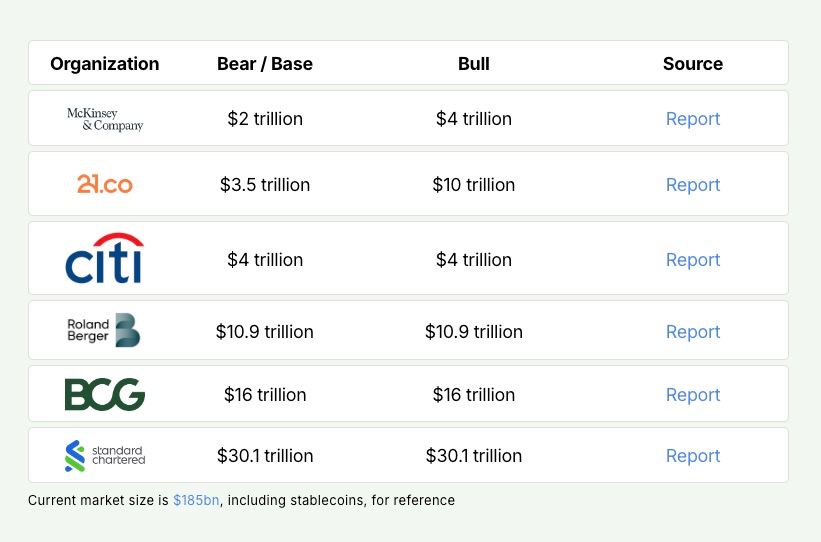

Allegedly, the RWA tokenization sector is on the brink of explosive growth, with experts predicting a massive increase in value by the year 2030. This bold claim comes from a Tren Finance report that has compiled forecasts from major financial institutions and business consulting firms. If these predictions hold true, we could see a more than 50-fold surge in the value of RWA tokens in just a few short years.

The concept of tokenization has been gaining traction in recent years, with more and more industries exploring its potential. RWA, which stands for Real World Assets, represents a new frontier in the world of digital assets. By tokenizing real-world assets such as real estate, commodities, or even fine art, investors can gain exposure to these traditionally illiquid markets in a more accessible and liquid form.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

The idea behind RWA tokenization is simple yet powerful. By converting physical assets into digital tokens on a blockchain, these assets can be divided into smaller units and traded more easily. This opens up a whole new world of possibilities for investors looking to diversify their portfolios and tap into new investment opportunities.

The potential for explosive growth in the RWA tokenization sector is driven by several key factors. First and foremost, the increasing digitization of assets across industries is creating a demand for new ways to invest and trade. As more assets are tokenized, the market for RWA tokens is expected to grow exponentially.

Additionally, the rise of blockchain technology has laid the groundwork for the tokenization of real-world assets. By leveraging the security and transparency of blockchain, investors can trust that their assets are secure and that transactions are conducted fairly and efficiently.

Furthermore, the increasing interest from institutional investors in digital assets is also fueling the growth of the RWA tokenization sector. As more traditional financial institutions enter the space, they bring with them a level of credibility and legitimacy that attracts a broader range of investors.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

While the predictions for the future of RWA tokenization are certainly exciting, it’s important to take them with a grain of salt. The cryptocurrency and blockchain space is notoriously volatile, and unexpected developments can quickly change the trajectory of a project or market.

That being said, the potential for growth in the RWA tokenization sector is undeniably significant. As more assets are tokenized and the market matures, we can expect to see increased liquidity, transparency, and accessibility for investors looking to diversify their portfolios.

In conclusion, while the future of the RWA tokenization sector is far from certain, the potential for explosive growth is certainly worth paying attention to. As the market evolves and new opportunities arise, investors would be wise to keep a close eye on this emerging sector and consider the role that RWA tokens could play in their investment strategies.

The #RWA tokenization sector is poised for explosive growth, with predictions from major financial institutions and business consulting firms—compiled in a Tren Finance report—forecasting a more than 50-fold increase by 2030.

The #RWA tokenization sector is poised for explosive growth, with predictions from major financial institutions and business consulting firms—compiled in a Tren Finance report—forecasting a more than 50-fold increase by 2030. pic.twitter.com/bFHVWEvn30

— Jordan @ Landshare (@FriskeJordan) October 17, 2024

When it comes to the world of finance and investment, there are always new trends and opportunities emerging. One such trend that has been gaining a lot of attention recently is the tokenization of real-world assets (RWA). This is a process where assets such as real estate, art, or even commodities are converted into digital tokens that can be bought, sold, and traded on blockchain platforms.

What is RWA tokenization?

RWA tokenization is the process of converting real-world assets into digital tokens that are then stored on a blockchain. This allows investors to buy and sell fractions of these assets, making it easier for them to invest in assets that were previously out of reach. This process has the potential to revolutionize the way we invest in assets, making it more accessible and liquid.

Why is the RWA tokenization sector poised for explosive growth?

There are several factors that are contributing to the explosive growth of the RWA tokenization sector. One of the main reasons is the increasing interest in blockchain technology and cryptocurrencies. As more people become familiar with these technologies, they are looking for new ways to invest and diversify their portfolios.

Additionally, the traditional financial system is becoming increasingly outdated, with many investors looking for alternatives that offer greater transparency and security. RWA tokenization provides a way for investors to access a wide range of assets in a transparent and secure manner, making it an attractive option for many.

What are the predictions for the RWA tokenization sector?

According to a report compiled by Tren Finance, major financial institutions and business consulting firms are predicting a more than 50-fold increase in the RWA tokenization sector by 2030. This is a significant growth projection and highlights the potential that this sector has to offer for investors.

How can investors benefit from RWA tokenization?

Investors can benefit from RWA tokenization in several ways. Firstly, it allows them to access a wide range of assets that were previously out of reach. This can help investors diversify their portfolios and reduce risk. Additionally, RWA tokenization offers greater liquidity, as investors can buy and sell fractions of assets without having to deal with the traditional barriers of entry.

What are the risks associated with RWA tokenization?

While RWA tokenization offers many benefits, there are also risks that investors need to be aware of. One of the main risks is the potential for regulatory uncertainty. As this is a relatively new sector, there is still a lack of clear regulations governing RWA tokenization. This can lead to legal issues and potential challenges for investors.

Additionally, there is the risk of technological vulnerabilities. Blockchain technology is still evolving, and there is always the possibility of security breaches or hacks. Investors need to be aware of these risks and take steps to protect their investments.

In conclusion, the RWA tokenization sector is poised for explosive growth, with predictions of a significant increase by 2030. This presents exciting opportunities for investors looking to diversify their portfolios and access new assets. However, it is essential for investors to be aware of the risks associated with this sector and take steps to protect their investments. With the right approach, RWA tokenization has the potential to revolutionize the way we invest in assets and offer significant benefits for investors.

Sources:

– Tren Finance Report

– Forbes Article on RWA Tokenization Growth