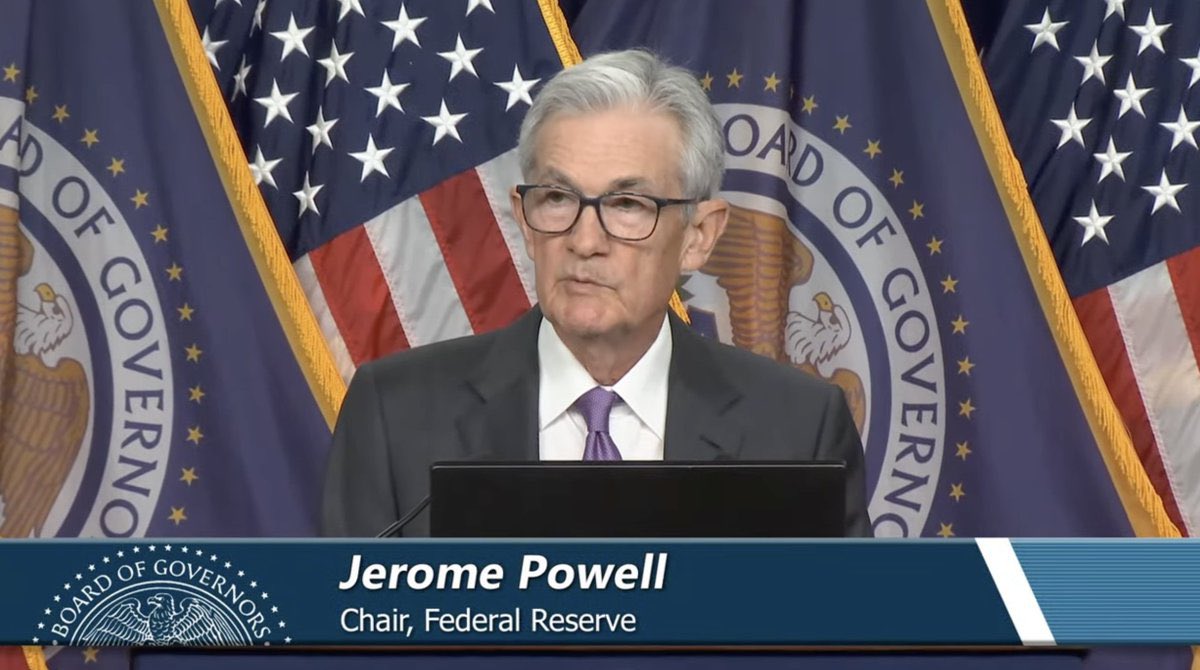

Alleged Breaking News: The Fed Announces 50 BPS Rate Cut

So, here’s the deal – there’s been some buzz on the internet about a major announcement from the Federal Open Market Committee (FOMC). According to a tweet from Ash Crypto (@Ashcryptoreal), the Fed has supposedly made a groundbreaking move by announcing a 50 basis point rate cut. And get this – it’s the first rate cut in four years! Talk about a giga bullish moment, right?

Now, before we dive into the implications of this alleged rate cut, let’s take a moment to address the elephant in the room – the authenticity of the tweet. As with any breaking news story, it’s essential to approach it with a healthy dose of skepticism. After all, anyone can claim anything on the internet these days. That being said, we can’t ignore the fact that the tweet has sparked quite the conversation among investors and financial experts alike.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

If the information in the tweet is indeed accurate, then the implications of a 50 basis point rate cut by the Fed are significant. For starters, a rate cut of this magnitude could potentially stimulate economic growth by making borrowing cheaper for businesses and consumers. This, in turn, could lead to increased spending, investment, and overall economic activity. On the flip side, some skeptics might argue that such a move could also fuel inflation and devalue the currency.

It’s important to note that the Federal Reserve closely monitors various economic indicators, such as inflation, employment, and GDP growth, when making decisions about interest rates. A rate cut is typically seen as a tool to stimulate economic activity during times of economic slowdown or uncertainty. However, it’s crucial to strike a balance between promoting growth and keeping inflation in check.

Now, let’s circle back to the tweet itself. The use of the term “giga bullish” in the tweet suggests that the individual behind the tweet is highly optimistic about the potential impact of the rate cut on the market. In the world of finance, the term “bullish” is often used to describe a positive outlook on the market or a particular asset. So, if we were to take the tweet at face value, it seems like the person behind it is pretty bullish on the implications of the rate cut.

