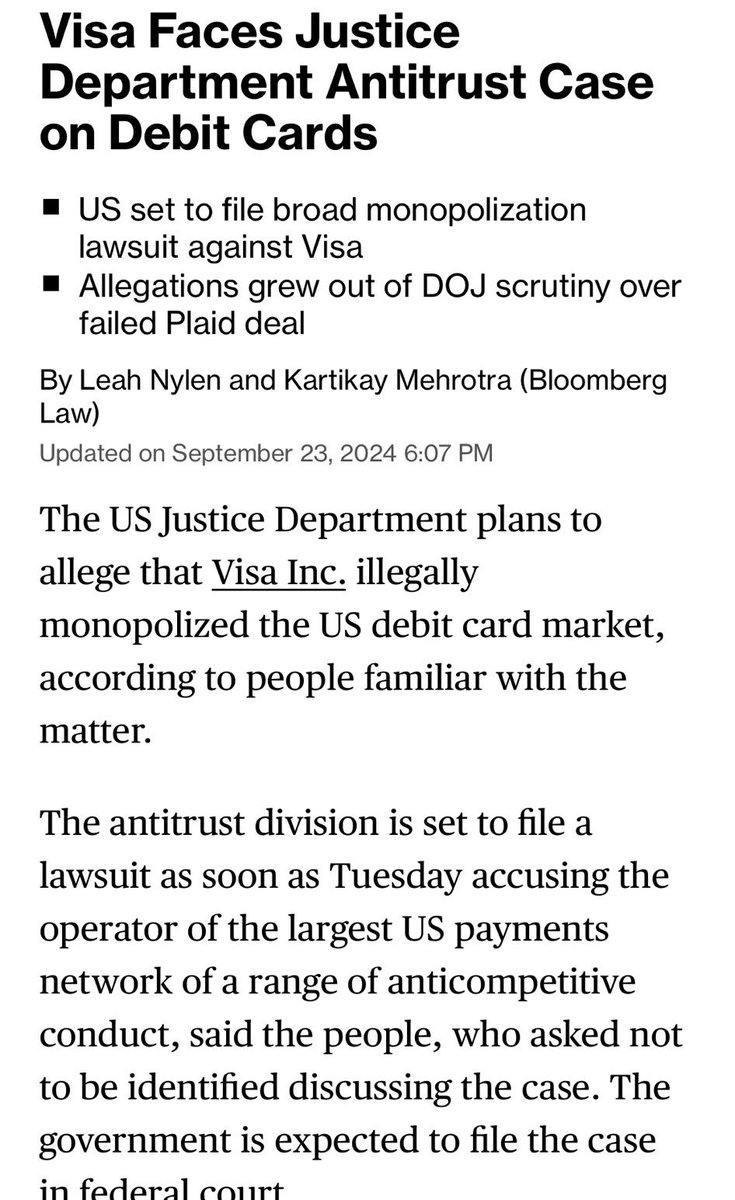

In a recent tweet that has been making waves on social media, it has been alleged that the Department of Justice (DOJ) is planning to file an antitrust lawsuit against Visa, claiming that the company has illegally monopolized the US debit card market. The tweet, posted by user unusual_whales, states that the DOJ is taking action against Visa for allegedly engaging in anti-competitive practices that have given them an unfair advantage in the market.

If true, this would be a significant development in the world of finance and could have far-reaching implications for Visa, one of the largest payment processing companies in the world. The tweet does not provide any specific details about the allegations or the evidence that the DOJ may have against Visa, but it has sparked a flurry of speculation and discussion online.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

Visa has long been a dominant player in the debit card market, with a large share of the market and a strong presence in both the US and around the world. The company’s network is used by millions of consumers and businesses every day to make payments and transfer funds, making it a vital part of the global economy.

However, if the allegations in the tweet are true, it could mean that Visa has been using its position of power to stifle competition and prevent other companies from entering the market. This could lead to higher prices for consumers, fewer choices in the marketplace, and a lack of innovation in the industry.

Antitrust laws are in place to protect consumers and promote fair competition in the marketplace. If Visa is found to have violated these laws, they could face significant fines and penalties, as well as possible changes to their business practices. The DOJ has not yet officially confirmed the allegations in the tweet, but if they do decide to move forward with a lawsuit, it could have major implications for Visa and the entire payment processing industry.

