Bitcoin Price Analysis: Potential Breakout Ahead?

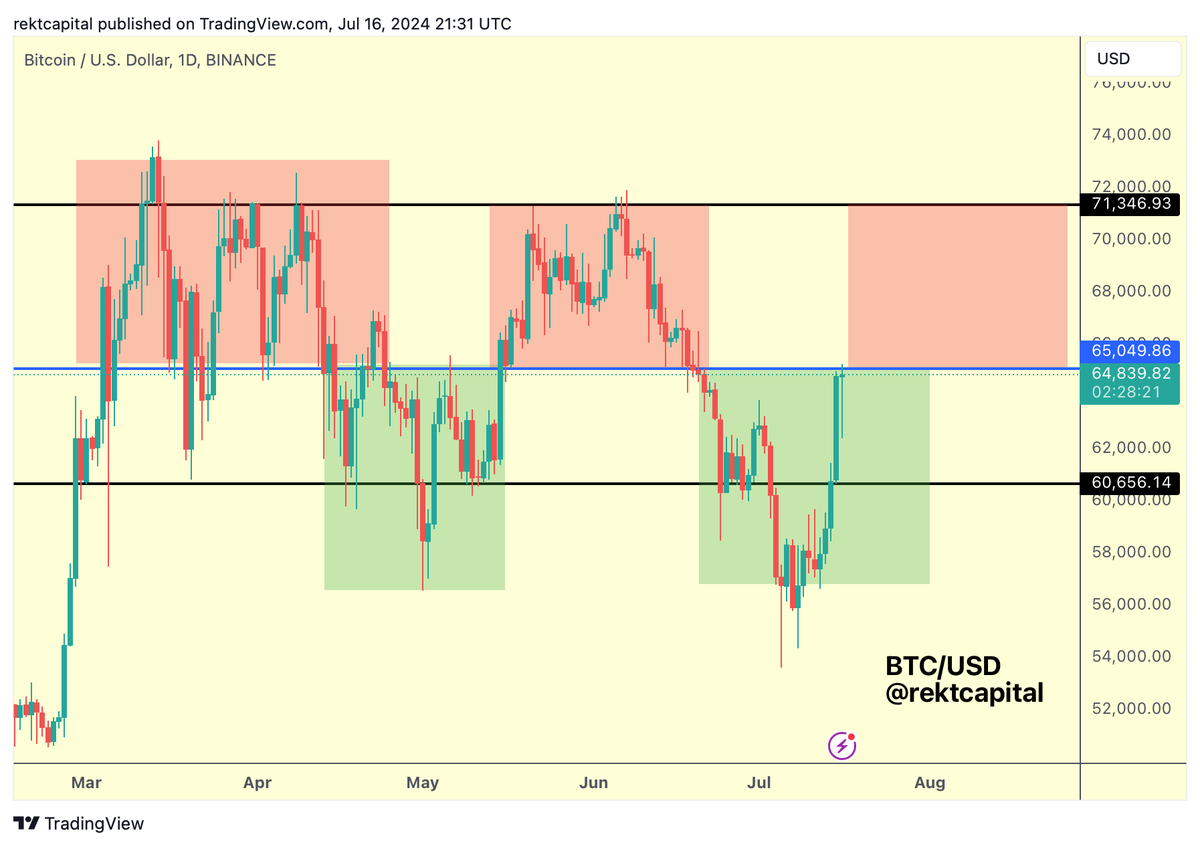

Are you keeping an eye on Bitcoin’s price movements? According to a recent tweet by Rekt Capital, there could be an interesting development on the horizon. The tweet suggests that if Bitcoin breaks the $65,000 mark, a new red cluster of price action could form. This could potentially signal a shift in the market dynamics.

Breaking the $65,000 resistance level could pave the way for Bitcoin to move within the $65,000-$71,500 range. This range could be a crucial battleground for bulls and bears, determining the short-term direction of the cryptocurrency. Crypto enthusiasts are eagerly watching to see if Bitcoin can muster the strength to break through this key level.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

The tweet by Rekt Capital provides valuable insight into the potential price movements of Bitcoin. As a popular cryptocurrency with a significant market cap, Bitcoin’s price action often influences the broader crypto market. Traders and investors are closely monitoring these developments to make informed decisions about their positions.

