Michael Saylor’s MicroStrategy Plans to Raise $2 Billion for Bitcoin Investment

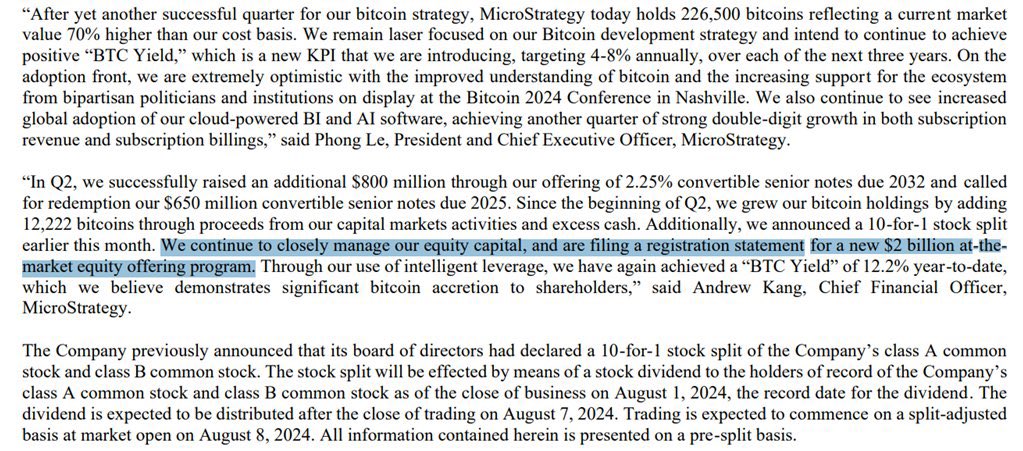

In a recent tweet by Ash Crypto, it has been revealed that Michael Saylor’s MicroStrategy is gearing up to file paperwork to issue new equity in order to raise a staggering $2 billion. The purpose behind this massive fundraising effort? To buy more Bitcoin.

This move by MicroStrategy has sent shockwaves through the cryptocurrency community, with many viewing it as a highly bullish signal for the future of Bitcoin. Saylor, known for his bullish stance on the digital currency, has been a vocal advocate for Bitcoin as a store of value and a hedge against inflation.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

With Bitcoin’s price reaching new heights in recent years, it comes as no surprise that companies like MicroStrategy are looking to capitalize on the potential growth of the cryptocurrency. By raising $2 billion to invest in Bitcoin, Saylor is making a bold statement about his confidence in the long-term viability of the digital asset.

This news has sparked a flurry of excitement among Bitcoin investors and enthusiasts, who see MicroStrategy’s move as a vote of confidence in the future of the cryptocurrency market. As Bitcoin continues to gain mainstream acceptance and adoption, it is clear that companies like MicroStrategy are willing to bet big on its success.

Overall, the decision by Michael Saylor’s MicroStrategy to raise $2 billion for Bitcoin investment is a significant development that highlights the growing influence of cryptocurrency in the financial world. It will be interesting to see how this investment plays out and what impact it will have on the broader cryptocurrency market in the months to come.

BREAKING

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

MICHAEL SAYLOR’S MICROSTRATEGY

IS FILING THE PAPERWORK TO ISSUE

NEW EQUITY TO RAISE $2 BILLION TO

BUY MORE BITCOIN.

THIS IS GIGA BULLISH

BREAKING

MICHAEL SAYLOR’S MICROSTRATEGY

IS FILING THE PAPERWORK TO ISSUE

NEW EQUITY TO RAISE $2 BILLION TO

BUY MORE BITCOIN.THIS IS GIGA BULLISH pic.twitter.com/RjJHJiA29L

— Ash Crypto (@Ashcryptoreal) August 1, 2024

What does Michael Saylor’s MicroStrategy plan to do with $2 billion?

MicroStrategy, the publicly traded business intelligence company led by CEO Michael Saylor, is making waves in the world of cryptocurrency once again. The company recently announced its plans to issue new equity in order to raise $2 billion. This massive amount of capital will be used to buy more Bitcoin, further solidifying MicroStrategy’s position as a major player in the crypto market.

Why is this move considered “giga bullish”?

The decision to raise $2 billion to invest in Bitcoin is being hailed as “giga bullish” by crypto enthusiasts and investors alike. This term refers to the extreme optimism surrounding the potential impact of this move on the price and adoption of Bitcoin. Michael Saylor has been a vocal advocate for Bitcoin, often touting its long-term value and potential to serve as a store of value. By committing such a substantial amount of money to Bitcoin, MicroStrategy is sending a clear signal to the market that they believe in the future of cryptocurrency.

How will MicroStrategy’s investment impact the crypto market?

MicroStrategy’s continued investment in Bitcoin has already had a significant impact on the crypto market. Each time the company announces a new purchase of Bitcoin, the price of the cryptocurrency tends to rise as a result. With $2 billion at their disposal, MicroStrategy’s buying power could have a substantial influence on the price of Bitcoin in the coming months. Additionally, the company’s continued support of Bitcoin helps to legitimize the cryptocurrency in the eyes of traditional investors and institutions.

What are the potential risks of MicroStrategy’s investment strategy?

While MicroStrategy’s bullish stance on Bitcoin has paid off handsomely so far, there are some potential risks to consider. The volatile nature of the cryptocurrency market means that MicroStrategy’s investment could face significant fluctuations in value. Additionally, if the price of Bitcoin were to experience a major crash, the company could potentially face substantial losses on their investment. However, Michael Saylor has consistently expressed confidence in Bitcoin’s long-term value, suggesting that he believes any short-term risks are outweighed by the potential long-term rewards.

How does this move fit into MicroStrategy’s overall business strategy?

MicroStrategy’s decision to raise $2 billion to buy more Bitcoin is just the latest in a series of moves that demonstrate the company’s commitment to cryptocurrency. In addition to their significant Bitcoin holdings, MicroStrategy has also launched a subsidiary focused on mining the cryptocurrency. By diversifying their business to include Bitcoin-related activities, MicroStrategy is positioning itself as a leader in the crypto space. This move also helps to differentiate the company from its competitors in the business intelligence sector, potentially attracting new investors and customers who are interested in cryptocurrency.

In conclusion, Michael Saylor’s MicroStrategy is once again making headlines in the world of cryptocurrency with its plans to raise $2 billion to buy more Bitcoin. This move is being met with extreme optimism by many in the crypto community, who see it as a bullish indicator of Bitcoin’s future potential. While there are certainly risks involved, MicroStrategy’s continued support of Bitcoin is helping to legitimize the cryptocurrency and attract new investors to the market. Only time will tell how this investment will ultimately impact MicroStrategy’s bottom line, but for now, the company’s bold stance on Bitcoin is certainly turning heads.