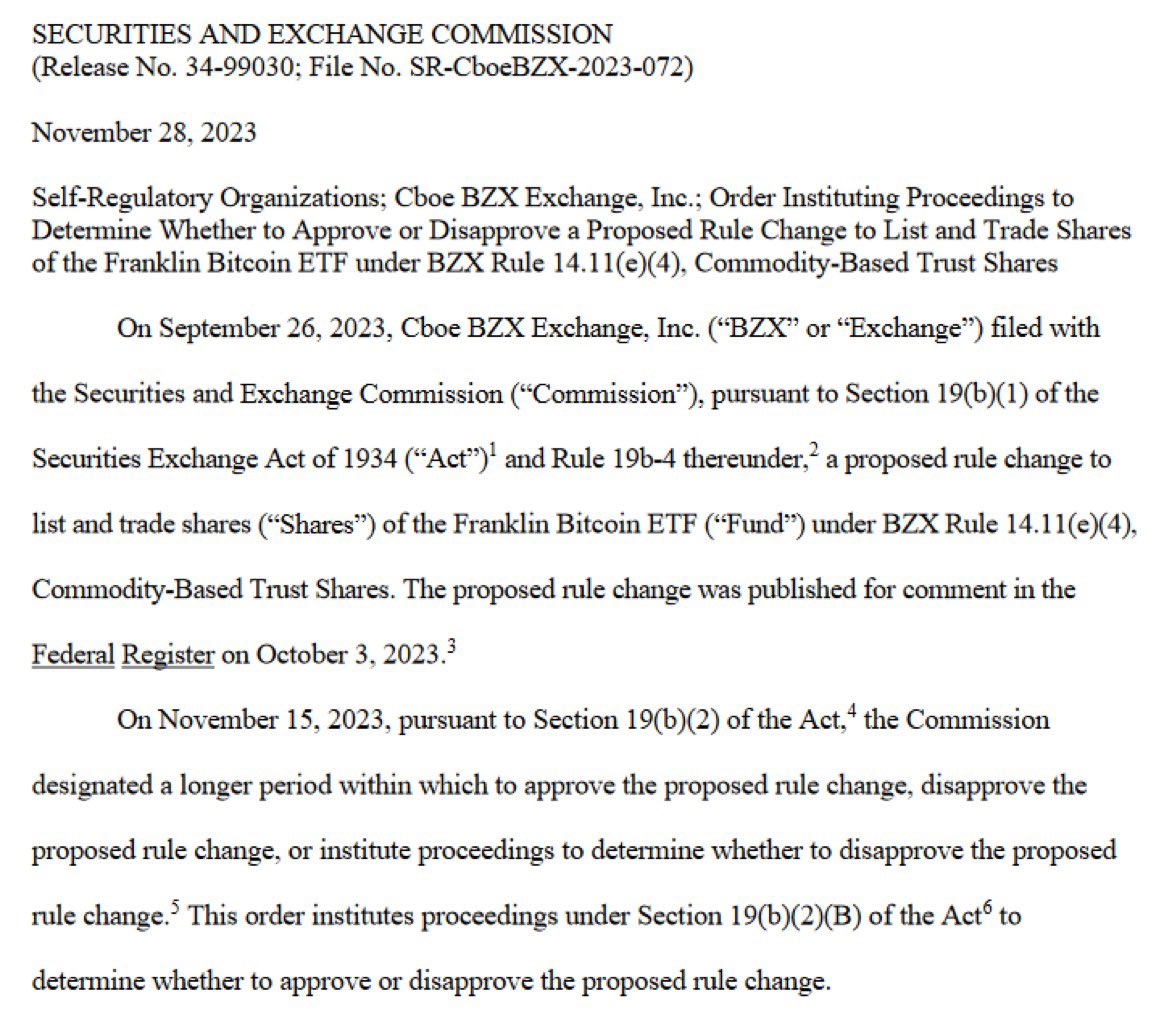

The SEC has announced a delay in approving the Franklin Spot Bitcoin ETF. The decision was made on November 28, 2023. No further details were provided.

You may also like to watch : Who Is Kamala Harris? Biography - Parents - Husband - Sister - Career - Indian - Jamaican Heritage

JUST IN: SEC DELAYS FRANKLIN SPOT #BITCOIN ETF pic.twitter.com/Ypm58xVTMr

— WhaleWire (@WhaleWire) November 28, 2023

RELATED STORY.

You may also like to watch: Is US-NATO Prepared For A Potential Nuclear War With Russia - China And North Korea?

The Securities and Exchange Commission (SEC) has announced a delay in the approval of the Franklin Spot Bitcoin Exchange-Traded Fund (ETF). This decision comes as a blow to cryptocurrency enthusiasts who were eagerly awaiting the launch of this ETF, which would have allowed investors to gain exposure to Bitcoin through a traditional investment vehicle.

The Franklin Spot Bitcoin ETF was expected to be the first ETF in the United States that specifically tracks the price of Bitcoin. It was designed to provide investors with a convenient and regulated way to invest in the world’s largest cryptocurrency. However, the SEC’s delay means that investors will have to wait longer for this investment opportunity.

The SEC’s decision to delay the approval of the Franklin Spot Bitcoin ETF is not entirely surprising. The regulatory body has been cautious when it comes to approving cryptocurrency-related financial products. It has previously expressed concerns about the lack of investor protection and market manipulation in the cryptocurrency market.

The delay in the approval of the Franklin Spot Bitcoin ETF raises questions about the future of Bitcoin ETFs in the United States. While several companies have filed applications for Bitcoin ETFs with the SEC, none have been approved so far. This delay further highlights the challenges that cryptocurrency ETFs face in gaining regulatory approval.

One of the main concerns raised by the SEC is the potential for market manipulation in the cryptocurrency market. The decentralized nature of cryptocurrencies makes them vulnerable to manipulation by bad actors. To address these concerns, companies applying for Bitcoin ETFs have implemented various safeguards, such as using regulated exchanges and partnering with reputable custodians.

Despite the delay, there is still hope that the SEC will eventually approve a Bitcoin ETF. The growing interest in cryptocurrencies and the increasing institutional adoption of Bitcoin have created a demand for regulated investment products. A Bitcoin ETF would make it easier for institutional investors to gain exposure to Bitcoin, potentially leading to increased liquidity and stability in the cryptocurrency market.

In the meantime, investors who are interested in Bitcoin can still gain exposure to the cryptocurrency through other means. There are several regulated investment products available, such as Grayscale’s Bitcoin Trust, which allows investors to gain exposure to Bitcoin without directly owning the cryptocurrency.

The delay in the approval of the Franklin Spot Bitcoin ETF is a setback for the cryptocurrency industry. However, it is important to remember that regulatory scrutiny is necessary to protect investors and ensure the integrity of the financial markets. As the cryptocurrency market continues to evolve, it is likely that we will see more efforts to create regulated investment products that cater to the growing demand for cryptocurrencies..

Source

@WhaleWire said JUST IN: SEC DELAYS FRANKLIN SPOT #BITCOIN ETF