As with any breaking news story, it’s essential to stay tuned for official confirmation and analysis from reputable sources. While social media can be a great tool for staying informed, it’s always a good idea to cross-reference information and seek out expert opinions before making any significant decisions based on a single tweet.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

In conclusion, the alleged announcement of a 50 basis point rate cut by the Federal Reserve is certainly a newsworthy development that has sparked a flurry of discussions online. Whether this alleged rate cut will materialize and what its actual implications will be remain to be seen. So, for now, let’s keep our eyes peeled for official updates and expert analysis to get a clearer picture of the situation.

BREAKING

FOMC : THE FED HAS ANNOUNCED

50 BPS RATE CUT. FIRST RATE CUT

AFTER 4 YEARS.

GIGA BULLISH

BREAKING

FOMC : THE FED HAS ANNOUNCED

50 BPS RATE CUT. FIRST RATE CUT

AFTER 4 YEARS.GIGA BULLISH pic.twitter.com/BbeABoMsx8

— Ash Crypto (@Ashcryptoreal) September 18, 2024

What is the FOMC and Why is it Important?

The Federal Open Market Committee (FOMC) is a branch of the Federal Reserve System responsible for overseeing the nation’s monetary policy. Made up of members of the Board of Governors and Reserve Bank presidents, the FOMC meets regularly to discuss economic conditions and make decisions on interest rates and other monetary policies. The FOMC plays a crucial role in shaping the country’s economic outlook and influencing financial markets.

One of the key tools the FOMC uses to control the economy is the federal funds rate. This is the interest rate at which banks lend to each other overnight. Changes in the federal funds rate can have a significant impact on borrowing costs for consumers and businesses, as well as on the overall health of the economy. When the FOMC adjusts the federal funds rate, it signals its stance on inflation, employment, and economic growth.

What Does a 50 BPS Rate Cut Mean?

A 50 basis point (BPS) rate cut refers to a reduction in the federal funds rate by 0.50%. This type of rate cut is considered to be significant because it indicates that the FOMC is taking decisive action to stimulate the economy. By lowering interest rates, the FOMC aims to encourage borrowing and spending, which can help boost economic activity and support job growth.

In the context of the tweet from Ash Crypto, the announcement of a 50 BPS rate cut is seen as a bullish signal for the market. Market participants interpret this move as a positive sign that the Federal Reserve is committed to supporting economic expansion and preventing a slowdown. The rate cut is expected to have a stimulative effect on the economy, potentially leading to increased investment and consumer spending.

Why is This Rate Cut Significant?

The announcement of a 50 BPS rate cut by the FOMC is significant for several reasons. First and foremost, this is the first rate cut in four years, which signals a shift in the Federal Reserve’s monetary policy stance. The fact that the FOMC has decided to lower interest rates after a prolonged period of stability suggests that policymakers are concerned about the state of the economy and are willing to take action to support growth.

Furthermore, the timing of the rate cut is crucial. In the face of economic uncertainty and market volatility, the FOMC’s decision to lower interest rates can help bolster confidence and provide a sense of stability. By signaling its commitment to maintaining accommodative monetary policy, the Federal Reserve is sending a strong message to investors and businesses that it is prepared to support the economy through challenging times.

What Does This Mean for Investors and the Market?

For investors, the announcement of a 50 BPS rate cut by the FOMC has significant implications. Lower interest rates can make stocks and other risk assets more attractive, as borrowing costs decrease and the potential for higher returns increases. In response to the rate cut, investors may reevaluate their portfolio allocations and adjust their strategies to take advantage of the new market conditions.

In the broader market, the rate cut is likely to have a positive impact on asset prices and economic growth. Lower interest rates can stimulate borrowing and investment, leading to increased business activity and job creation. Additionally, the rate cut can help offset the effects of inflation and support consumer spending, which are essential drivers of economic expansion.

In conclusion, the announcement of a 50 BPS rate cut by the FOMC represents a significant development in monetary policy and has far-reaching implications for the economy and financial markets. By lowering interest rates, the Federal Reserve aims to support growth, boost investor confidence, and provide stability in uncertain times. As investors and market participants digest this news, it will be important to monitor how the rate cut impacts economic indicators and market dynamics in the weeks and months ahead.

Sources:

– Federal Reserve

– Bloomberg

– CNBC