So, will Bitcoin be able to break the $65,000 barrier and enter into a new phase of price action? Only time will tell. In the meantime, keep a close watch on Bitcoin’s price movements and market sentiment. The crypto market is known for its volatility, so anything can happen in the blink of an eye.

Stay tuned for more updates on Bitcoin’s price analysis and potential breakout opportunities. The crypto space is always full of surprises, and Bitcoin’s next move could be a game-changer for the market. Don’t miss out on the action!

#BTC

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

The moment Bitcoin breaks $65,000 (blue) is the moment Bitcoin will form a new red cluster of price action

Breaking $65,000 would mean price would be ready to move inside the $65,000-$71,500 region

$BTC #Crypto #Bitcoin

The moment Bitcoin breaks $65,000 (blue) is the moment Bitcoin will form a new red cluster of price action

Breaking $65,000 would mean price would be ready to move inside the $65,000-$71,500 region$BTC #Crypto #Bitcoin pic.twitter.com/TZMP37ufjx

— Rekt Capital (@rektcapital) July 16, 2024

Bitcoin, the world’s first and most popular cryptocurrency, has been making waves in the financial markets for over a decade. With its decentralized nature and limited supply, Bitcoin has become a sought-after asset for investors looking to diversify their portfolios and hedge against inflation. In this article, we will delve into the price action of Bitcoin, specifically focusing on the $65,000 price level and its implications for future price movements.

What does it mean for Bitcoin to break $65,000?

The $65,000 price level has been a crucial resistance level for Bitcoin in recent months. Breaking this level would signify a significant bullish breakout for the cryptocurrency, indicating that buyers have overcome the selling pressure at this key level. This would likely lead to a surge in buying interest and propel Bitcoin to new all-time highs.

According to a recent article by CoinDesk, breaking $65,000 would signal that Bitcoin is ready to move inside the $65,000-$71,500 region. This range has been a major area of interest for traders and analysts, as it represents a potential consolidation phase before another leg up in price.

What is a red cluster of price action?

In technical analysis, a red cluster of price action refers to a period of price consolidation or retracement after a significant bullish move. This phase is characterized by a series of red candles on the price chart, indicating that sellers are stepping in to take profits or push the price lower.

When Bitcoin forms a red cluster of price action after breaking $65,000, it suggests that the cryptocurrency is undergoing a healthy correction before resuming its upward trend. This can provide an opportunity for traders to enter long positions at lower price levels, anticipating a continuation of the bullish momentum.

How can traders navigate the $65,000-$71,500 region?

Navigating the $65,000-$71,500 region requires a combination of technical analysis and risk management strategies. Traders can use key support and resistance levels within this range to identify potential entry and exit points for their trades.

According to a research report by CryptoSlate, the $65,000 level is a critical support level that traders should watch closely. If Bitcoin manages to hold above this level, it could signal a strong bullish bias and pave the way for a move towards $71,500.

On the other hand, if Bitcoin fails to hold above $65,000 and breaks below this level, it could indicate a shift in market sentiment and a potential downtrend. Traders should be prepared to cut their losses and reassess their trading strategy if this scenario unfolds.

What are the long-term implications of Bitcoin breaking $65,000?

Breaking $65,000 would not only mark a new milestone for Bitcoin but also signal a broader acceptance of cryptocurrency as a legitimate asset class. Institutional investors and mainstream financial institutions have been increasingly turning to Bitcoin as a store of value and a hedge against traditional market risks.

A recent article by CNBC highlighted the growing interest in Bitcoin among institutional investors, with major companies such as Tesla and MicroStrategy adding Bitcoin to their balance sheets. Breaking $65,000 could further boost confidence in Bitcoin as a long-term investment and fuel its adoption across various sectors of the economy.

In conclusion, the $65,000 price level holds significant importance for Bitcoin and its future price movements. Breaking this level could open the door to new opportunities for traders and investors, while also solidifying Bitcoin’s position as a leading digital asset in the global financial landscape. As always, it is essential to conduct thorough research and practice sound risk management when trading or investing in cryptocurrencies.

Sources:

1. CoinDesk – https://www.coindesk.com/

2. CryptoSlate – https://cryptoslate.com/

3. CNBC – https://www.cnbc.com/