1. President Biden veto

2. Financial regulation Bitcoin

3. Crypto veto legislation

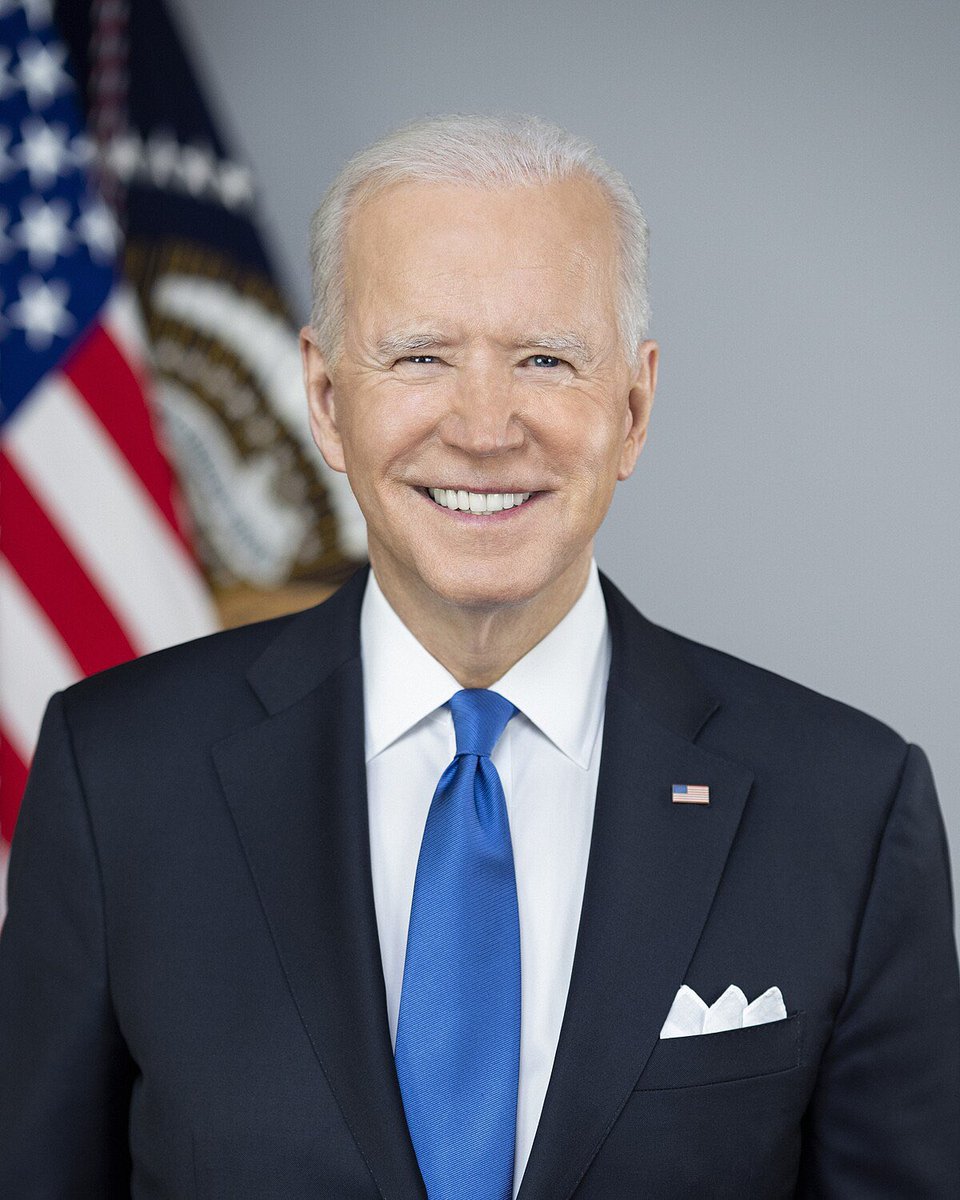

BREAKING: President Biden vetoes bill that allows highly regulated financial firms to hold #Bitcoin and crypto.

President Biden has vetoed a bill that would have allowed highly regulated financial firms to hold Bitcoin and other cryptocurrencies. This decision has sparked controversy within the crypto community, as many were hopeful for increased adoption and legitimacy of digital assets. The implications of this veto on the future of cryptocurrency regulation remain uncertain, leaving investors and enthusiasts on edge. Stay tuned for more updates on this developing story. Watcher.Guru is closely monitoring the situation and providing timely updates on Twitter. Follow them for the latest news and analysis on the crypto market. #Bitcoin #PresidentBiden #cryptocurrency #regulation

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

BREAKING: President Biden vetoes bill that allows highly regulated financial firms to hold #Bitcoin and crypto. pic.twitter.com/qRWC2myigR

— Watcher.Guru (@WatcherGuru) May 31, 2024

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

Related Story.

In a surprising move, President Biden has vetoed a bill that would have allowed highly regulated financial firms to hold Bitcoin and other cryptocurrencies. This decision has sent shockwaves through the crypto community and has sparked a heated debate about the future of digital assets in the financial sector.

The bill, which was initially proposed as a way to modernize the financial industry and provide more opportunities for institutions to invest in digital currencies, faced strong opposition from the Biden administration. The President cited concerns about the volatility and lack of regulation in the crypto market as the primary reasons for vetoing the bill.

This decision has divided opinions among experts and investors. Some believe that allowing financial firms to hold Bitcoin and other cryptocurrencies would have increased mainstream adoption and legitimacy for digital assets. Others argue that the risks associated with cryptocurrencies, such as market manipulation and security breaches, outweigh the potential benefits.

The veto comes at a time when the cryptocurrency market is experiencing significant growth and attention from institutional investors. Bitcoin, the most popular digital currency, has reached new all-time highs in recent months, attracting both retail and institutional interest.

Despite the veto, the future of cryptocurrencies remains uncertain. The Biden administration has signaled that they are open to exploring regulatory frameworks for digital assets, but it is unclear what form these regulations will take. In the meantime, the crypto community is left to speculate on the implications of this decision for the industry as a whole.

Many experts believe that President Biden’s veto will not have a significant impact on the long-term trajectory of cryptocurrencies. The market has proven to be resilient in the face of regulatory challenges and has continued to attract new investors and projects. However, the lack of clarity around regulations could slow down the pace of innovation and investment in the industry.

In conclusion, President Biden’s decision to veto the bill allowing financial firms to hold Bitcoin and crypto has ignited a debate about the future of digital assets in the financial sector. While some see this as a setback for mainstream adoption, others believe that it is a necessary step to protect investors and ensure the stability of the market. As the crypto community waits for further guidance from the Biden administration, it is clear that the regulatory landscape for cryptocurrencies is still evolving.