Visa has not yet responded to the allegations in the tweet, but they are likely taking the situation very seriously. The company’s reputation and business could be on the line if they are found to have violated antitrust laws, so they will need to carefully consider their response and how they plan to defend themselves against the allegations.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

In the meantime, consumers and businesses who rely on Visa for their payment processing needs may be feeling uncertain about the future. If Visa is found to have engaged in anti-competitive practices, it could lead to changes in the industry that could impact how payments are processed and how much consumers pay for these services.

Overall, the allegations in the tweet are still just that – allegations. The DOJ has not yet officially confirmed that they are planning to file an antitrust lawsuit against Visa, so it is important to wait for more information before jumping to any conclusions. However, if the allegations are true, it could be a major turning point in the world of finance and could have lasting effects on the payment processing industry. Only time will tell how this situation will unfold, but it is definitely a story worth keeping an eye on.

JUST IN: DOJ plans to file antitrust lawsuit against $V Visa saying they illegally monopolized the US debit card market

JUST IN: DOJ plans to file antitrust lawsuit against $V Visa saying they illegally monopolized the US debit card market pic.twitter.com/U5W6ri2TVF

— unusual_whales (@unusual_whales) September 23, 2024

When news broke that the Department of Justice (DOJ) planned to file an antitrust lawsuit against Visa, citing that they illegally monopolized the US debit card market, it sent shockwaves through the financial industry. This move by the DOJ raises questions about the implications for consumers, competition in the market, and the future of Visa as a global financial powerhouse. Let’s delve deeper into the details surrounding this antitrust lawsuit and explore the potential outcomes.

### What Led to the Antitrust Lawsuit Against Visa?

The DOJ’s decision to file an antitrust lawsuit against Visa stems from allegations that the company engaged in anti-competitive practices that stifled competition in the US debit card market. By allegedly monopolizing the market, Visa may have limited consumer choice, driven up prices, and hindered innovation in the industry. These actions could have far-reaching consequences for both consumers and businesses that rely on debit card transactions for everyday purchases.

### How Did Visa Allegedly Monopolize the US Debit Card Market?

Visa’s alleged monopolization of the US debit card market may have occurred through various means, such as exclusive agreements with banks, restrictive rules for merchants, and anti-competitive behavior that disadvantaged rival payment networks. These practices could have created barriers to entry for other players in the market, ultimately leading to a lack of competition and consumer choice. The DOJ’s investigation likely uncovered evidence of these tactics, prompting the decision to pursue legal action against Visa.

### What Are the Potential Implications of the Antitrust Lawsuit?

If the DOJ’s antitrust lawsuit against Visa is successful, it could have significant implications for the company and the broader financial industry. Visa may be forced to change its business practices, pay hefty fines, or even divest certain assets to promote competition in the market. This could open the door for new players to enter the debit card market, leading to increased innovation, lower prices, and better options for consumers.

### How Will This Lawsuit Impact Consumers and Businesses?

Consumers and businesses that rely on debit card payments could see a shift in the landscape if the antitrust lawsuit against Visa is successful. Increased competition in the market could lead to lower fees for merchants, more rewards and benefits for consumers, and a wider range of payment options to choose from. However, there may also be short-term disruptions as Visa adapts to new regulations and changes in the industry.

### What Does the Future Hold for Visa?

The outcome of the DOJ’s antitrust lawsuit against Visa will undoubtedly shape the company’s future trajectory. Depending on the ruling, Visa may need to reevaluate its business model, strengthen its compliance measures, and invest in promoting competition in the market. This could lead to a more dynamic and diverse financial ecosystem that benefits both businesses and consumers in the long run.

In conclusion, the DOJ’s decision to file an antitrust lawsuit against Visa marks a significant development in the financial industry. This move underscores the importance of promoting competition, protecting consumer choice, and fostering innovation in the market. As the case unfolds, it will be crucial to monitor how Visa responds to these allegations and the potential impact on the broader financial landscape.

Sources:

– [DOJ plans to file antitrust lawsuit against Visa](https://twitter.com/unusual_whales/status/1838357575353667994?ref_src=twsrc%5Etfw)

– [Antitrust Lawsuit against Visa](https://www.reuters.com/business/finance/doj-plans-file-antitrust-lawsuit-against-visa-saying-it-illegally-monopolized-us-2024-09-23/)