1. Nancy Pelosi Tesla stock sale

2. Pelosi investment portfolio update

3. Congresswoman Pelosi stock transactions

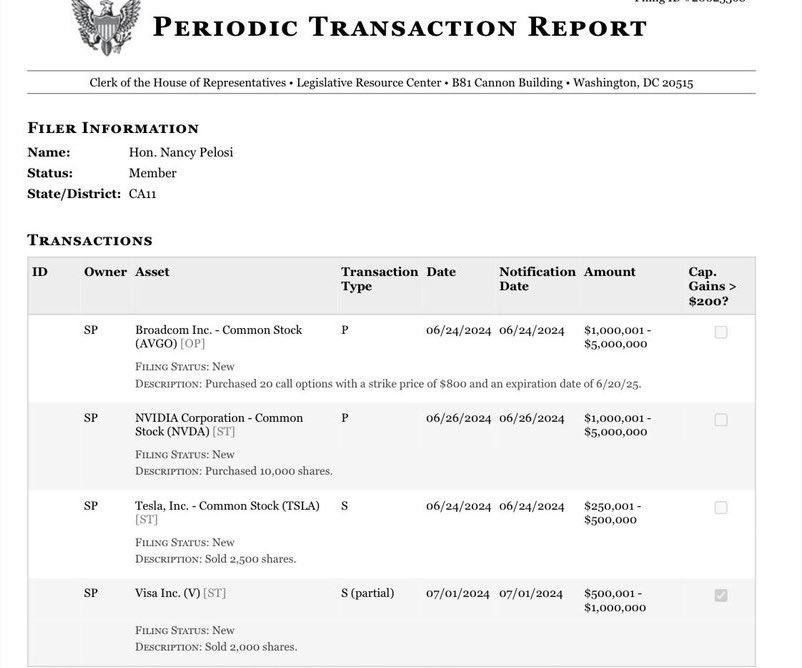

BREAKING: Nancy Pelosi has sold her Tesla, $TSLA, position worth ~$500,000.

She has also purchased an addition $1.2 million of Nvidia, $NVDA, and $5 million of Broadcom, $AVGO.

Nancy Pelosi made significant changes to her investment portfolio, selling her Tesla position and adding $1.2 million of Nvidia and $5 million of Broadcom. This move reflects her confidence in the tech industry, with Nvidia and Broadcom being key players in the semiconductor sector. Pelosi’s decision to diversify her holdings shows a strategic approach to managing her investments. Stay updated on the latest financial news and market trends with The Kobeissi Letter. Follow us for more insights into the world of finance and investment. #NancyPelosi #InvestmentPortfolio #TechIndustry #FinancialNews

BREAKING: Nancy Pelosi has sold her Tesla, $TSLA, position worth ~$500,000.

She has also purchased an addition $1.2 million of Nvidia, $NVDA, and $5 million of Broadcom, $AVGO. pic.twitter.com/fl8zjcnvBb

— The Kobeissi Letter (@KobeissiLetter) July 3, 2024

Related Story.

If you’ve been following the latest financial news, you may have heard about a recent investment move made by none other than Nancy Pelosi. In a surprising turn of events, the Speaker of the House has decided to sell her Tesla position, valued at approximately $500,000. But that’s not all – Pelosi has also made some significant purchases, including an additional $1.2 million of Nvidia and $5 million of Broadcom.

Pelosi’s decision to sell her Tesla shares and reinvest the funds into other tech companies like Nvidia and Broadcom has certainly caught the attention of many investors and analysts alike. This move reflects Pelosi’s confidence in the future growth potential of these companies, as well as her strategic approach to diversifying her investment portfolio.

Nvidia, a leading semiconductor company known for its graphics processing units (GPUs) and artificial intelligence technology, has been a favorite among investors for its strong performance in recent years. With a market capitalization of over $500 billion, Nvidia is well-positioned to capitalize on the growing demand for AI and data center solutions.

On the other hand, Broadcom, a global technology company specializing in semiconductor and infrastructure software, has also been a popular choice among investors. With a market capitalization of over $200 billion, Broadcom has a strong track record of delivering value to its shareholders through innovative products and strategic acquisitions.

Pelosi’s decision to invest $5 million in Broadcom further demonstrates her confidence in the company’s long-term growth prospects. By diversifying her portfolio with investments in both Nvidia and Broadcom, Pelosi is not only spreading her risk but also positioning herself to benefit from the continued growth of the tech sector.

It’s worth noting that Pelosi’s investment decisions are not made lightly. As a seasoned investor with a background in finance, she understands the importance of conducting thorough research and analysis before making any investment moves. By carefully evaluating the financial health and growth potential of companies like Nvidia and Broadcom, Pelosi is able to make informed decisions that align with her investment goals.

In conclusion, Pelosi’s recent investment moves serve as a reminder of the importance of staying informed and proactive when it comes to managing your investment portfolio. Whether you’re a seasoned investor like Pelosi or just starting, it’s essential to conduct thorough research, diversify your investments, and stay up-to-date on the latest market trends. Who knows – you may just uncover the next big investment opportunity that could help you achieve your financial goals.

-------------- -------------