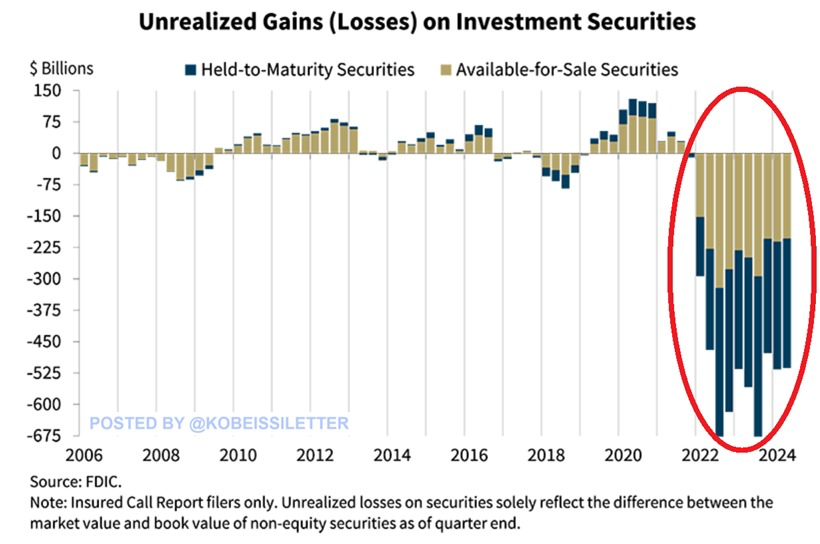

Unrealized losses on investment securities for US banks have reportedly reached a staggering $512.9 billion in the second quarter of 2024. This jaw-dropping figure is a whopping 7 times higher than the peak of losses experienced during the 2008 Financial Crisis. The data, as shared by The Kobeissi Letter on Twitter, also indicates that Q2 2024 marked the 11th consecutive quarter of unrealized losses for these financial institutions. The prolonged streak of losses can be attributed to the ongoing trend of interest rates, which have continued to impact the banking industry significantly.

The implications of such massive unrealized losses on investment securities are profound and far-reaching. For starters, it raises concerns about the stability and financial health of US banks. With such substantial losses, banks may face challenges in meeting their financial obligations and maintaining adequate capital reserves. Additionally, investors and stakeholders in these financial institutions may experience a decline in confidence, leading to potential repercussions in the broader financial markets.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

The comparison to the losses seen during the 2008 Financial Crisis is particularly alarming. The fact that the current losses are significantly higher than those experienced during one of the most severe financial crises in recent history is a cause for concern. It underscores the magnitude of the challenges facing US banks in the current economic climate and highlights the potential risks that lie ahead.

The continuous trend of unrealized losses over 11 consecutive quarters further exacerbates the situation. It indicates a prolonged period of financial strain for US banks, which may have long-term implications for the industry as a whole. The persistence of these losses suggests that the challenges facing banks are not temporary or isolated but rather systemic in nature.

The impact of interest rates on these unrealized losses cannot be understated. Fluctuations in interest rates have a direct impact on the value of investment securities held by banks, leading to unrealized losses when the market value falls below the book value. The sustained low-interest-rate environment in recent years has likely contributed to the prolonged period of losses experienced by US banks.

As the source of this information is a tweet from The Kobeissi Letter, it is essential to note that the data presented is alleged and should be taken with caution. While the numbers shared in the tweet paint a grim picture of the current state of US banks, further verification and analysis are necessary to fully understand the implications of these unrealized losses.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

In conclusion, the reported unrealized losses on investment securities for US banks are a cause for concern and highlight the challenges facing the banking industry. The comparison to the losses seen during the 2008 Financial Crisis, the prolonged streak of losses, and the impact of interest rates all point to a complex and challenging financial landscape for banks. As more information becomes available, it will be crucial to monitor how US banks navigate these challenges and what steps they take to address the implications of these substantial unrealized losses.

BREAKING: Unrealized losses on investment securities for US banks reached $512.9 billion in Q2 2024.

This is 7 TIMES higher than at the peak of the 2008 Financial Crisis.

Q2 2024 also marked the 11th consecutive quarter of unrealized losses as interest rates continued to

BREAKING: Unrealized losses on investment securities for US banks reached $512.9 billion in Q2 2024.

This is 7 TIMES higher than at the peak of the 2008 Financial Crisis.

Q2 2024 also marked the 11th consecutive quarter of unrealized losses as interest rates continued to… pic.twitter.com/S7WZP6eOWV

— The Kobeissi Letter (@KobeissiLetter) September 21, 2024

When it comes to the financial stability of banks, one crucial indicator to keep an eye on is the unrealized losses on investment securities. Recently, a tweet by The Kobeissi Letter revealed some alarming statistics about US banks in the second quarter of 2024. According to the tweet, unrealized losses on investment securities for US banks reached a staggering $512.9 billion during this period. This figure is a cause for concern as it is 7 times higher than at the peak of the 2008 Financial Crisis. Additionally, Q2 2024 marked the 11th consecutive quarter of unrealized losses as interest rates continued to fluctuate.

What are Unrealized Losses on Investment Securities?

Unrealized losses on investment securities refer to the decrease in value of a bank’s investments that have not been sold. Essentially, it represents the paper loss on investments that are currently held by the bank. These losses are not realized until the bank decides to sell the securities, at which point they become realized losses.

How Do Unrealized Losses Impact Banks?

Unrealized losses can have a significant impact on a bank’s financial health. When a bank holds investments that have decreased in value, it affects the bank’s overall capital position. If the losses are substantial, they can erode the bank’s capital reserves, which are essential for absorbing unexpected losses and maintaining liquidity.

Why Did Unrealized Losses Reach $512.9 Billion in Q2 2024?

There are several factors that could have contributed to the high level of unrealized losses on investment securities in Q2 2024. One possible reason is the volatility in the financial markets during that period. Fluctuations in interest rates, geopolitical events, and economic uncertainty can all impact the value of investment securities held by banks.

How Does This Compare to the 2008 Financial Crisis?

The comparison to the 2008 Financial Crisis is particularly concerning. The fact that unrealized losses in Q2 2024 were 7 times higher than at the peak of the 2008 crisis indicates a potential systemic risk in the banking sector. It suggests that banks may be exposed to higher levels of risk in their investment portfolios, which could have far-reaching implications for the financial system as a whole.

What Does the 11th Consecutive Quarter of Unrealized Losses Signify?

The 11th consecutive quarter of unrealized losses is a troubling trend. It suggests that banks have been struggling to recover from their investment losses for an extended period of time. This could indicate underlying issues with the banks’ risk management practices, investment strategies, or exposure to certain asset classes.

In conclusion, the data presented in the tweet by The Kobeissi Letter highlights the precarious financial position of US banks in Q2 2024. The significant unrealized losses on investment securities, the comparison to the 2008 Financial Crisis, and the prolonged period of losses all point to potential vulnerabilities in the banking sector. It is essential for regulators, policymakers, and bank executives to closely monitor these developments and take appropriate actions to safeguard the stability of the financial system.

Sources:

– The Kobeissi Letter

– Bloomberg