Exciting Times Ahead for Bitcoin as It Nears ReAccumulation Range

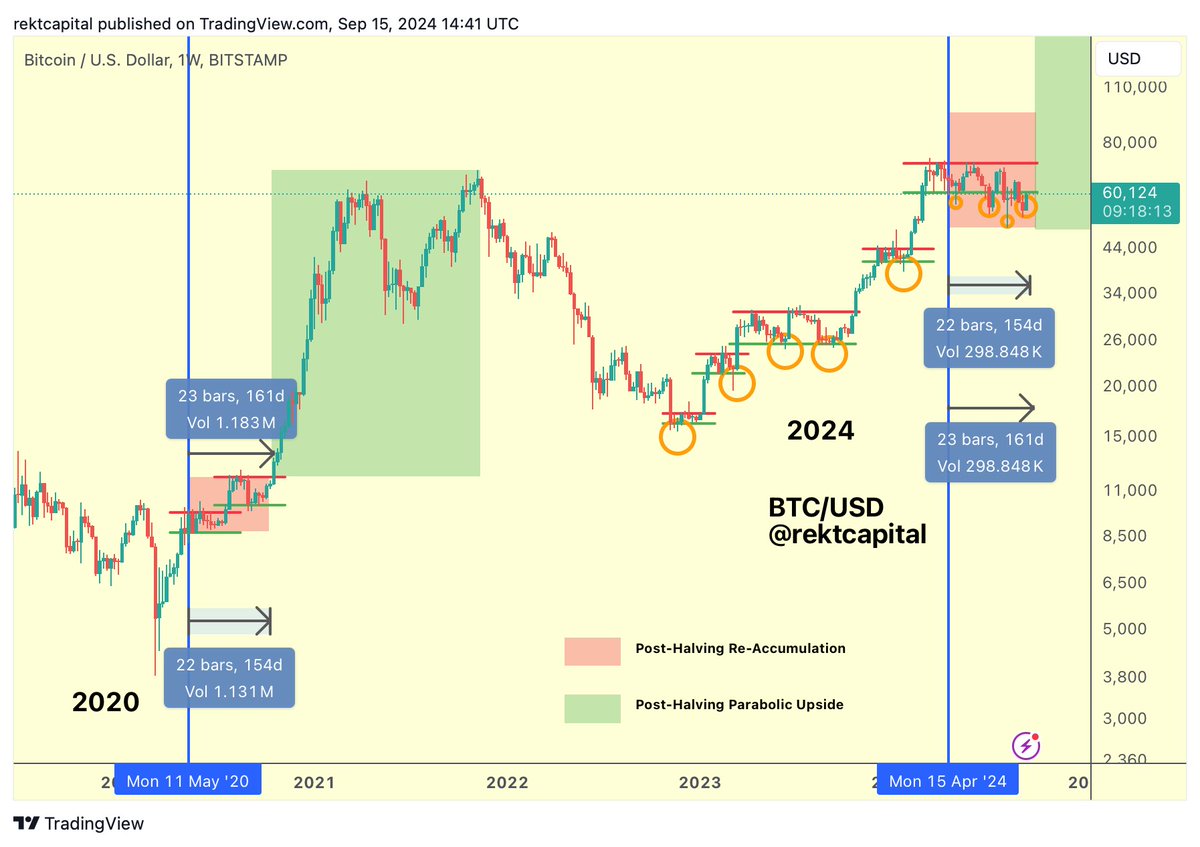

Bitcoin enthusiasts have reason to be optimistic as the cryptocurrency inches closer to reclaiming the ReAccumulation Range and aligning with Post-Halving price tendencies. According to historical data, Bitcoin is poised for a breakout in the coming weeks, setting the stage for potentially significant price movements.

The anticipation surrounding Bitcoin’s next move is palpable, with many investors eagerly awaiting what the future holds for the leading cryptocurrency. The possibility of a breakout has sparked excitement within the crypto community, as traders brace themselves for potential market shifts.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

With Bitcoin’s price trajectory indicating a potential rally in the near future, now is an opportune time for investors to pay close attention to market developments. The convergence of factors such as reclaiming the ReAccumulation Range and aligning with Post-Halving price tendencies suggests that Bitcoin may be on the cusp of a significant uptrend.

