network, similar to other popular cryptocurrencies like Bitcoin and Ethereum. However, unlike traditional currencies, Runes transactions are not regulated by any central authority, making them highly secure and resistant to censorship.

The recent surge in Runes transactions has been linked to the increase in USD-denominated transaction fees. As more people engage in buying, selling, and trading Runes, the demand for processing these transactions has skyrocketed, leading to a corresponding increase in fees. This has raised questions about the scalability and efficiency of the current cryptocurrency infrastructure, as well as the impact of rising fees on the overall user experience.

## Why Have Transaction Fees Increased?

The sharp rise in transaction fees can be attributed to a variety of factors, including the growing popularity of cryptocurrencies like Runes, network congestion, and changes in market dynamics. As more people flock to the world of digital assets, the demand for processing transactions has outstripped the capacity of existing networks, leading to delays and higher fees.

Additionally, changes in market conditions, such as fluctuations in the price of cryptocurrencies and regulatory developments, can impact transaction fees. For example, a sudden surge in the price of Runes may attract more traders to the market, increasing the volume of transactions and putting pressure on network resources. Similarly, new regulations or policy changes can introduce uncertainty and volatility, affecting the cost of processing transactions.

## What Does This Mean for the Cryptocurrency Industry?

The increase in transaction fees highlighted in VanEck’s report has raised concerns about the long-term sustainability of the cryptocurrency industry. While cryptocurrencies offer many advantages, such as decentralization, security, and transparency, high transaction fees can deter users and limit the growth of the market.

To address this issue, developers and industry stakeholders are exploring solutions to improve scalability and reduce transaction costs. One approach is the implementation of layer 2 solutions, such as the Lightning Network, which aim to increase the speed and efficiency of transactions while lowering fees. Additionally, ongoing research and development in blockchain technology may lead to innovations that enhance the scalability and usability of cryptocurrencies.

In conclusion, the increase in USD-denominated transaction fees highlighted in VanEck’s report is a significant development that underscores the challenges facing the cryptocurrency industry. By understanding the reasons behind this surge in fees and exploring potential solutions, we can work towards a more efficient and sustainable future for digital assets. As the world of cryptocurrencies continues to evolve, it is crucial for stakeholders to collaborate and innovate to overcome these challenges and unlock the full potential of this transformative technology.

Sources:

– [VanEck’s Mid-October Report](https://twitter.com/vaneck_us)

– [Cryptolution’s Tweet](https://twitter.com/cryptolution101/status/1846719846781735051)