1. Bitcoin holdings by countries

2. VanEck Bitcoin report

3. Bitcoin ETF investments

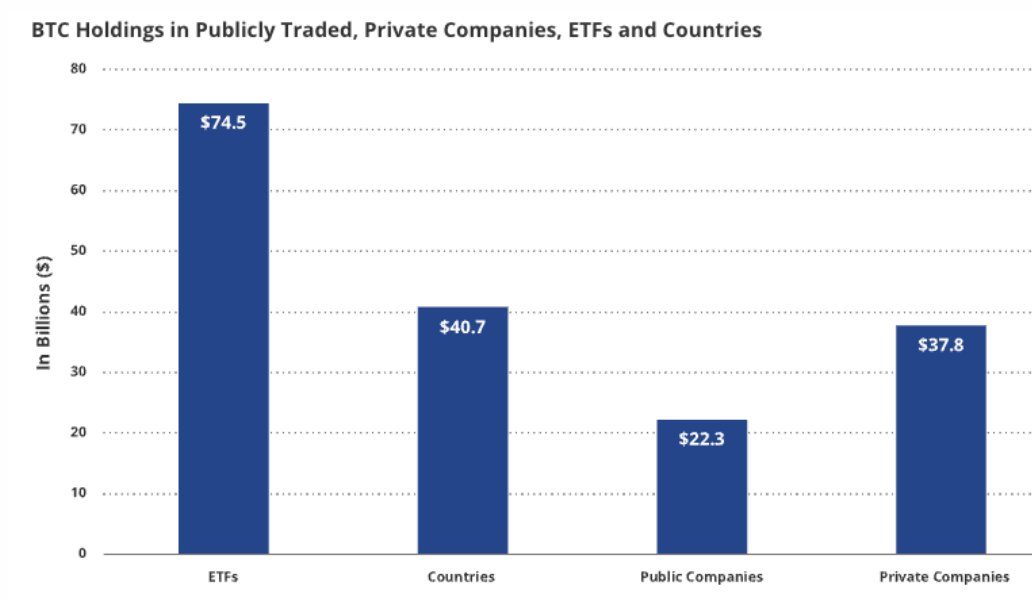

JUST IN: VanEck says about $175 billion in #Bitcoin is held by various countries, ETFs, and companies

VanEck reveals that approximately $175 billion worth of Bitcoin is held by various countries, ETFs, and companies. This news, announced on Twitter by Bitcoin Magazine, sheds light on the widespread adoption of the popular cryptocurrency. The information indicates a significant level of institutional and global interest in Bitcoin, highlighting its growing importance in the financial world. This development could potentially impact the future of Bitcoin and the broader cryptocurrency market. Stay tuned for more updates on this evolving story. #Bitcoin #VanEck #cryptocurrency #financialnews

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

JUST IN: VanEck says about $175 billion in #Bitcoin is held by various countries, ETFs, and companies pic.twitter.com/B7a3rGITic

— Bitcoin Magazine (@BitcoinMagazine) May 1, 2024

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

Related Story.

Just in: According to a recent report by VanEck, approximately $175 billion worth of Bitcoin is currently held by various countries, ETFs, and companies. This revelation has sent shockwaves through the cryptocurrency community and has solidified Bitcoin’s position as a valuable asset in the global financial landscape.

Bitcoin, the world’s most popular cryptocurrency, has been gaining mainstream acceptance and adoption over the past few years. Its decentralized nature and limited supply have made it an attractive investment option for individuals and institutions alike. The fact that $175 billion worth of Bitcoin is being held by countries, ETFs, and companies further underscores its growing importance in the financial world.

Countries holding Bitcoin in their reserves is a significant development. As governments around the world continue to explore the potential of blockchain technology and cryptocurrencies, adding Bitcoin to their reserves signals a shift towards digital assets as a viable store of value. This move also indicates a growing acceptance of Bitcoin as a legitimate asset class that can provide diversification and hedging benefits to traditional portfolios.

ETFs, or exchange-traded funds, are investment funds that are traded on stock exchanges and hold assets such as stocks, bonds, or commodities. The fact that ETFs are holding a substantial amount of Bitcoin highlights the increasing interest in cryptocurrencies among institutional investors. As more ETFs incorporate Bitcoin into their portfolios, it provides retail investors with easier access to the cryptocurrency market and further legitimizes Bitcoin as a mainstream investment option.

Companies holding Bitcoin on their balance sheets is another interesting development. As more businesses start to recognize the value of Bitcoin as a store of value and a hedge against inflation, they are diversifying their portfolios by adding cryptocurrencies to their assets. This trend has been particularly evident in tech companies and financial institutions, but other industries are also starting to explore the benefits of holding Bitcoin.

The $175 billion figure reported by VanEck is a testament to the growing interest and adoption of Bitcoin on a global scale. As more countries, ETFs, and companies continue to hold Bitcoin in their reserves, it is likely that the cryptocurrency will become even more integrated into the traditional financial system. This could lead to increased price stability, liquidity, and acceptance of Bitcoin as a legitimate asset class.

In conclusion, the revelation that $175 billion worth of Bitcoin is held by various countries, ETFs, and companies is a significant milestone for the cryptocurrency market. It highlights the growing acceptance and adoption of Bitcoin as a valuable asset and signals a shift towards digital assets in the global financial landscape. As more institutions and businesses continue to embrace Bitcoin, its position as a mainstream investment option is likely to strengthen, paving the way for further growth and innovation in the cryptocurrency space.