As the cryptocurrency market continues to evolve, staying informed and attuned to market trends is crucial for investors looking to capitalize on potential opportunities. By closely monitoring Bitcoin’s movements and keeping abreast of market analysis, traders can position themselves strategically to benefit from potential price surges.

In conclusion, the weeks ahead are shaping up to be pivotal for Bitcoin, with the cryptocurrency poised for a potential breakout. As excitement builds and anticipation mounts, all eyes are on Bitcoin as it navigates the path ahead in the ever-changing world of cryptocurrency trading.

#BTC

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

Bitcoin is so close to reclaiming the ReAccumulation Range and resynchronising with Post-Halving price tendencies

At the same time, history suggests Bitcoin should be breaking out in the next few weeks

Very exciting weeks lay ahead

$BTC #Crypto #Bitcoin

Bitcoin is so close to reclaiming the ReAccumulation Range and resynchronising with Post-Halving price tendencies

At the same time, history suggests Bitcoin should be breaking out in the next few weeks

Very exciting weeks lay ahead$BTC #Crypto #Bitcoin pic.twitter.com/ivvkoyZw7c

— Rekt Capital (@rektcapital) September 15, 2024

Bitcoin has been making significant strides in recent weeks, with the cryptocurrency market experiencing increased volatility. As Bitcoin approaches the ReAccumulation Range and post-halving price tendencies, many investors are eagerly anticipating a potential breakout. In this article, we will explore the current state of Bitcoin, its historical price movements, and what the future may hold for the world’s most popular cryptocurrency.

What is the ReAccumulation Range and Post-Halving Price Tendencies?

The ReAccumulation Range refers to a period of consolidation and accumulation in the price of Bitcoin before a potential breakout. During this time, the price tends to move within a specific range, indicating that buyers and sellers are in a state of equilibrium. This range typically precedes a significant price movement, either to the upside or downside.

On the other hand, post-halving price tendencies refer to the historical price movements of Bitcoin following a halving event. A halving occurs approximately every four years and involves cutting the rewards for mining new blocks in half. This scarcity mechanism is designed to control inflation and ensure the longevity of the Bitcoin network.

Why is Bitcoin Close to Reclaiming the ReAccumulation Range?

Bitcoin is currently on the verge of reclaiming the ReAccumulation Range due to a combination of factors. The recent surge in institutional interest, the growing adoption of Bitcoin as a store of value, and the increasing recognition of cryptocurrency as a legitimate asset class have all contributed to the upward momentum of Bitcoin.

Furthermore, the recent price action of Bitcoin suggests that the cryptocurrency is in a strong position to break out of the ReAccumulation Range and establish a new uptrend. Technical indicators such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are signaling bullish momentum, indicating that Bitcoin may soon experience a significant price rally.

What Does History Suggest About Bitcoin’s Potential Breakout?

Historical data indicates that Bitcoin tends to experience significant price movements following periods of consolidation and accumulation. In the past, Bitcoin has exhibited a pattern of breaking out of price ranges and establishing new trends, often leading to sharp increases in price.

For example, after the previous halving events in 2012 and 2016, Bitcoin experienced substantial price rallies that propelled the cryptocurrency to new all-time highs. These historical precedents suggest that Bitcoin may be on the cusp of a major breakout in the coming weeks, potentially leading to new price records.

What Can Investors Expect in the Coming Weeks?

As Bitcoin approaches the ReAccumulation Range and post-halving price tendencies, investors should prepare for a period of increased volatility and potential price fluctuations. While the exact timing and magnitude of the breakout are difficult to predict, historical trends and technical indicators suggest that Bitcoin may be on the brink of a significant price rally.

Investors should closely monitor key support and resistance levels, as well as market sentiment and fundamental developments, to gauge the potential direction of Bitcoin’s price movement. Additionally, it is essential to have a solid risk management strategy in place to protect against unexpected market movements and mitigate potential losses.

In conclusion, the next few weeks are shaping up to be very exciting for Bitcoin and the broader cryptocurrency market. With the potential for a breakout looming on the horizon, investors should stay informed, remain vigilant, and be prepared to capitalize on opportunities as they arise. As always, it is essential to conduct thorough research, seek advice from financial professionals, and make informed decisions based on your own risk tolerance and investment goals.

Sources:

– https://www.coindesk.com/

– https://cointelegraph.com/

– https://www.bloomberg.com/crypto