Japan’s Nikkei 225 Stock Market Faces Historic 2-Day Drop

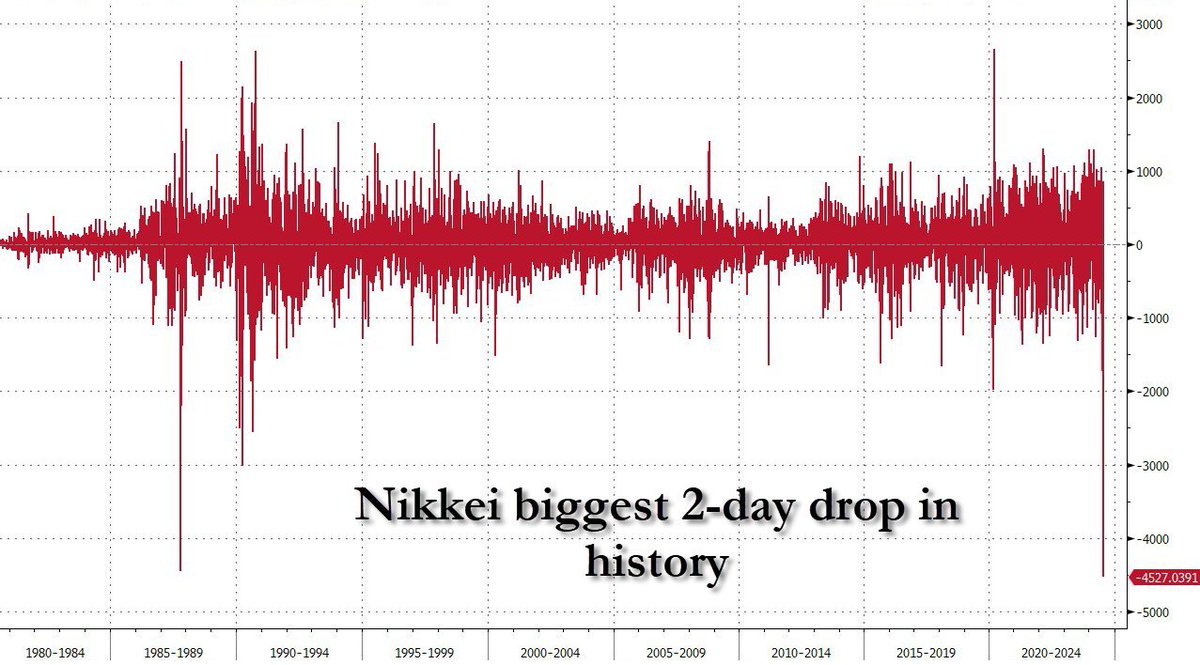

Have you heard the latest news about Japan’s stock market? The Nikkei 225 is currently experiencing its largest 2-day drop in history, surpassing even the infamous Black Monday crash of 1987. This shocking development has sent shockwaves throughout the financial world, with markets in South Korea halting all sell orders as panic selling takes hold.

The Kobeissi Letter reported on Twitter that Japan’s Nikkei 225 is on track to make history with this unprecedented drop. Investors and analysts are scrambling to make sense of the situation as the market plunges further into turmoil. The impact of this crash is being felt not only in Japan but across the globe, as investors brace for the fallout.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

With South Korea taking drastic measures to stop the bleeding, it’s clear that the situation is dire. The uncertainty surrounding the market has left many wondering what the future holds for Japan’s economy and how this drop will reverberate throughout the rest of the world.

As the Nikkei 225 faces this historic 2-day drop, investors are left to navigate through the chaos and uncertainty. The implications of this crash are far-reaching, and only time will tell how the market will recover from this unprecedented event. Stay tuned as we continue to monitor this developing situation and provide updates on the latest news from Japan’s stock market.

BREAKING: Japan's stock market, the Nikkei 225, is currently set to post its largest 2-day drop in history.

This is an even larger drop than the Black Monday crash of 1987, per Zerohedge.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

Now, South Korea has halted ALL sell orders as markets crash.

Panic selling has arrived.

BREAKING: Japan’s stock market, the Nikkei 225, is currently set to post its largest 2-day drop in history.

This is an even larger drop than the Black Monday crash of 1987, per Zerohedge.

Now, South Korea has halted ALL sell orders as markets crash.

Panic selling has arrived. pic.twitter.com/eoxEeaxIh8

— The Kobeissi Letter (@KobeissiLetter) August 5, 2024

BREAKING: Japan’s stock market, the Nikkei 225, is currently set to post its largest 2-day drop in history. This news comes as a shock to investors and analysts alike, as the stock market in Japan is known for its stability and resilience. The Nikkei 225 is a key indicator of the Japanese economy, and a drop of this magnitude is sure to have far-reaching implications. But what exactly is causing this unprecedented decline in the stock market? Let’s take a closer look.

What is the Nikkei 225?

The Nikkei 225 is Japan’s leading stock market index, comprised of 225 of the largest and most actively traded companies listed on the Tokyo Stock Exchange. It is often used as a barometer for the overall health of the Japanese economy, as well as a gauge of investor sentiment in the country. The index is weighted by market capitalization, meaning that larger companies have a greater impact on its movements.

What is causing the decline in the Nikkei 225?

The current drop in the Nikkei 225 is being attributed to a combination of factors, including global economic uncertainty, geopolitical tensions, and concerns about the impact of the COVID-19 pandemic on the Japanese economy. Additionally, rising inflation and interest rates are also contributing to the market volatility. Investors are growing increasingly nervous about the outlook for the Japanese economy, leading to panic selling and a sharp decline in stock prices.

How does this drop compare to the Black Monday crash of 1987?

The current drop in the Nikkei 225 is even larger than the infamous Black Monday crash of 1987, which saw global stock markets plummet in a single day. The magnitude of the current decline is unprecedented in the history of the Nikkei 225, further underscoring the severity of the situation. Investors are now grappling with the prospect of a prolonged bear market, as well as the potential for further losses in the coming days.

What is the impact on South Korea?

In response to the market turmoil, South Korea has taken the drastic step of halting ALL sell orders as markets crash. This move is aimed at preventing a further freefall in stock prices and restoring investor confidence. The decision to suspend sell orders underscores the interconnectedness of global financial markets, as well as the ripple effects of a major market downturn. South Korea’s actions are a stark reminder of the fragility of the financial system in times of crisis.

What is the outlook for the future?

As the Nikkei 225 continues to experience unprecedented levels of volatility, investors are bracing for a rocky road ahead. The coming days and weeks will be crucial in determining the long-term impact of the current market downturn on the Japanese economy. Analysts are closely monitoring key economic indicators and policy decisions to gauge the trajectory of the market. In the meantime, investors are advised to exercise caution and seek guidance from financial experts to navigate the uncertain terrain.

In conclusion, the current drop in Japan’s stock market, the Nikkei 225, is sending shockwaves through the global financial system. The magnitude of the decline is unprecedented, surpassing even the Black Monday crash of 1987. As panic selling grips the market and South Korea takes drastic measures to stem the tide, investors are left grappling with uncertainty and fear. The road ahead is fraught with challenges, but with vigilance and strategic planning, it is possible to weather the storm. Stay tuned for further updates as the situation evolves.